- WTI struggles to keep $46.00 amid a choppy session.

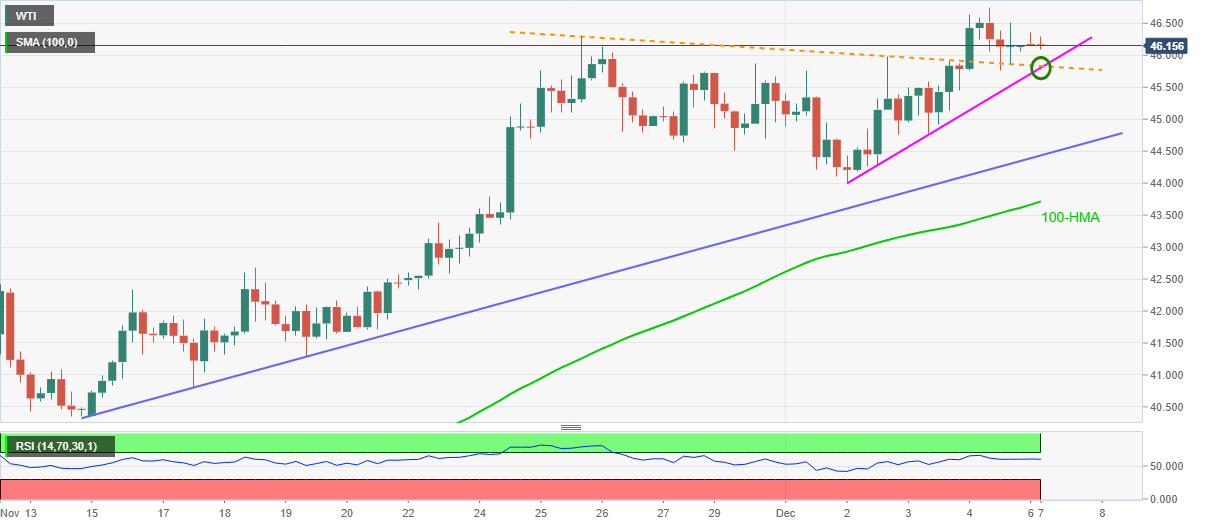

- An eight-day-old previous resistance line, ascending support line from Wednesday restricts immediate downside.

- March high lures the bulls ahead of early-February lows.

WTI eases to $46.17 during early Monday. The energy benchmark crosses the short-term resistance line on Friday but failed to rise beyond $46.75.

Even so, a confluence of the stated resistance, now support, coupled three-day-long rising trend line, around $45.80, limits the quote’s immediate downside.

Also favoring the odds of the black gold’s further upside is the upbeat RSI condition as well as sustained trading beyond 100-HMA.

As a result, WTI bulls targeting March 202 peak surrounding $48.75 are looking for a clear break above the latest high of $46.75.

Alternatively, a downside break below $45.80 can take rest on the monthly support line near $44.40 while the 100-HMA level of $43.70 can please the oil bears afterward.

WTI hourly chart

Trend: Bullish