- Bulls stepped up again overnight and are firm in Asia as well, propelling the black gold to the 6th May highs, through the channel resistance and piercing hourly 200 SMA.

- The price is holding above the golden cross and but did pierce below the 50 DMA, printing a lower low and the lowest level since 2nd May.

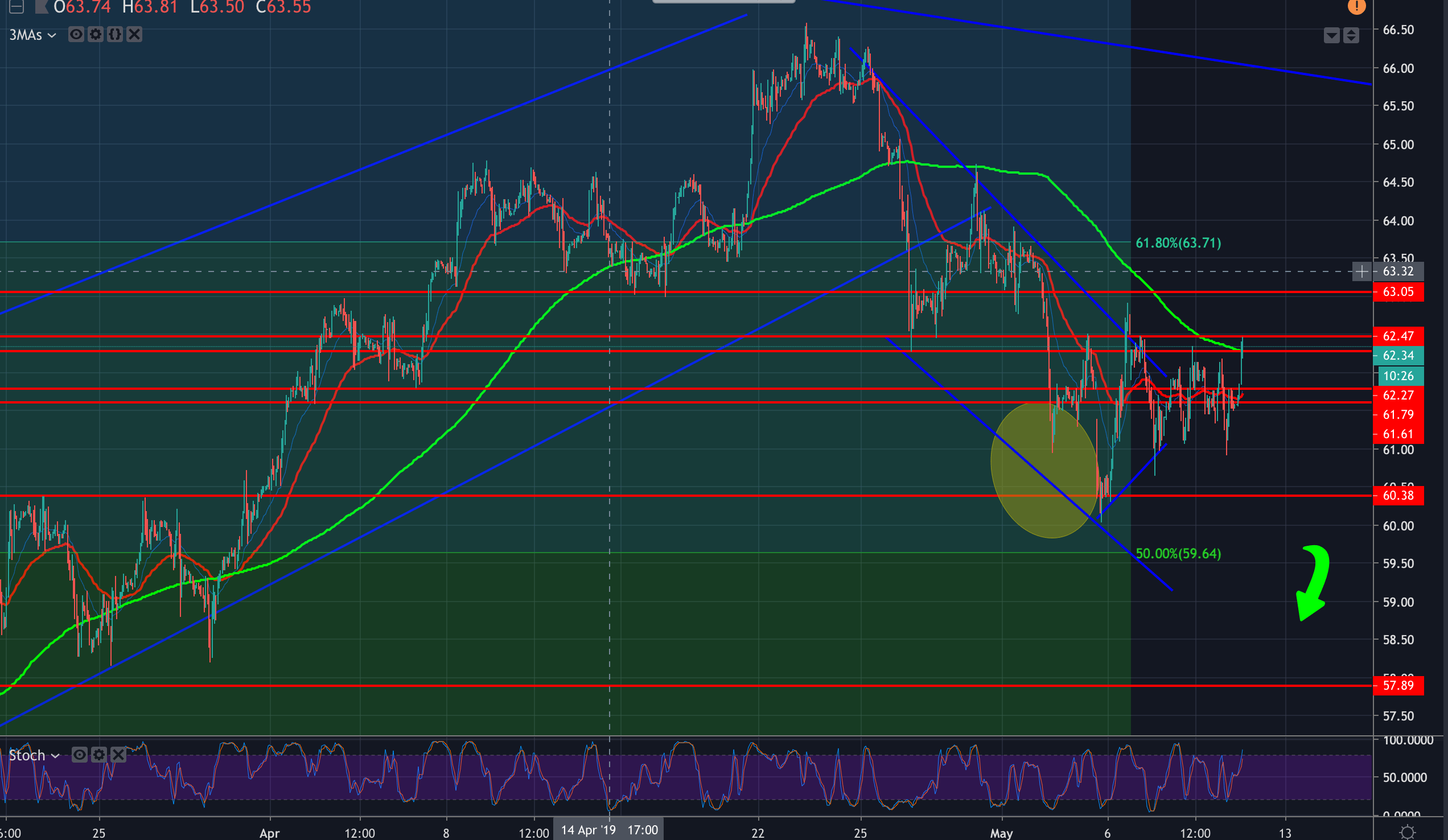

- On the flipside, the 200 DMA and 50% Fibo level accumulating in confluence at 60.60/59.60 respectively is key and could come into play while bulls are still below the 63 handle.

- A break of the 50% level opens prospects for the 25th March lows at 58.20 ahead of the late Feb/early March highs guarding a break to the early Feb highs at 55.80.

- A break of 63 opens the 61.8% Fibo target, however stochastics lean bearish.

Hourly chart