- Prices of the WTI extends the sell-off to the boundaries of $47.00.

- The barrel of WTI trades in levels last seen in January 2019.

- Coronavirus panic continues to rise among oil traders.

Crude oil prices remain well under heavy pressure on Thursday, dropping to the vicinity of the $47.00 mark per barrel on rising coronavirus fears,

WTI meets support near $47.00… for now

Prices of the American benchmark for the sweet light crude oil are down for the sixth day in a row on Thursday, challenging the $47.00 mark per barrel, area last visited in January 2019.

As usual in past weeks, unremitting fears stemming from the fast-spreading coronavirus and its impact on global demand for crude oil continue to put the traders’ sentiment under pressure. It is worth noting that the barrel of WTI lost more than 28% since 2020 highs near the $66.00 mark on January 8th.

In the meantime, traders continue to wait for the OPEC+ meeting in Vienna on March 5-6, where an extension of the ongoing oil output cut deal as well as potential deeper cuts will be on top of the agenda.

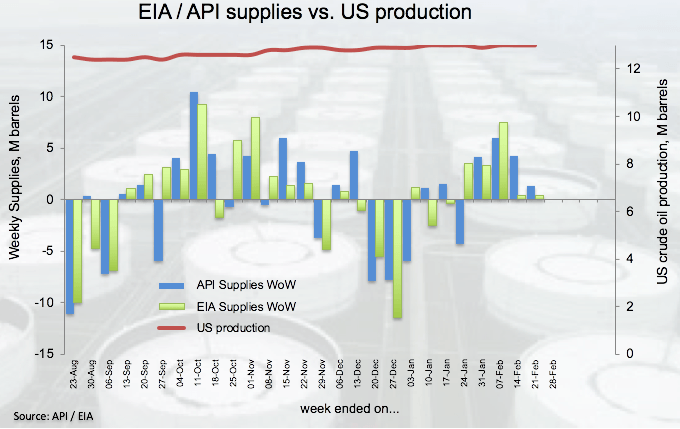

Further downside in crude oil comes after the weekly reports by the API and the EIA, showing that US crude oil supplies went up by 1.3M barrels and 0.492M barrels, respectively, during last week.

WTI significant levels

At the moment the barrel of WTI is losing 2.82% at $47.07 and a breach of $42.20 (2018 low Dec.24) would aim for $41.83 (2017 low Jun.21) and finally $38.85 (monthly low Aug.2016). On the other hand, the next resistance of note emerges at $49.31 (low Feb.4) seconded by $51.07 (21-day SMA) and then $54.40 (monthly high Feb.20).