- WTI has rallied 1% at the open today on a series of provocative Iran headlines from the weekend and last week.

- The price has taken out the 20 and 50 4HR MAs, the 17th May low at 62.51 and 26th April lows at 62.26 respectively.

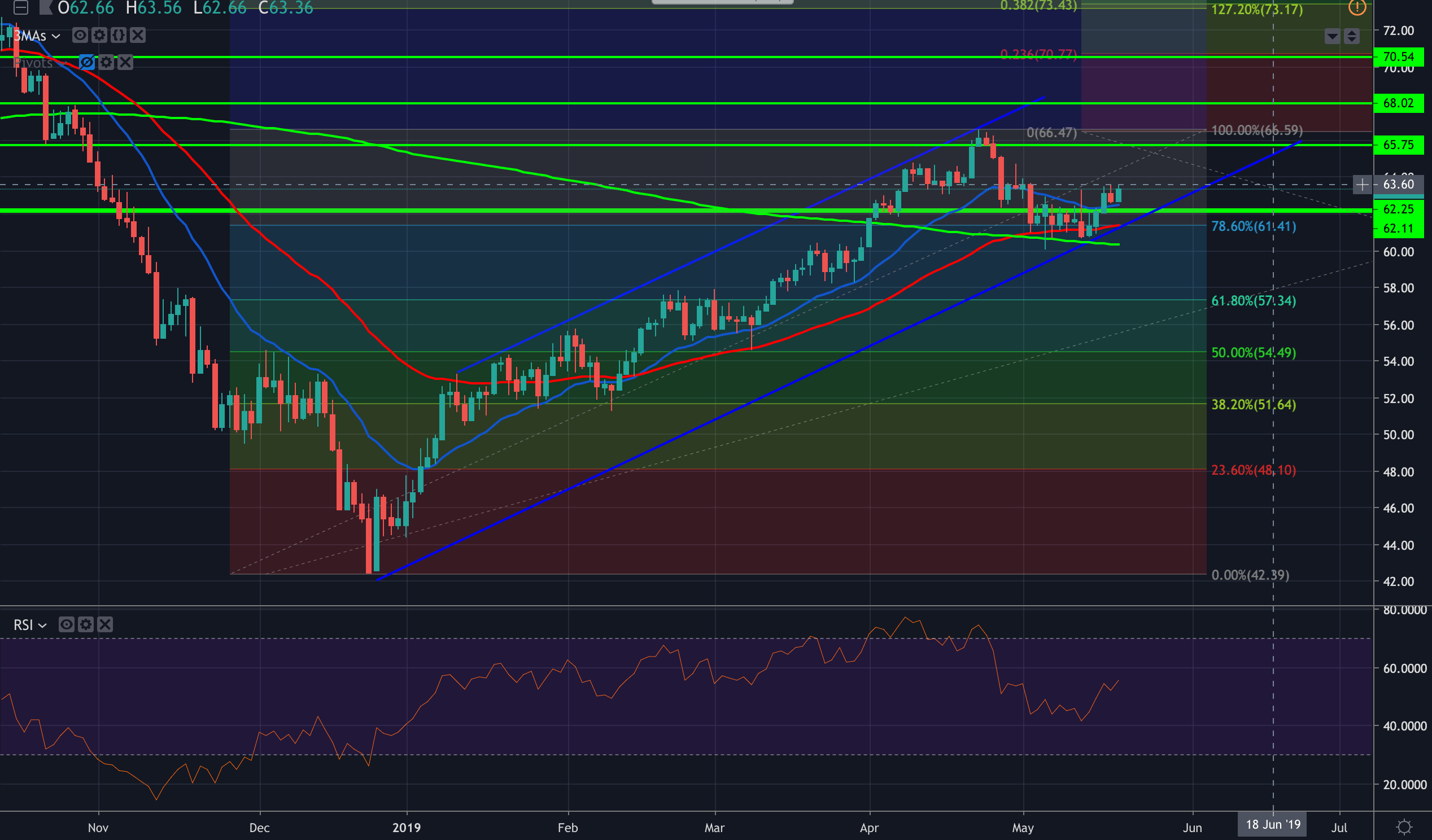

- WTI has hit the 63.50s on the opening spike, supported from the golden cross (50/200 DMA cross-over) where it coincides with the 23.6% Fibo, late Dec-late April range, and ascending channel support.

- Daily MACD and Stochastics had been turning more positive, and there is an upside bias on the medium term.

- However, the 4HR time frame is a little more complex.

- Momentum indicators are only just being relieved from overbought readings.

- The next significant upside target comes in at 65.70 (fractal low) then 66.58 as the 2019 highs which meets a series of historical support and resistance levels.

- A break there opens the 68 levels fractal targets guarding a break towards the 72.80-127.20% Fibo extensions around at 73.20 window.

- On the flip side, 62.09 14th May fractal high, or, the 62.18 9th May fractal highs could be a support level

- A break below channel support and the golden cross opens risk all the way down to 57.80 and the 61.8% Fibo around 57.30. 54.50 and the 50% retracement of 2019 range come in next.