- Prices of the WTI advance further above the $58.00 handle.

- US-China trade headlines weigh on sentiment.

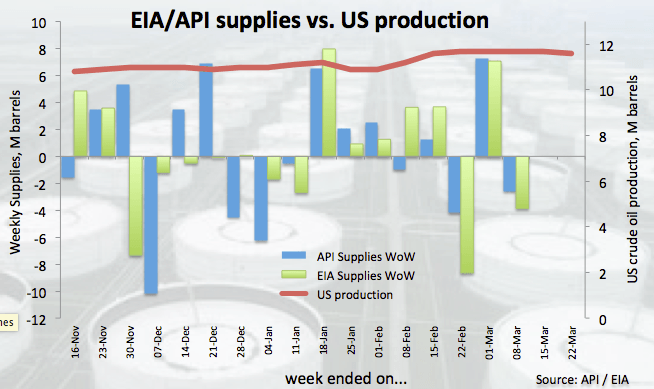

- US supplies dropped more than expected said the EIA.

The upbeat tone in crude oil prices remains firm in the second half of the week, pushing the barrel of WTI to fresh yearly tops beyond the $58.00 mark per barrel.

WTI looks to trade, supplies

Prices of the barrel of West Texas Intermediate are advancing since Monday backed on a stronger rebound in the sentiment around the riskier assets in tandem with declining momentum in the buck.

However, prices of WTI receded from tops today after news cited the key meeting between President Trump and China’s Xi Jinping – originally expected later this month – has been kicked back to, probably, April. This news falls in line with previous comments from US trade negotiator R.Lighthizer, who stressed that ‘major issues’ remain unresolved.

The up move in prices are also propped up by declining US crude oil supplies, as per yesterday’s weekly report by the DoE.

What to look for around WTI

Crude oil is navigating levels last seen in mid-November 2018 further north of the $58.00 mark per barrel, always bolstered by a softer buck and a generalized better tone in the risk-associated complex. The underlying bullish view in crude oil remains firm, in the meantime, on the back of the so-called ‘Saudi put’, tight conditions in the US markets (amidst US net imports in historic low levels and the rising activity in refiners ahead of the summer session), the current OPEC+ agreement to cut oil output and ongoing US sanctions against Iran and Venezuela crude oil exports. However, uncertainty around the US-China trade dispute (as per recent events) remains a threat to this view and could undermine further bullish attempts.

WTI significant levels

At the moment the barrel of WTI is up 0.50% at $58.53 and a breakout of $59.63 (50% Fibo of the October-December drop) would open the door for $62.00 (200-day SMA) and then $63.74 (78.6% Fibo of the October-December drop). On the downside, the next support emerges at $56.63 (10-day SMA) seconded by $54.37 (low Mar.8) and finally $53.36 (55-day SMA).