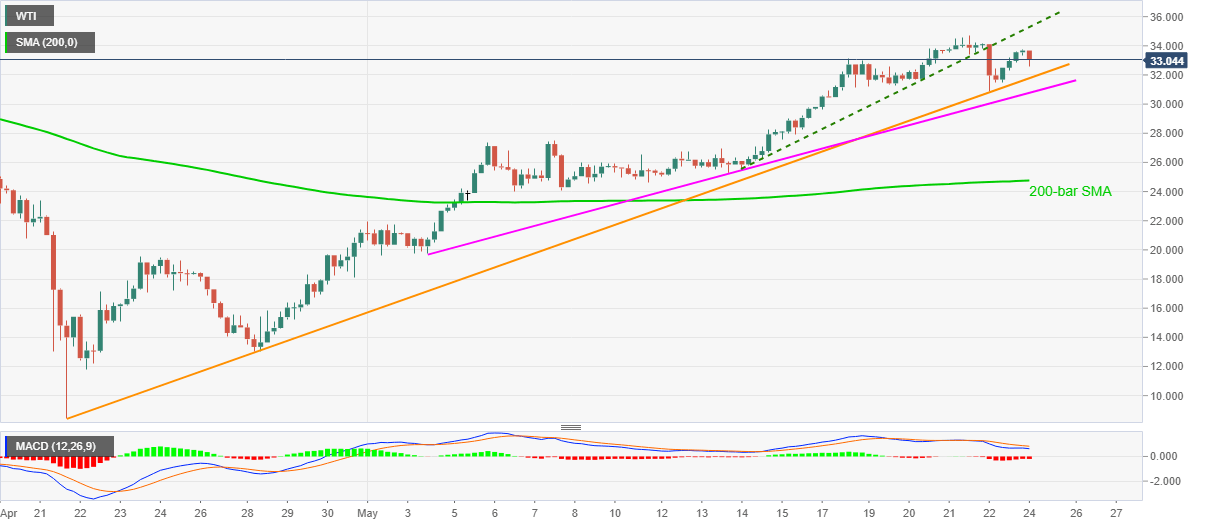

- WTI recovers from an intraday low of $32.60.

- A two-week-old support-turned-resistance on buyers’ radars.

- Multiple supports will question the sellers below $31.80.

Having initially slipped to $32.60, WTI Futures on NYMEX pulls back to $33.05, down 1.86% on a day, during the early Asian session on Monday.

Despite the black gold’s recent recovery, the quote stays below a short-term ascending trend line from May 14, at $35.25, which in turn keeps the upside capped.

Though, the energy benchmark’s pullback towards the monthly high of $34.74, on the successful break of $33.72, can’t be ruled out.

Alternatively, An upward sloping trend line from April 21, at $31.77 now, followed by another rising support line from May 04 around $30.75, can keep the black gold supported for a while.

In a case where the oil prices slip below $30.75, $30.00 may offer an intermediate halt before highlighting the 200-bar SMA level of $24.77.

WTI four-hour chart

Trend: Bullish