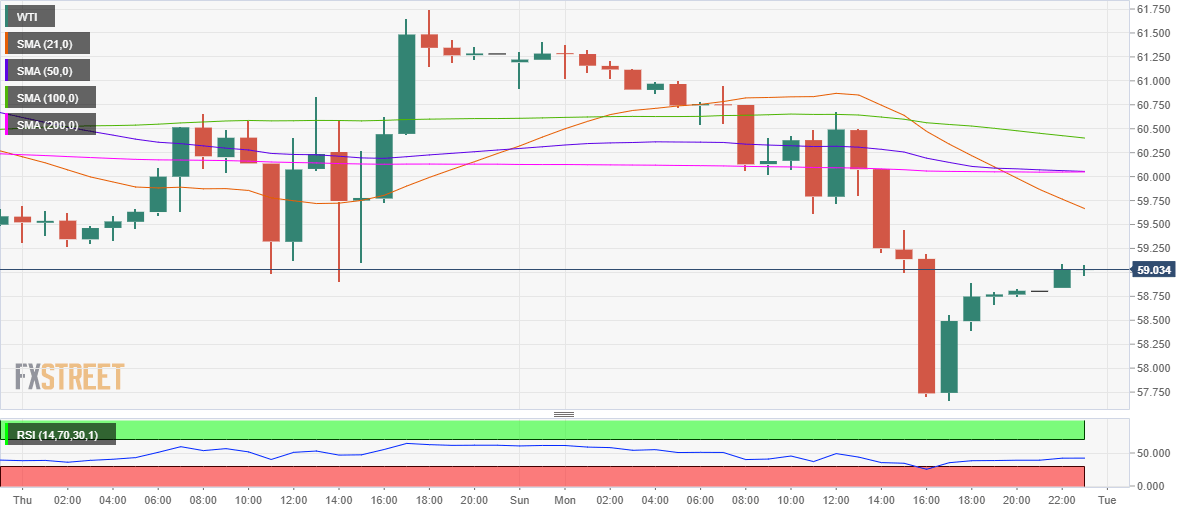

- WTI sees a dead cat bounce amid bearish RSI, potential death cross.

- The US oil could face stiff resistance at the bearish 21-HMA at $59.66.

- Markets await the API crude stocks data for fresh impetus.

WTI (futures on NYMEX) is attempting a minor recovery around the $59 mark, although the risks remain skewed to the downside amid bearish fundamental as well as technical factors.

The US oil tumbled on Monday, despite the sell-off in the US dollar across the board, as rising oil supplies from OPEC and its allies as well as from Iran weighed heavily on the commodity.

All eyes now remain on the American Petroleum Institute’s (API) weekly crude supplies report due later on Tuesday for the next direction in prices.

From a near-term technical perspective, the recovery in the WTI barrel appears to fizzle out just above the $59 threshold, as the Relative Strength Index (RSI) continues to remain in the bearish region on the hourly chart.

Adding credence to the downbeat outlook, the price has witnessed a bear cross earlier in the day, as the 21-hourly moving average (HMA) pierced through the 50 and 200-HMAs from above.

Further, a looming death cross, represented by the 50-DMA cutting the 200-HMA from above, also keeps the sentiment in favor of the oil bears.

Therefore, the US oil could drop back towards Monday’s low of $57.66 if the sellers regain control.

Ahead of that, the bears could challenge the $58 threshold.

If Monday’s low is cleared then March lows of $57.27 could be on the sellers’ radars.

WTI one-hour chart

On the flip side, WTI faces immediate resistance at the downward-pointing 21-HMA at $59.66.

The next relevant barrier is seen at the $60 mark (50 and 200-HMAs convergence), above which the 100-HMA at $60.40 could be challenged.

WTI additional levels