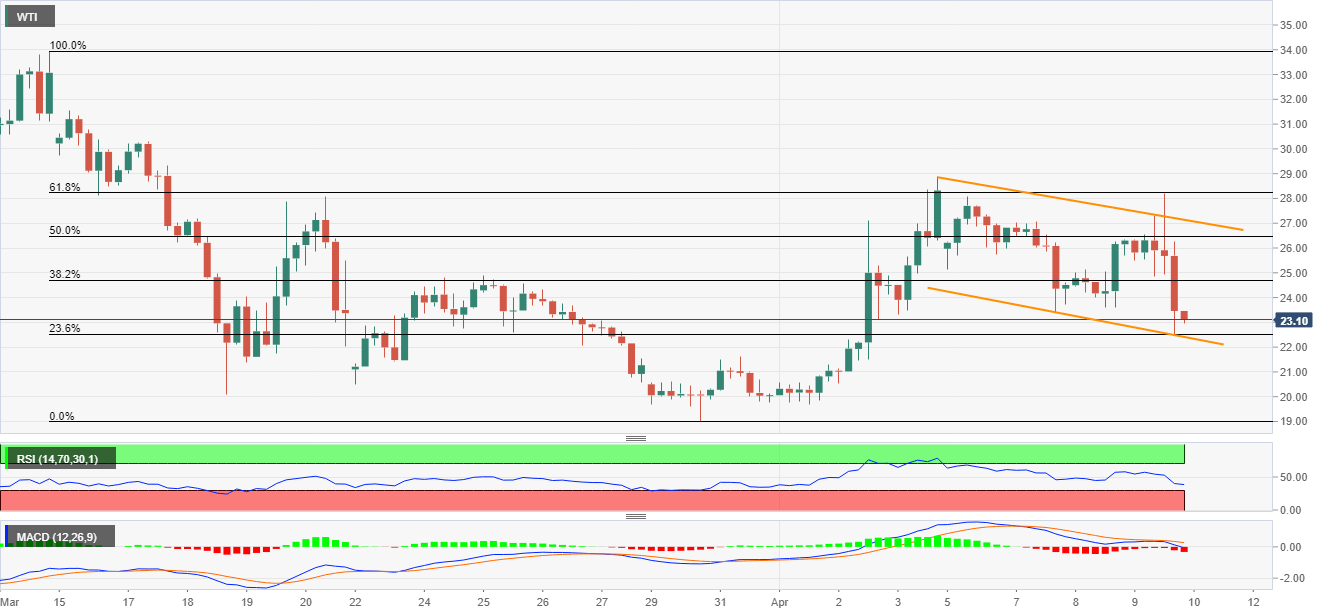

- WTI remains on the back foot inside following its U-turn from 61.8% Fibonacci retracement.

- Channel’s support, 23.6% Fibonacci retracement could check further downside.

- Buyers could target $30.00 during the sustained run-up.

Following its U-turn from the key Fibonacci retracement, WTI forms a short-term falling channel while declining to $23.10.

23.6% Fibonacci retracement of March 13-30 fall and the channel’s support, near $22.50/40, can question the oil benchmark’s immediate downside.

If bears chose to ignore the channel formation, $20.50, $19.80 and the previous month’s low near $19.00 could return to the charts.

On the upside, 38.2% and 50% of Fibonacci retracement, respectively around $24.470 and $26.50, could challenge the black gold’s recovery ahead of the channel’s resistance near $27.15.

Also exerting downside pressure on the oil prices could be 61.8% Fibonacci retracement level near $28.25 that holds the gate for $30.00.

WTI four-hour chart

Trend: Bearish