- WTI moves higher and retakes the $63.00 handle, drops afterwards.

- Support emerged near $62.00 following Friday’s sell off.

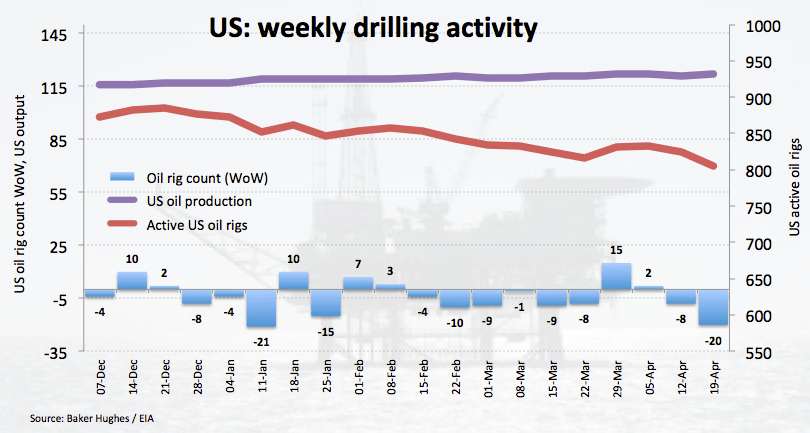

- US oil rig count dropped by 20 last week.

After Friday’s sharp sell off, prices of the barrel of WTI have started the week on a better footing, managing to reclaim the $63.00 area and above although running out of steam afterwards.

WTI looks to risk trends, data, trade

Prices of the barrel of the West Texas Intermediate are alternating gains with losses today after three consecutive daily pullbacks, particularly after being rejected from YTD tops beyond the $66.00 mark recorded last week.

Friday’s sharp down move came once again after President Trump criticised the high level of crude oil prices, ‘suggesting’ at the same time the OPEC to pump further oil to counteract the imminent termination of the US waiver programme for Iranian exports.

Today’s better mood in the riskier assets appears to be lending some support to crude oil prices amidst the generalized lack of direction in the greenback and some cautiousness ahead of the upcoming US-China trade talks in Beijing.

In addition, the recovery in prices found extra oxygen after driller Baker Hughes reported oil rig count went down by 20 rigs during last week, taking active rigs to 805.

What to look for around WTI

WTI climbed to fresh 6-month highs beyond the $66.00 mark per barrel last week, although the up move lacked of sustainability. In the meantime, US sanctions against Iranian crude oil exports and the response from OPEC members to the probable supply disruptions are posed to drive the sentiment in the near term along with rising geopolitical effervescence in Libya and developments from the US-China trade talks in Beijing later this week. Looking at the broader scenario, the so-called ‘Saudi put’, tighter conditions in the US oil market, the current OPEC+ deal to curb oil output, favourable speculative positioning and increasing turmoil in Venezuela keep propping up the underlying bullish view on crude oil.

WTI significant levels

At the moment the barrel of WTI is gaining 0.03% at $62.76 and faces the next support at $62.16 (low Apr.26) seconded by $61.64 (low Apr.5) and then $60.87 (200-day SMA). On the other hand, a surpass of $66.46 (2019 high Apr.23) would expose $68.06 (low Oct.29 2018) and finally $69.60 (78.6% Fibo of the October-December drop).