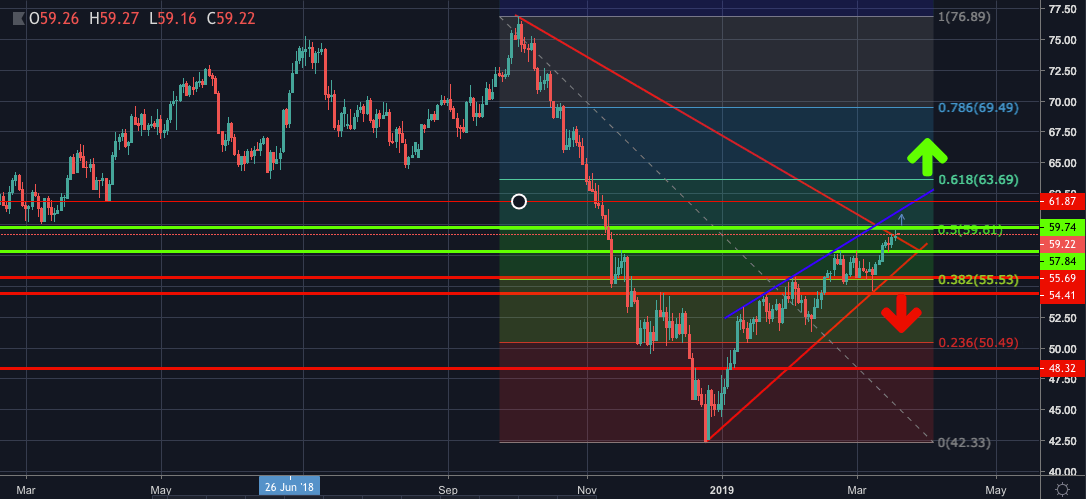

- So long as WTI holds above the double-top highs and above the 57.93 horizontal prior resistance line going back to mid-Nov 2018, the 60 handle is within reach and at this juncture, the price is supported at the 21-4hr SMA at 58.97 as a solid safeguard.

- However, a clean break of 59.70 is needed where bulls will then look to the rising wedge formation’s resistance just below the 62 handle at 61.87 ahead of the 61.8% Fibo of the Oct 2018 sell-off to late Dec lows at 63.74, reviving prospects for the 70 handle.

- On the flip side, should the 61.87 resistance equate to a correction, a break below 59.80 opens risk of a break out of the rising channel to the downside, especially on a break of 57.84.

- On the wide, a fall to 54.50 will open a case for 50.50 as the 23.6% Fibo support structure.

WTI daily chart