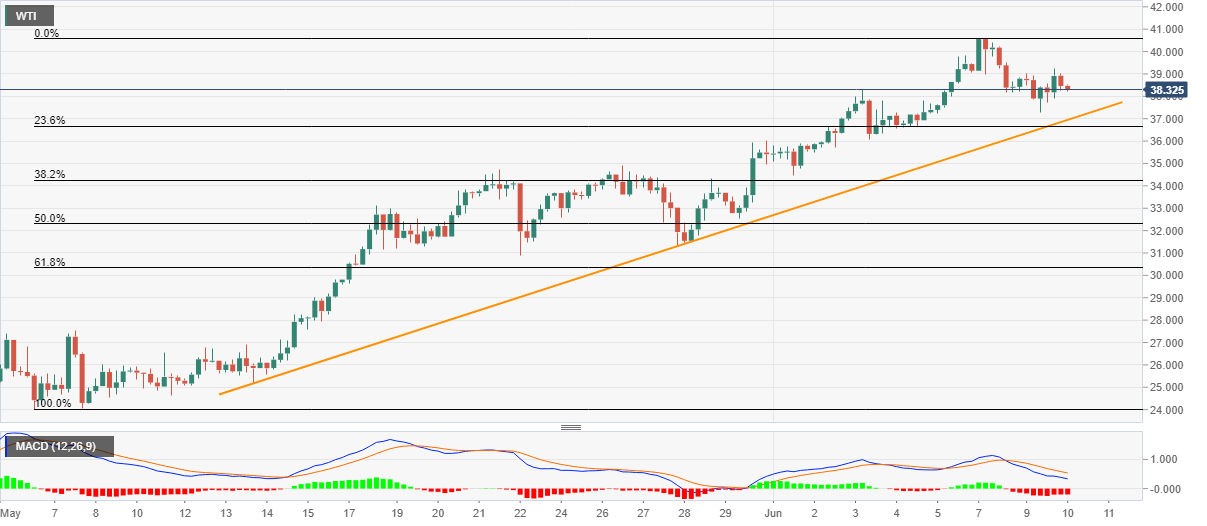

- WTI benchmark snaps the previous day’s recovery moves from $37.26.

- Bearish MACD signals drag the quote towards an ascending trend line from May 13.

- Buyers may look for a sustained break above $40.00 for fresh entries.

WTI crude oil prices on NYMEX decline to $38.27 during the initial Asian session on Wednesday. The barrels of black gold recovered from $37.26 on Tuesday but failed to rise past-$38.55 on the daily closing basis.

Other than the energy benchmark’s failure to cross $38.55, bearish MACD also favors the odds of further downside towards the monthly support near $36.95.

Should the bears refrain from respecting the short-term key support line, May 26 high near $34.90 could offer intermediate halt ahead fetching the quote to sub-$31.00 area.

Meanwhile, $40.00 round-figure and the weekly high near $40.61 might keep the bulls away during the pair’s U-turn towards the north. Given the commodity prices rally past-$40.61, March 06 low near $41.22 could lure the bulls.

WTI four-hour chart

Trend: Further downside likely