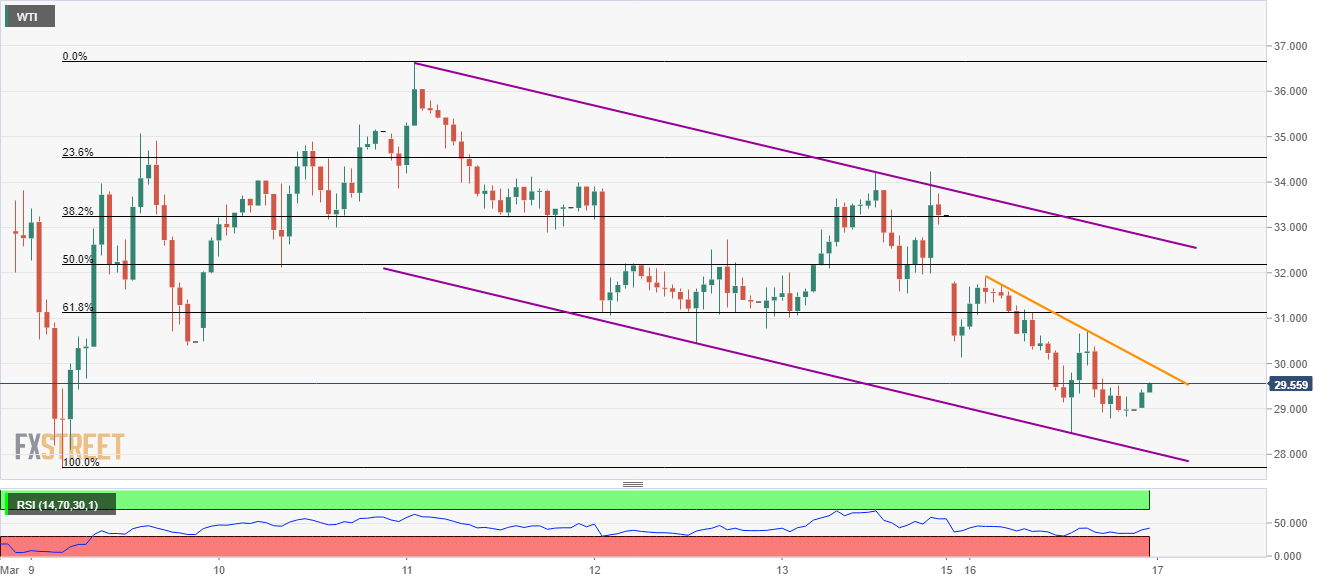

- WTI remains under pressure inside a short-term falling trend channel.

- An immediate descending trend line adds a filter to the black gold’s pullback moves.

- An upside clearance of the gap could push buyers towards filling the early-month gap.

WTI takes rounds to $29.50 amid the Asian session on Tuesday. The energy benchmark remains under pressure below $30.00 while staying inside a four-day-old descending trend channel.

Also exerting downside pressure is the nearby resistance line, currently at $30.10, a break of which could escalate the quote towards 61.8% Fibonacci retracement of its recovery moves between March 09 and 11, at $31.12.

It should, however, be noted that the black gold’s sustained break above the channel’s resistance, at $32.80 now, can push it beyond $36.60 to fill in the early-month gap below $41.70.

On the downside, the channel’s support near $28.00 and the monthly bottom close to $27.70 holds the key to the oil prices’ further downside.

WTI hourly chart

Trend: Bearish