- Bulls testing the 21-DMA, firmer by 0.28% in Asia.

- Bears have their sights on a break below the 50 handle.

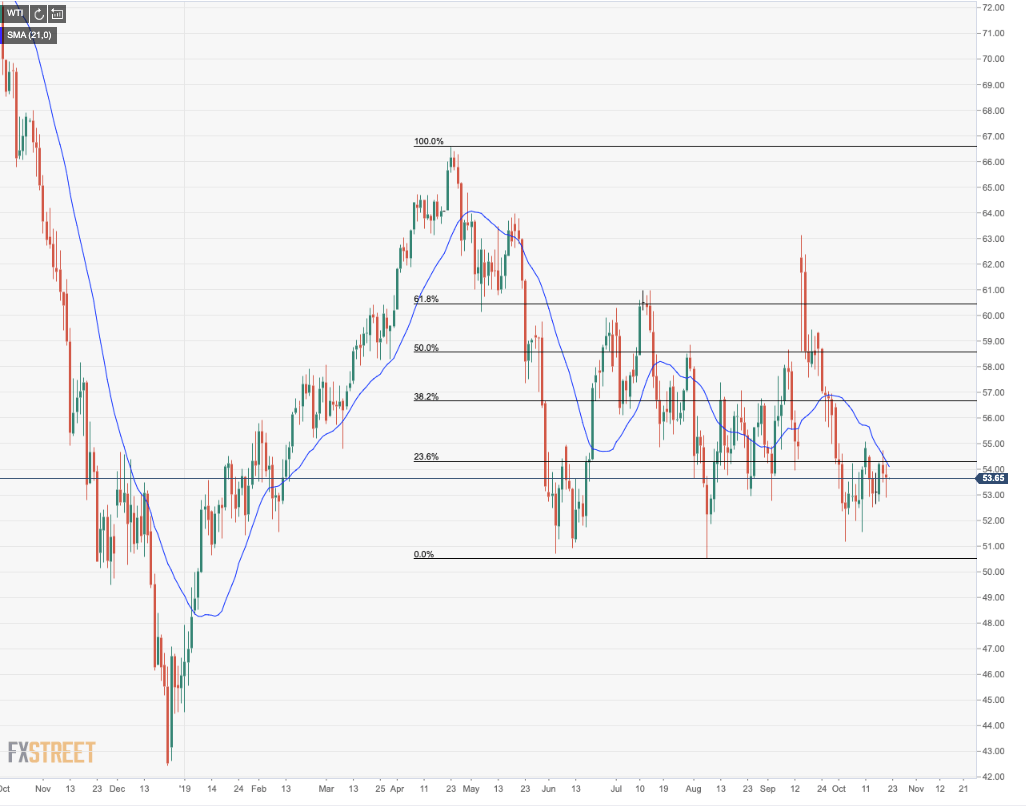

The price of WTI is firmer in Asia, higher by 0.28% having risen from the $51 handle at the start of the month, failing to follow through the 55 figure mid-month and morphing into a wedge contained between familiar ranges. However, the outlook remains bearish while below the 200-day moving average and keeping the bearish GMMAs on the daily chart.

The price is now testing the 21-day moving average but bears will seek a break below the 50 handle at this juncture, which will bring the prospects of a run down to the Nov 2018 lows at 49.39 again. The 46.90 level ahead of the 18th Dec lows down at 45.77 will then be in focus. On the flip side, a break of the 50% mean reversion of the March to August range opens risk to the 64 handle.

WTI daily chart