- Prices of the WTI trade firmer above $57.00.

- Traders focused on US-China trade dispute, Chinese slowdown.

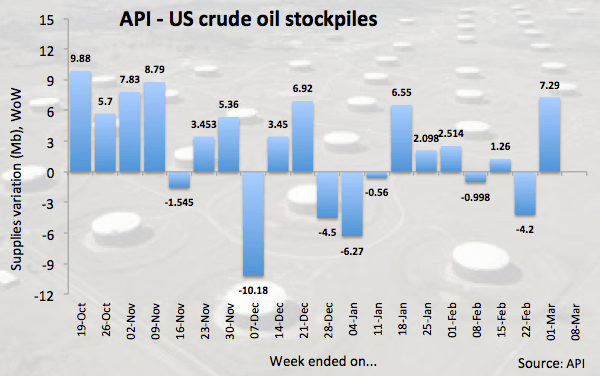

- API report on US crude oil supplies coming up next.

Prices of the barrel of the American benchmark for the sweet light crude oil remain firm in the first half of the week and are now targeting yearly peaks in the mid-$57.00s.

WTI looks to data

Prices of the West Texas Intermediate are up for the second session/week in a row on Tuesday, looking to leave behind last week’s consolidative theme.

In the meantime, crude oil prices remain well supported by the recent announcement from Saudi Arabia, stating that the country is planning to cut its output further next month.

Additionally, Venezuelan oil exports are expected to suffer further in light of the persistent and large power outages seen in recent days.

Moving forward, the API will publish its usual weekly report on US crude oil stockpiles later in the NA session ahead of tomorrow’s official report by the DoE.

What to look for around WTI

Crude oil prices are inching higher this week and remain propped up by speculations over a US-China trade agreement, the so-called ‘Saudi put’, tight conditions in the US markets (amidst US net imports in historic low levels and the rising activity in refiners ahead of the summer session), the current OPEC+ agreement to cut oil output and ongoing US sanctions against Iran and Venezuela crude oil exports.

WTI significant levels

At the moment the barrel of WTI is up 0.99% at $57.21 and a breakout of $57.43 (high Mar.12) would open the door for $57.60 (2019 high Mar.1) and then $58.00 (high Nov.16 2018). On the downside, the next support emerges at $55.89 (21-day SMA) seconded by $54.50 (low Mar.8) and finally $52.86 (55-day SMA).