- Bulls eye 59.50 could prove a more likely near term target while above trendline resistance.

- However, bulls have run into resistance and a daily doji has been painted on the daily time frame.

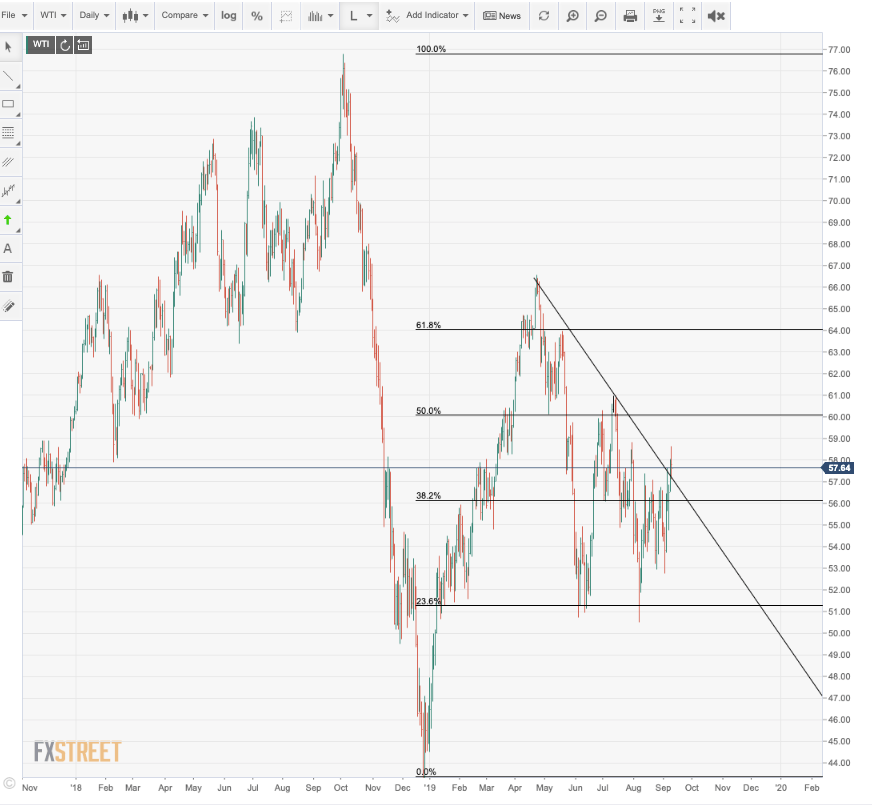

WTI has been holding up in neutral territories. The bulls have been eyeing the 78.6% Fibonacci retracement levels of the July swing lows and highs with the 60 handle on the radar, but bulls have run into resistance and a daily doji has been painted on the daily time frame.

60.65 comes as the key target. Meanwhile, however, a 50% mean reversion of the Sep to Dec 2018 lows located at 59.50 could prove a more likely near term target. To the downside, the 23.6% level at 53 the figure is critical.

WTI daily chart