- The barrel of WTI reverts the recent downside, trades around $75.00.

- Crude oil prices advance despite the better tone in the Dollar.

- API, EIA weekly reports on US supplies coming in Wednesday and Thursday.

Prices of the barrel of the West Texas Intermediate are reverting the recent downside and regain the $75.00 neighbourhood on Tuesday.

WTI higher on Iran exports

Crude oil prices are trading on positive note so far on Tuesday, reverting at the same time three consecutive daily pullbacks after clinching fresh multi-year tops beyond the $77.00 mark per barrel last week.

WTI is posting moderate gains around the $75.00 mark today following news by agency Reuters citing a further drop in Iranian oil exports ahead of the US sanctions, due to kick in on November 4.

It is worth mentioning that prices of the barrel of the American reference for the sweet light crude oil have been losing ground in past sessions after the Trump’s administration hinted at the probability that Iran could sell some oil after November 4.

Earlier in the session, IEA’s Birol said that the oil market in ‘entering the red zone’, somewhat lending support to the positive performance today, while Russia’s Novak suggested that tweets from President Trump have been collaborating with higher oil prices as of late.

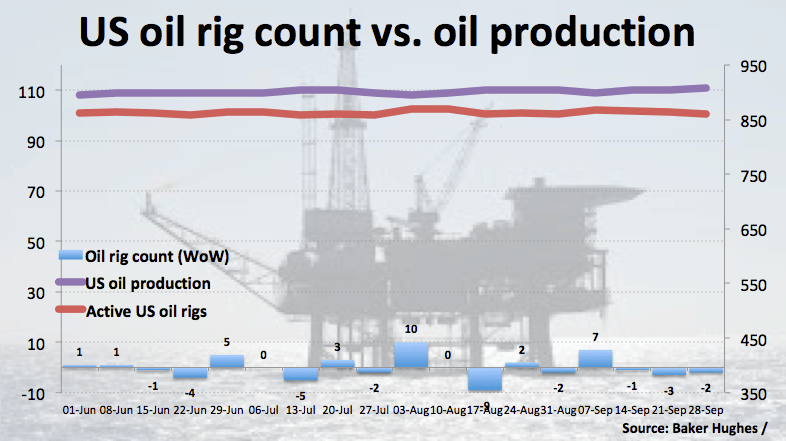

Also supporting the better tone in prices, Friday’s oil rig count dropped for the third week in a row, this time by 2 to 861 US active oil rigs, according to the latest report by driller Baker Hughes.

Looking ahead, the API will report on US crude oil supplies on Wednesday seconded by the EIA’s report on Thursday and Baker Hughes’ oil rig count on Friday.

WTI significant levels

At the moment the barrel of WTI is up 0.89% at $75.02 and a breakout of $77.12 (2018 high Oct.3) would aim for $77.95 (high Nov.21 2014) and finally $79.92 (high Nov.10 2014). On the flip side, the next down barrier emerges at $74.50 (10-day SMA) seconded by $73.27 (low Oct.8) and then $72.38 (21-day SMA).