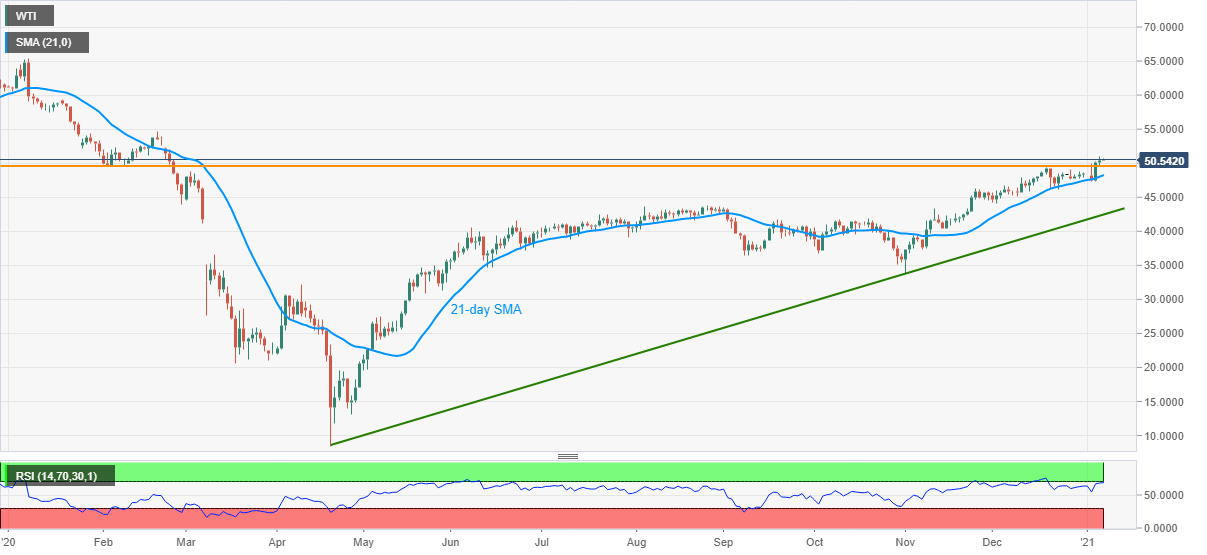

- WTI reverses the pullback from the highest since February 2020 flashed on Thursday.

- Sustained trading above key horizontal resistance battles overbought RSI conditions.

- 21-day SMA restricts immediate downside, bulls eye to refresh multi-month top.

WTI picks up the bids around $50.50, up 0.35% intraday, during Thursday’s Asian trading. The energy benchmark refreshed a multi-month high the previous day before stepping back from $50.95. However, the quote remains above a horizontal area comprising February 2020 low and the previous month’s high, which in turn keeps the energy buyers hopeful.

That said, overbought RSI conditions challenge WTI bulls and hence can delay the run-up target February high of $54.68 while highlighting $51.00 as immediate resistance.

It should be noted that the commodity’s ability to cross $54.68 enables it to challenge the mid-January 2020 low near $57.45 but any further advances won’t hesitate to question the $60.00 and the year 2020 peak of $65.45.

On the downside, a daily closing below $49.45/40 support, previous resistance, will drag the quote towards a 21-day SMA level of $48.25.

Further, WTI’s weakness past-$48.25 will be questioned by the late-November tops close to $46.30 ahead of highlighting an ascending trend line from April 21, 2020, currently around $42.45.

Overall, oil prices are up for challenging the early 2020 tops but overbought RSI and wait for the fundamental decisions, mainly from the US, can keep the momentum choppy.

WTI daily chart

Trend: Bullish