- Prices of WTI rebound from Friday’s lows near $55.30.

- Optimism around US-China trade deal sustains sentiment.

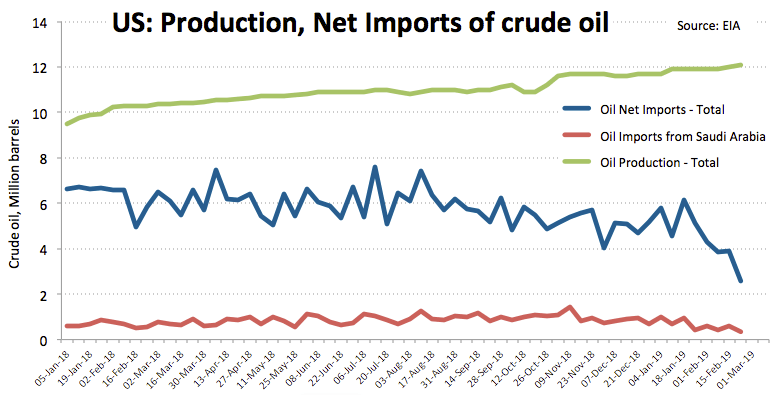

- US oil net imports dropped to record lows.

Prices of the barrel of American reference for the sweet light crude oil are inching higher at the beginning of the week, recovering part of the ground lost on Friday’s sell off and regaining the key $56.00 mark for the time being.

WTI looks to trade, data

Rising optimism in the riskier assets continues to be bolstered by expectations that a US-China trade deal could be just around the corner, according to latest news on the matter.

The barrel of WTI manages to regain traction despite the better tone in the greenback, which has quickly left behind another bout of criticism from President Trump to the Fed’s ongoing monetary policy, reiterating at the same time that the greenback remains ‘too strong’.

By the same token, crude oil prices have recovered from similar comments from Trump last week, that time targeting the OPEC+ agreement to support higher crude oil prices.

Later in the week, the usual weekly report on US stockpiles by the API (Tuesday) and EIA (Wednesday) are due ahead of Baker Hughes’ oil rig count on Friday.

What to look for around WTI

The (apparent) proximity of a trade agreement between US and China keeps supporting traders’ sentiment and collaborates with the view of higher prices. Also sustaining prices, US supply conditions are expected to remain tight amidst US net imports in historic low levels and the expected increasing activity in refiners ahead of the summer session. Added to this scenario, the so-called ‘Saudi Put’ plus the current OPEC+ agreement to curb production should also add to the bullish prospects of prices along with current US sanctions on Iranian and Venezuelan oil exports.

WTI significant levels

At the moment the barrel of WTI is gaining 1.41% at $56.29 and a break above $57.60 (2019 high Mar.1) would open the door to $58.00 (high Nov.16 2018) and finally $59.63 (50% Fibo retracement of the October-December drop). On the other hand, the initial support emerges at $55.01 (21-day SMA) seconded by $54.73 (low Feb.26) and then $51.89 (55-day SMA).