- WTI bull-bear tug-of-war persists while above the 40 barrier.

- The path of least resistance appears to the upside.

- EIA crude stocks data to decide the next direction?

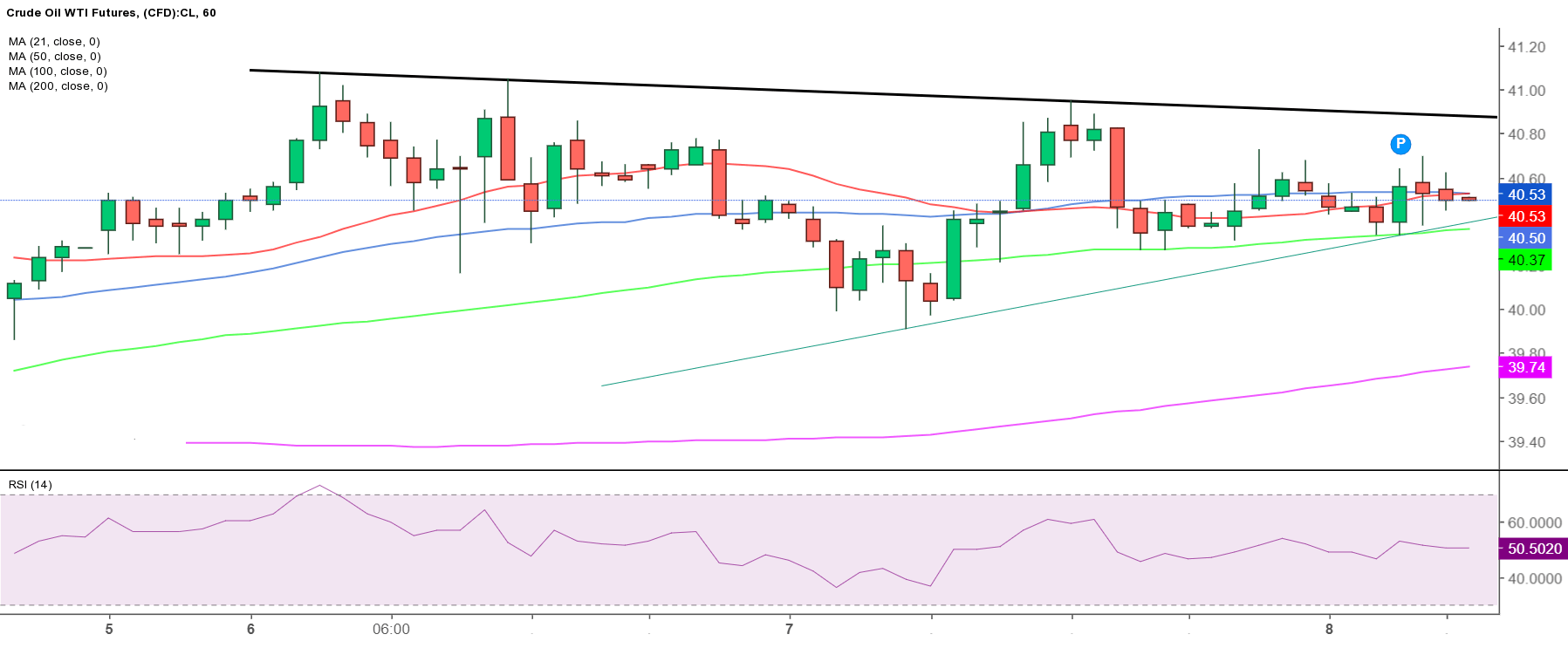

WTI (August futures on NYMEX) is trading in a tight range around 40.50 so far this Wednesday, with the upside attempts capped near 40.70 while the bulls continue to guard the 40 barrier.

The US oil consolidates Tuesday’s drop from near 41.00 after the risk-off market mood and a build in the American Petroleum Institute’s (API) weekly crude stockpiles undermined the sentiment around the black gold.

From a near-term technical perspective, the bulls and bears remain in a wait and see mode, as the price clings to the 40.50 level, which is the confluence of the 21 and 50-hourly Simple Moving Averages (HMA).

Despite the range play, the path of least resistance appears to the upside, as the barrel of WTI trades almost above all the major HMAs. The falling trendline resistance at 40.88 is the level to beat for the bulls, as they look to regain the momentum above the 41 handle.

The bullish bias will remain intact as long as the commodity holds above the horizontal 100-HMA and rising trendline support at 40.35. An hourly closing below the latter will negate the near-term upbeat momentum, calling for a test of the upward sloping 200-HMA at 39.72.

WTI hourly chart

WTI additional levels