- The barrel of WTI recorded fresh yearly highs near $66.00 mark.

- US could end waivers on Iranian oil exports.

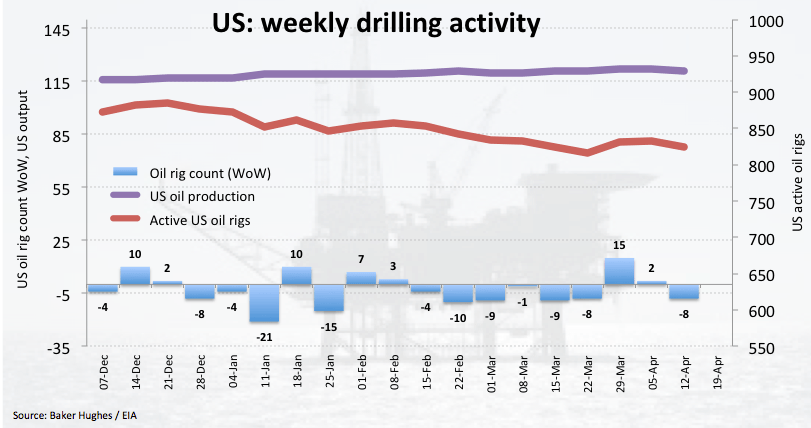

- US oil rig count dropped by 8 to 825 last week.

Crude oil prices are sharply higher at the beginning of the week, pushing the barrel of WTI and Brent to 2019 highs near $66.00 and beyond $74.00, respectively.

WTI up on US-Iran waivers story

Prices of the American reference for the sweet light crude oil have advanced to fresh 2019 highs in the boundaries of the $66.00 mark per barrel earlier in the session after the White House said it will eliminate waivers issued to 8 countries to buy Iranian crude oil under the current scheme of US sanctions. These countries are China, India, S.Korea, Turkey, Italy, Greece, Taiwan and Japan.

Also lending support to higher oil prices, the US oil rig count shrunk by 8 rigs during last week, taking the total active oil rigs to 825. Later in the week, the usual reports on US crude oil stockpiles by the API and the EIA will be published on Tuesday and Wednesday, respectively.

What to look for around WTI

WTI climbed to fresh 6-month highs near the $66.00 mark per barrel earlier today following US-Iran news. In addition, hopes of a closer US-China trade deal remain on the rise and are also collaborating with the upbeat sentiment around crude oil. On the broader picture, the bullish view on crude oil stays underpinned by the so-called ‘Saudi put’ in combination with tighter conditions in the US markets (amidst US net imports in historic low levels and the rising activity in refiners ahead of the summer session), the current OPEC+ deal to curb production, US sanctions against Iranian and Venezuelan crude oil exports and positive speculative positioning.

WTI significant levels

At the moment the barrel of WTI is gaining 2.06% at $65.25 and a breakout of $65.85 (2019 high Apr.22) would expose $68.06 (low Oct.29 2018) and finally $69.60 (78.6% Fibo of the October-December drop). On the other hand, the next down barrier lines up at $62.93 (low Apr.16) followed by $60.99 (200-day SMA) and then $59.63 (50% Fibo of the October-December drop).