- Prices of crude oil are losing further momentum.

- US-China trade jitters remain in centre stage.

- API, EIA coming up next in the docket.

Prices of the barrel of WTI have resumed the leg lower at the end of the week, finding some decent support in the boundaries of the $58.00 mark so far today.

WTI looks to trade, data for direction

Crude oil prices have lost the shine in past sessions, now retreating for the second week in a row and navigating levels last seen in mid-march around the $58.00 mark per barrel.

Prices of the barrel of the West Texas Intermediate dropped and met support in the $57.20 region during last week – coincident with a Fibo retracement of the December-April rally – and are now looking to consolidate in this zone.

Rising concerns over the potential drop in the global demand for crude oil in response to the US-China trade dispute plus rising US supplies have been weighing on traders’ sentiment as of late, dragging prices lower and offsetting oil-positives such as US-Iran rising tensions, persistent turmoil in Libya and the OPEC+ deal to curb oil output.

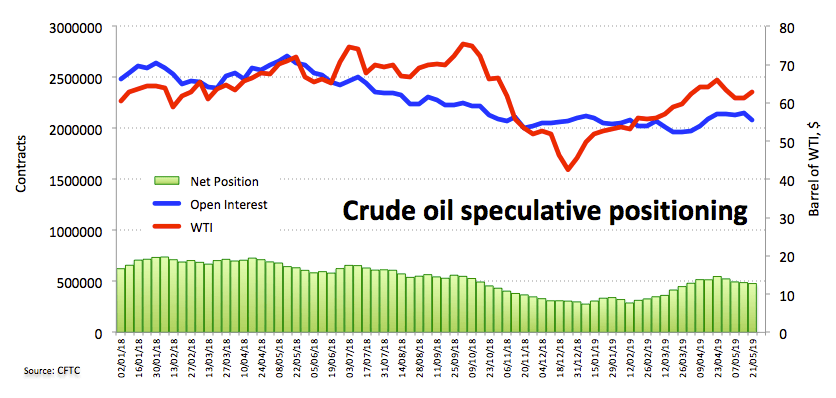

Regarding speculative positioning and according to the latest CFTC report, crude oil net longs receded to the lowest level since March 26 during the week ended on May 21. In addition, US oil rig count decreased for the third session in a row during last week, taking active oil rigs to 797.

Later in the week, the API and the EIA will report on US crude oil inventories and oil rig count by driller Baker Hughes.

What to look for around WTI

Prices of the WTI are starting the week on a negative note in the area of $58.00 mark per barrel, adding to last week’s sharp pullback of more than 10%. As usual, traders keep looking to the US-China trade dispute as the main catalyst for crude oil prices, at least in the near to medium term. These fears have undermined the bullish perspective on WTI for the time being, which remain mainly supported by the ongoing agreement in the OPEC+ and geopolitical tensions albeit at a lesser degree.

WTI significant levels

At the moment the barrel of WTI is losing 1.09% at $58.23 and faces the next support at $57.19 (low May 24) followed by $54.37 (low Mar.8) and then $52.31 (200-week SMA). On the flip side, a break above $60.16 (200-day SMA) would aim for $61.60 (55-day SMA) and finally $63.79 (high May 20).