- WTI bounces off intraday low, dropped earlier as US dollar extends Friday’s recovery moves.

- Greenback benefits from virus woes, stimulus passage amid a light calendar day.

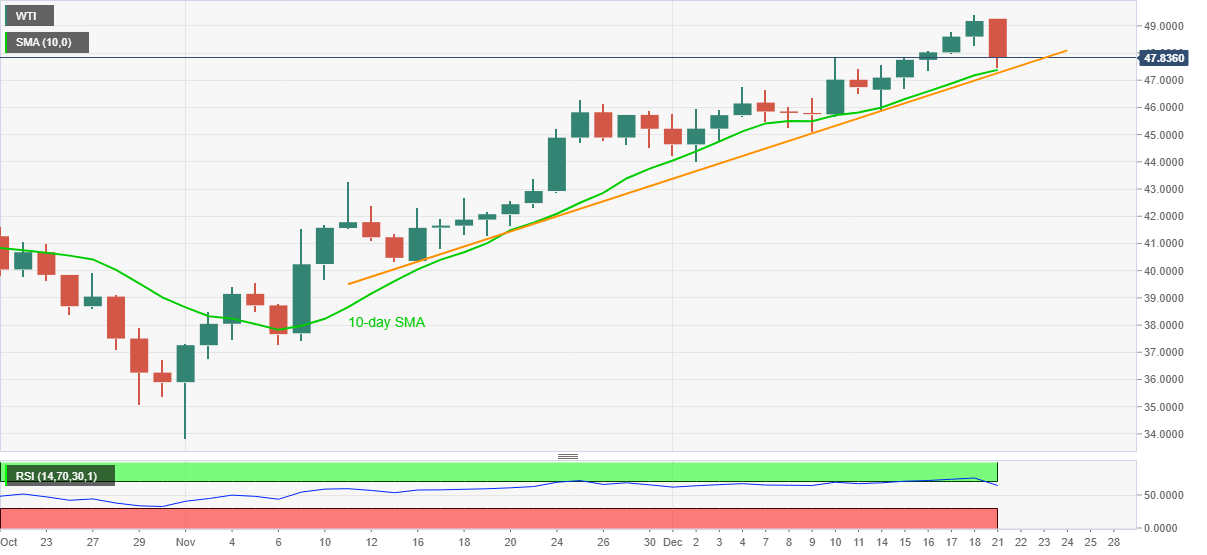

- 10-day SMA, five-week-old support line restricts immediate downside.

WTI picks up the bids near $47.85, down 2.68% intraday, during early Monday. In doing so, the energy benchmark takes the U-turn from the highest levels since February, marked last Friday, amid US dollar gains, mainly backed by the risk-off mood and nearness to the American aid package.

Read:

Other than the fundamentals, overbought RSI conditions also favored the WTI sellers’ return. However, a confluence of 10-day SMA and an ascending trend line from mid-November, near $47.40/25, offers strong immediate support.

While the recent dip in RSI and fundamentals favor further weakness of oil prices, a sustained downside break of $47.25, also breaking the $47.00, becomes necessary for the sellers’ entry.

In a case, the WTI bears keep reins past-$47.00, November high near $46.30 and the monthly bottom near $44.00 will gain market attention.

On the flip side, the recent high near $49.45 and the $50.00 offer immediate resistance to the commodity. However, any further upside will not refrain from the February high of $54.68.

WTI daily chart

Trend: Further weakness expected