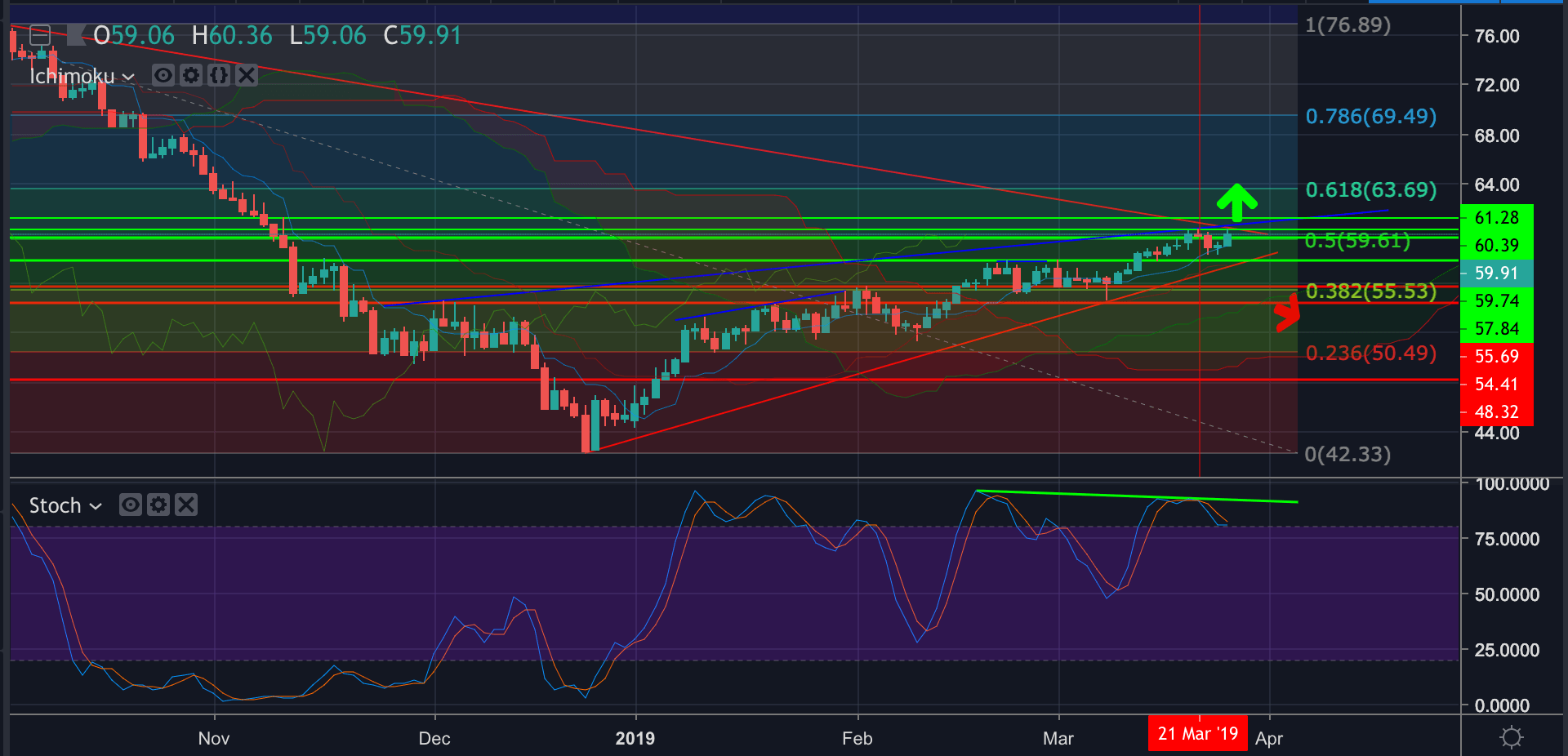

- WTI was rejected at the rising wedges resistance but bulls have stepped back in and are testing the prior highs once again on the 60 handle.

- This is likely to be a tough area of resistance but on a break above trend line resistance and the 61.20s, bulls will have a green light to attack territory towards the 61.8% Fibo in the 63.60s, reviving prospects for the 70 handle.

- However, what should be concerning to the bulls is the bearish divergence in stochastics as marked by the verticle red line on the chart and green descending horizontal line on stochastics; While below 61.20, bulls should tread with caution.

- On the flip side, a break of the 50% Fibo and cloud support and thus trend line support at 54.50m will open a case for 50.50 as the 23.6% Fibo support structure.

WTI daily chart