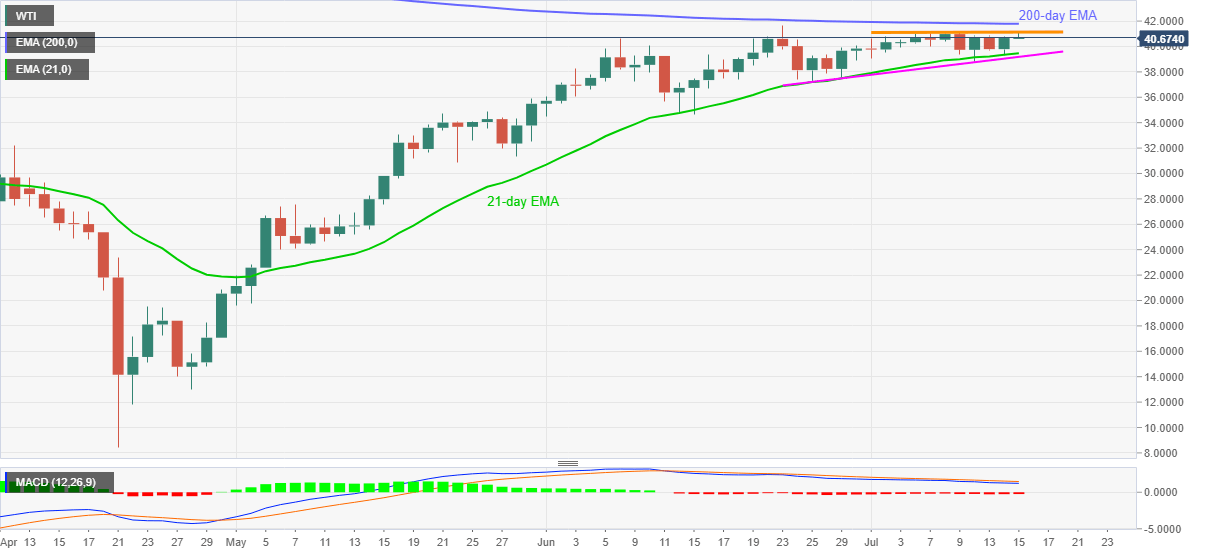

- WTI takes a U-turn from $41.08 to mark fifth failure to stay beyond the $41.00 threshold.

- 21-day EMA, a three-week-old support line restrict immediate downside.

- June month high, 200-day EMA offers strong resistance.

WTI trims early-day gains while declining to $40.72 during the initial hour of Tokyo open on Wednesday. In doing so, the energy benchmark portrays one more failure to stay beyond $41.00. The quote bounced off 21-day EMA the previous day.

With the bearish MACD joining the black gold’s repeated failures to cross $41.00, sellers are rolling up their sleeves for $40.00 psychological magnet. Though, 21-day EMA near $39.50 and an upward sloping trend line from June 25, at $39.15 now, could challenge the bears.

In a case where the oil prices remain weak past-$39.15, the late-June month’s bottom surrounding $37.10 should return to the charts.

Alternatively, a clear break beyond $41.00 needs validation from June month’s top of $41.65 and 200-day EMA, currently around $41.80, to aim for February’s low close to $44.00.

WTI daily chart

Trend: Pullback expected