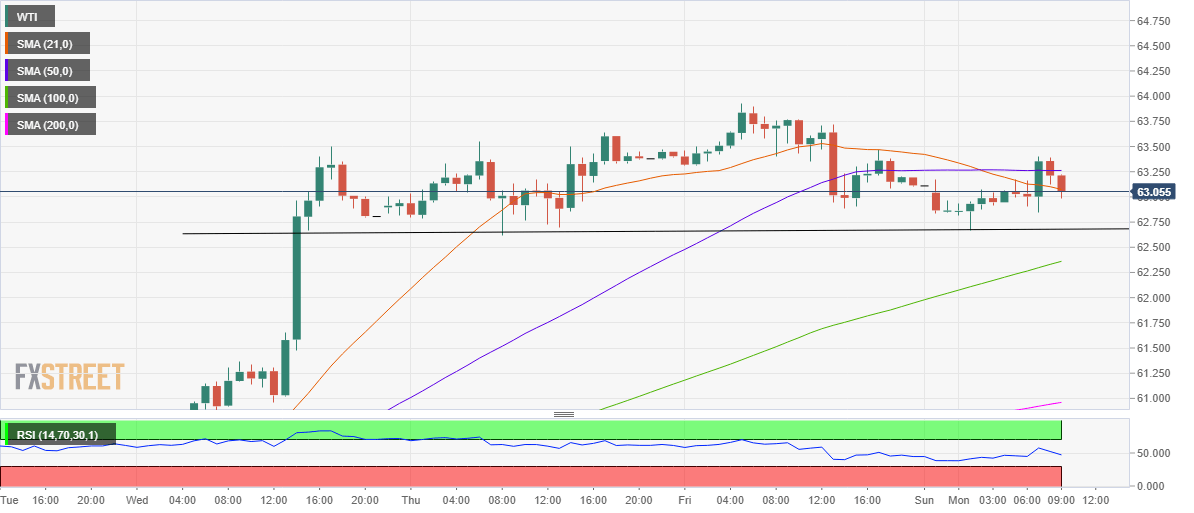

- Sellers return after WTI faces rejection above 50-HMA.

- The US oil clings to 21-HMA support just above the $63 mark.

- RSI turns bearish, key support at $62.65 appears at risk.

WTI (futures on NYMEX) has wiped off early gains, now back in the red zone around the $63 mark, as sellers fight back control in the European session.

At the time of writing, WTI is flirting with the downward-pointing 21-hourly moving average (HMA) support at $63.07, modestly lower on the day.

The bearish pressures got revived after the US oil failed to find acceptance once again above the 50-HMA at $63.26.

The next cushion for the WTI bulls is aligned at the horizontal trendline support at $62.65, from where the price has rebounded on a couple of occasions.

An hourly closing below that level could expose the bullish 100-HMA cap at $62.36.

The hourly Relative Strength Index (RSI) has edged into the bearish zone, backing the additional downside.

WTI one-hour chart

However, if the 50-HMA hurdle is scaled on a sustained basis, the bulls could look to challenge the April 16 high of $63.93.

Further up, the psychological $64.50 level will be on the buyers’ radars.

WTI additional levels