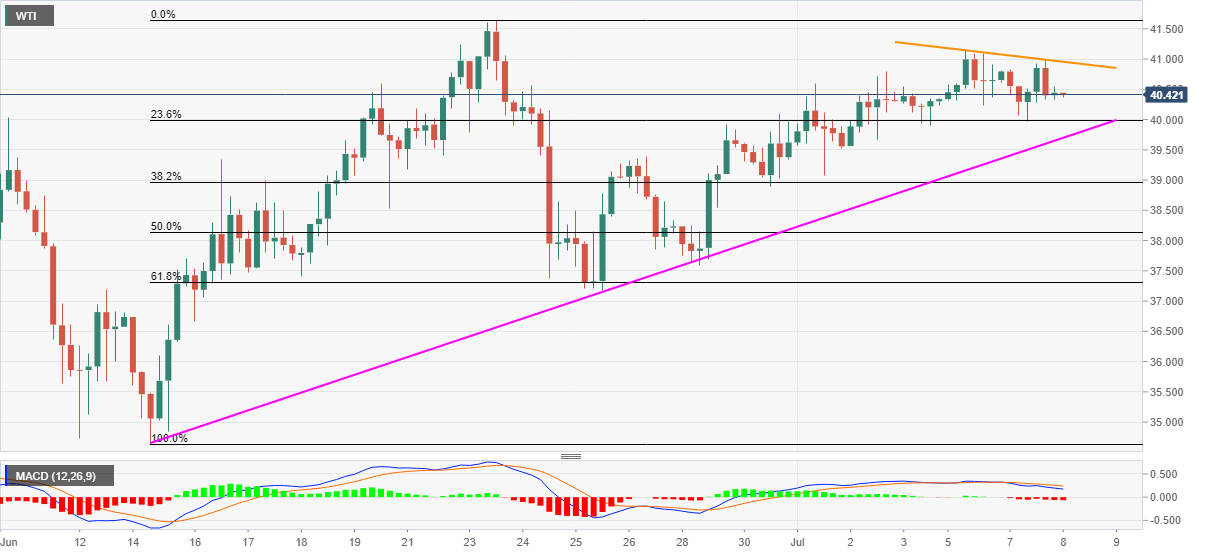

- WTI stays pressured after rising to two-week top the previous day.

- Immediate falling trend line, bearish MACD suggests further weakness.

- An upward sloping trend line from June 15 offers immediate support.

- Bulls will have to cross June month top to aim for February high.

WTI takes rounds to $40.50/40 as the Tokyo session opens for Wednesday. The energy benchmark repeated failures to cross $41.00 so far during the current week. In its latest attempt on Tuesday, the quote reversed from $40.99.

Considering the commodity’s inability to stay strong beyond $40.00, coupled with the bearish MACD signals, the sellers are likely to wait for an entry. As a result, a three-week-old support line, at $39.70, becomes the key to watch.

If at all the buyers get defeated with a price level below $39.70, June 24 top near $39.40 and 61.8% Fibonacci retracement level of June 15-23 rise, around $37.30, will return to the charts.

On the contrary, a clear break above the immediate resistance line, at $40.96 now, will need a sustained cross past-June month high of $41.65 to challenge February month low surrounding $44.00.

WTI four-hour chart

Trend: Pullback expected