- The barrel of WTI drops to multi-day lows near $55.50.

- President Trump criticized OPEC for higher prices.

- Saudi Arabia expected to cut its output further.

Prices of the barrel of the American reference for the sweet light crude oil are reverting Friday’s gains and are now navigating in 4-day lows in the mid-$55.00s.

WTI offered on Trump’s comments

The barrel of the West Texas Intermediate remains on the defensive at the beginning of the week after President Trump resumed his attacks to the oil cartel, this time suggesting the OPEC to ‘relax and take it easy’.

Comments by President Trump relegated the increasing optimism around the US-China potential trade agreement following recent progress at the Beijing and Washington meetings as a broad-based driver for crude oil and the rest of the risk-associated assets.

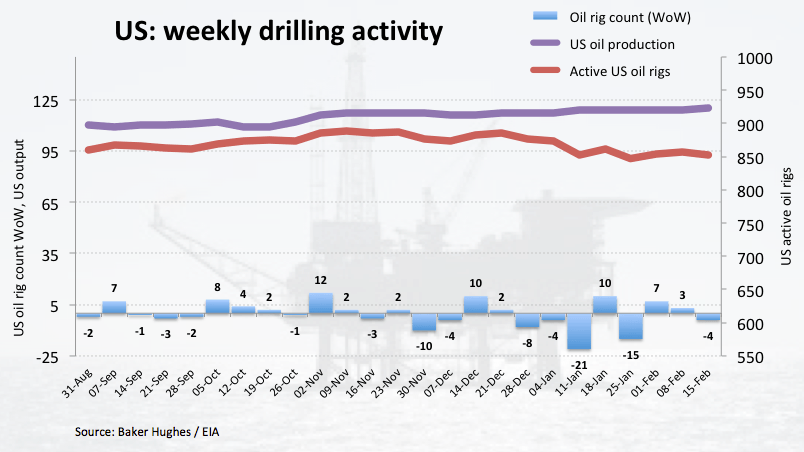

Additionally, driller Baker Hughes reported US oil rig count dropped by 4 during last week, taking the total US active oil rigs to 853.

Looking ahead, the usual weekly reports on US crude oil supplies by the API and the EIA are due on Tuesday and Wednesday, respectively.

What to look for around WTI

Today’s attack from President Trump to the OPEC’s policy of higher prices could undermine a more serious bull run in crude oil, mainly if US lawmakers are willing to invoke the NOPEC act. On the shining side, optimism around a US-China trade deal should remain supportive of crude oil as well as Saudi Arabia’s (so far) commitment to curb its oil production more than expected (the so-called ‘Saudi put’). Also bolstering prices emerge the ongoing US sanctions on Iranian and Venezuelan oil exports.

WTI significant levels

At the moment the barrel of WTI is losing 1.55% at $55.87 and a break below $55.40 (low Feb.25) would aim for $54.42 (21-day SMA) and finally $51.15 (low Feb.11). On the upside, the initial hurdle is located at $57.45 (2019 high Feb.22) seconded by $58.00 (high Nov.16 2018) and then $59.63 (50% Fibo retracement of the October-December drop).