- The spot price of oil is firm in Asia, with bulls seeking a test of the $41 level.

- US COVID-19 cases are rising 2.0% v a 7-day average of 1.8%, markets ignore driving season implications.

West Texas Intermediate was little changed in European and US markets.

US oil prices declined modestly with the WTI for August delivery decreased 2 cents to settle at 40.63 U.S. dollars a barrel on the New York Mercantile Exchange.

US states are set to be reimposing stricter measures and fuel consumption over the July 4 weekend was down 20% YoY.

The summer driving demand in the US is low, keeping gasoline demand subdued as another season factor to consider.

Bloomberg was quoting one house suggesting that gasoline demand in July could be down 17%YoY adding to pressure on margins and refinery demand.

Meanwhile, Saudi Arabia hiked its official selling price for August shipments, signalling that Asian oil demand is gaining ground.

OPEC’s supply cuts saw exports from the region falling in June while civil unrest in Libya is impacting production and exports prospects.

US COVID-19 cases rising 2.0% v a 7-day average of 1.8%

US COVID-19 data has been compiled for July 6 with US cases rising 2.0% v a 7-day average of 1.8%.

The following are the latest update of the key developments across the critical states for which are suffering the most:

- Texas Cases Rise 2.7% v 7-Day Avg. 4.0%.

- Texas Hospitalizations Rise 517 To Record 8,698.

- Florida Cases Rise 3.2% v 7-Day Avg. 5.1%.

- Arizona Cases Rise 3.4% v 7-Day Avg 4.1%

- California Cases Rise By Record 11,529.

US cases had been continuing to rise over the weekend, with the total number of cases nearing 2.9 million and deaths closing in on 130,000 reported yesterday.

“In energy markets, we see evidence that growing supply expectations are starting to weigh on the recovery in prices, for the first time in the post-COVID-19 era,” analysts at TD Securities explained.

Indeed, we caution that the market participants may have already picked the low hanging fruit from the Great Rebalancing, as our real-time supply indicators continue to deteriorate — at best, signaling that supply-side support has been baked into the cake.

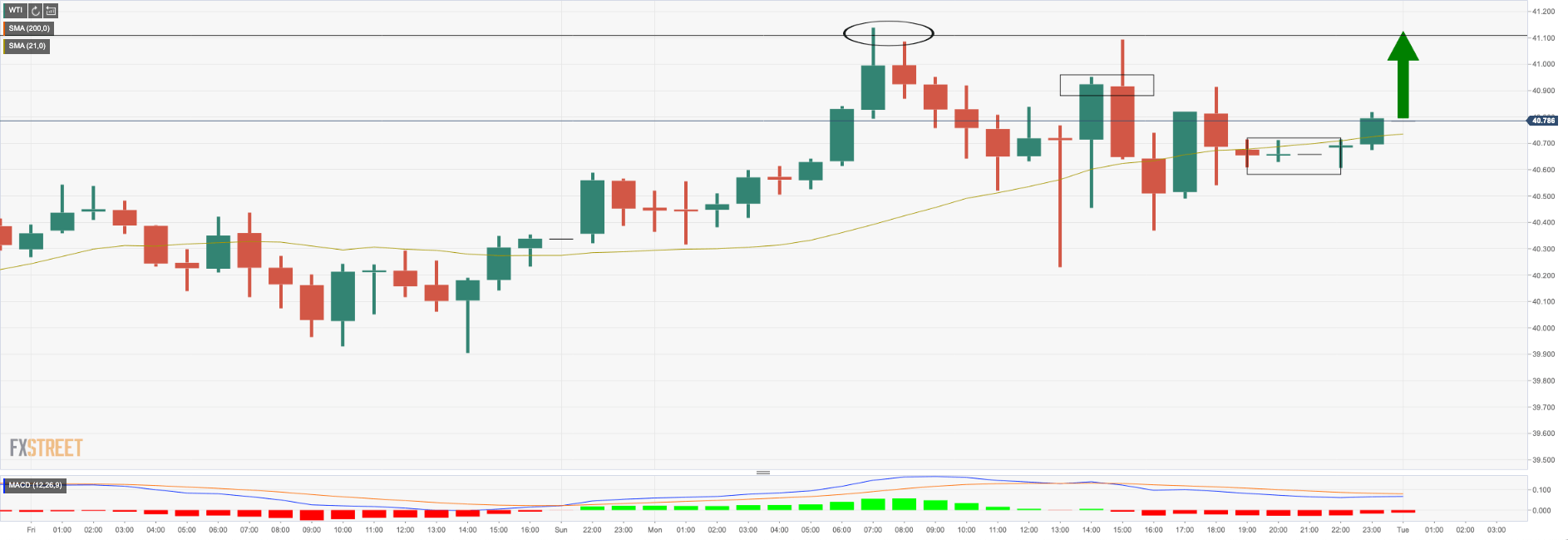

WTI levels

With price above the 21-hour moving average, bulls are on track of a retracement test to the $41 level on a break of 40.80 resistance. Hourly MACD is bullish and prior resistance turned support has been tested making for the firm support structure at $40.65.