- Prices of the WTI recover ground lost above $56.00.

- US crude supplies rose more than 7M barrels last week.

- OPEC+ deal, sanctions keep limiting the downside.

Prices of the West Texas Intermediate are inching higher on Thursday, retaking the $56.00 mark per barrel and above, or new 2-day highs.

WTI bid above $56.00, looks to data

After two consecutive daily pullbacks, prices of the barrel of the American reference for the sweet light crude oil have regained some shine above the $56.00 mark today.

The better tone in crude oil prices comes in response to the ongoing OPEC+ agreement to curb production and US sanctions against Venezuelan and Iranian exports, while optimism over a potential end to the US-China trade dispute has alleviated somewhat in past sessions. Speaking about supply disruptions, the Sharara oilfield in Libya is expected to gradually increase its output after resuming its operations last week (the oilfield has been shut since December).

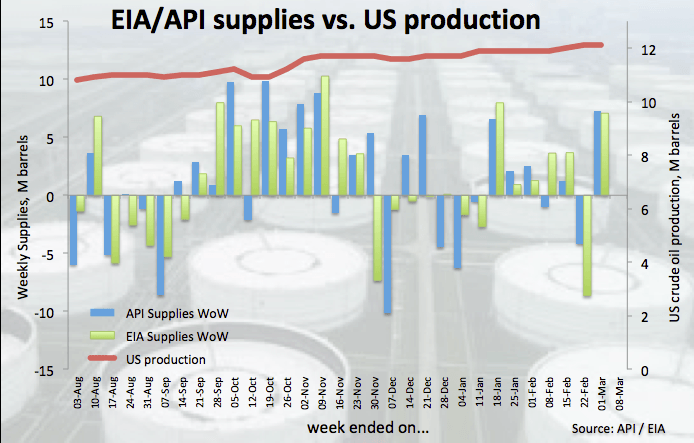

In the same direction, WTI has managed to leave behind yesterday’s strong build in US crude oil supplies, as reported by the EIA (more than 7 M barrels during last week).

What to look for around WTI

The potential trade agreement between US and China keeps supporting traders’ sentiment and collaborates with the view of higher prices despite hopes have been declining in past days. The bullish view on crude oil is sustained as well by tight conditions in the US markets amidst US net imports in historic low levels and the rising activity in refiners ahead of the summer session. Added to this scenario, the so-called ‘Saudi Put’ plus the current OPEC+ agreement to curb production should also reinforce the scenario of higher prices helped by current US sanctions against Iran and Venezuela.

WTI significant levels

At the moment the barrel of WTI is gaining 1.19% at $56.65 and a break above $57.60 (2019 high Mar.1) would open the door to $58.00 (high Nov.16 2018) and finally $59.63 (50% Fibo retracement of the October-December drop). On the other hand, the initial support emerges at $55.33 (21-day SMA) seconded by $54.73 (low Feb.26) and then $52.30 (55-day SMA).