- WTI run out of steam above the $24.00 mark per barrel.

- Traders remain sceptical after the OPEC-Russia deal.

- The OPEC+ and Russia agreed to cut oil output by almost 10Mbpd.

Prices of the American reference for the sweet light crude oil are now losing the grip and recedes to the $23.00 neighbourhood per barrel following the initial move to the $24.50 region.

WTI remains under pressure despite OPEC+ deal

After an initial move to the $24.50/bbl region during early trade, the upside pressure in WTI fizzled out and encouraged seller to return to the markets and drive prices back to the negative territory, although some decent support emerged near the $22.00 mark.

In fact, traders seem unconvinced of the effectiveness of the recently clinched deal between the OPEC and other oil producers – excluding the US – to cut the oil output by nearly 10 Mbpd in May and June.

The deal is aimed at stabilizing the beleaguered oil industry and at fighting the negative impact of the coronavirus pandemic, which saw crude oil prices shedding around 70% since January’s tops below the $66.00 mark to late March’s bottom in sub-$20.00 levels, while the global demand for oil has dropped by around 30%.

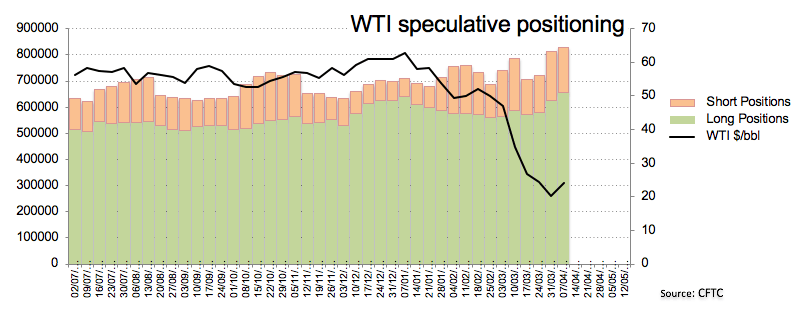

On another front, and according to the latest CFTC Positioning Report for the week ended on April 7th, gross longs in crude oil climbed to the highest level since early September 2018 to more than 655K contracts, in turn motivating speculative net longs to rise to levels last seen in late January.

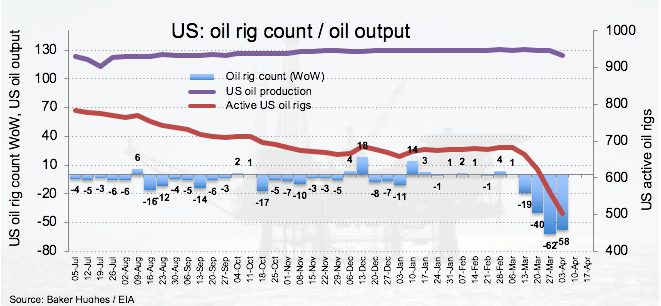

Further out, driller Baker Hughes reported the fourth consecutive drop in US oil rig count during last week, this time by 58 and taking the total US active oil rigs to 504.

What to look for around WTI

The outlook on crude oil prices remains fragile to say the least and despite the recent agreement between the OPEC and other oil-producer countries to cut the oil production by around 10 Mbpd in the next couple of months. Scepticism among oil players and market chatter regarding the measure is insufficient to bring in some stabilization in the market against the backdrop of the persistent drop in demand keep oil bulls at bay and have opened the door for a deeper pullback in the not-so-distant horizon.

WTI significant levels

At the moment the barrel of WTI is losing 0.75% at $22.98 and a breach of $19.29 (2020 low Mar.30) would expose $17.12 (monthly low November 2001) and finally $10.65 (monthly low December 1998). On the upside, the next resistance emerges at $29.11 (weekly/monthly high Apr.3) followed by $30.22 (23.6% Fibo of the 2020 drop) and then $36.99 (38.2% Fibo of the 2020 drop).