- WTI moved lower and tested the $52.00 area.

- Wuhan virus keeps weighing on traders’ mood.

- API, EIA, FOMC keep events later in the week.

There is no respite for the barrel of WTI on Monday, as prices of the American benchmark for the sweet light crude oil tumbled to the $52.00 region in early trade, area last visited in early October 2019.

WTI focused on China, data

Prices of the West Texas Intermediate dropped to the boundaries of the $52.00 mark per barrel earlier on Monday amidst rising concerns on the fast-spreading coronavirus in China and its probable impact on the economic outlook of the second world oil importer.

In addition, traders’ concerns regarding an oversupplied oil market remain far from abated for the time being and are forecasted to keep hurting the sentiment and undermining any attempt of recovery in prices.

Further out, the speculative community continued to trim their long positions in the crude oil during the week ended on January 21st, taking the net longs to 5-week lows at around 520.6K contracts, as per the latest CFTC report.

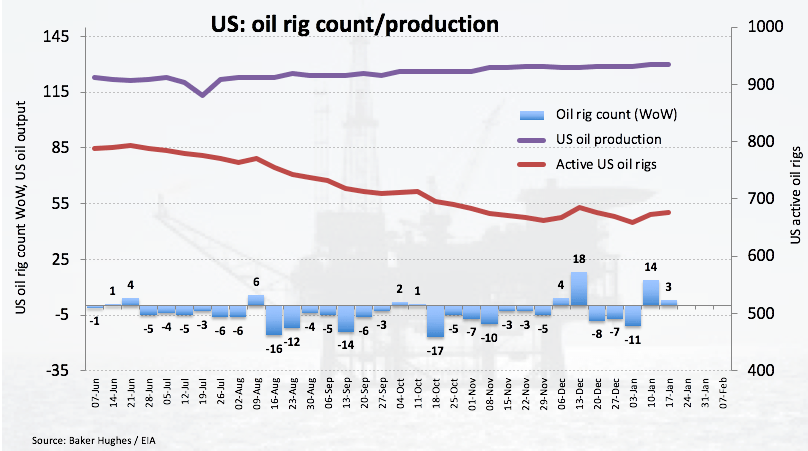

On another front, driller Baker Hughes reported on Friday another uptick in the US oil rig count, this time by 4 and taking the total active oil rigs to 676.

Later in the week, the FOMC will decide on interest rates seconded by the press conference by Chief J.Powell. Still in the US, and as usual, the API and the EIA are expected to report on US crude oil supplies on Tuesday and Wednesday, respectively.

What to look for around WTI

The outbreak of the Wuhan virus and its potential impact on Chinese growth have been heavily weighing on traders’ sentiment during the past couple of weeks, adding to the already rising concerns on the excess of crude oil supply in the markets. Supporting the later, and undermining any serious rebound, the IEA expects prices to remain capped during the first half of the year following a forecasted surplus of nearly a million bpd. On the supportive side for prices emerge the persistent supply disruptions in Libya, social unrest in Iraq and a fragile US-Iran scenario.

WTI significant levels

At the moment the barrel of WTI is retreating 2.93% at $52.57 and a break below $52.13 (2020 low Jan.27) would aim for $51.06 (monthly low Oct.3 2019) and finally $50.47 (monthly low Aug.7 2019). On the flip side, the next resistance aligns at $57.41 (200-day SMA) seconded by $58.67 (55-day SMA) and finally $59.73 (weekly high Jan.20).