- Prices of the WTI are correcting lower around $59.50.

- US crude oil supplies dropped more than expected yesterday.

- US-China trade dispute back to the fore.

After briefly testing the psychological $60.00 mark per barrel, prices of the WTI are now giving away some gains and returning to the $59.50 region.

WTI looks to trade, data

Prices of the barrel of the West Texas Intermediate are navigating the lower bound of the daily range, easing some ground for the first time after three consecutive daily advances and coming down after testing levels just above the $60.00 mark, area last visited in mid-November 2018.

WTI is coming under some selling pressure after the Federal Reserve highlighted the likeliness of a slowdown in the economy at its meeting on Wednesday.

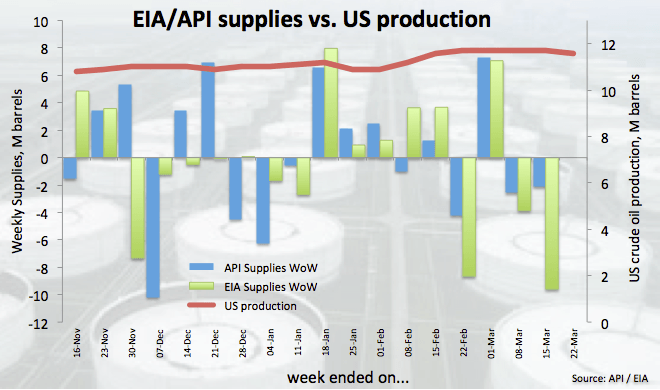

However, the persistent selling bias hitting the greenback plus another drop of US crude supplies as reported by the EIA on Wednesday and the ongoing OPEC+ output cut deal continue to sustain the underlying bullish view in the commodity.

Later on Friday, Baker Hughes will publish its weekly report on US drilling activity.

What to look for around WTI

Crude oil has managed to retake the critical $60.00 mark per barrel albeit for a few moments earlier today following the continuation of the negative mood around buck and a generalized better tone in the risk-associated complex. The bullish view in crude oil remains well in place, in the meantime, on the back of the so-called ‘Saudi put’, tight conditions in the US markets (amidst US net imports in historic low levels and the rising activity in refiners ahead of the summer session), the current OPEC+ agreement to cut oil output and ongoing US sanctions against Iranian and Venezuelan crude oil exports. Furthermore, the OPEC+ could announce an extension of the ongoing agreement to curb oil production at the cartel’s meeting in June.

WTI significant levels

At the moment the barrel of WTI is losing 0.27% at $59.51 and a breakout of $60.03 (2019 high Mar.21) would open the door for $61.84 (200-day SMA) and then $63.74 (61.8% Fibo of the October-December drop). On the downside, the next support emerges at $58.17 (10-day SMA) seconded by $57.12 (21-day SMA) and finally $54.37 (low Mar.8).