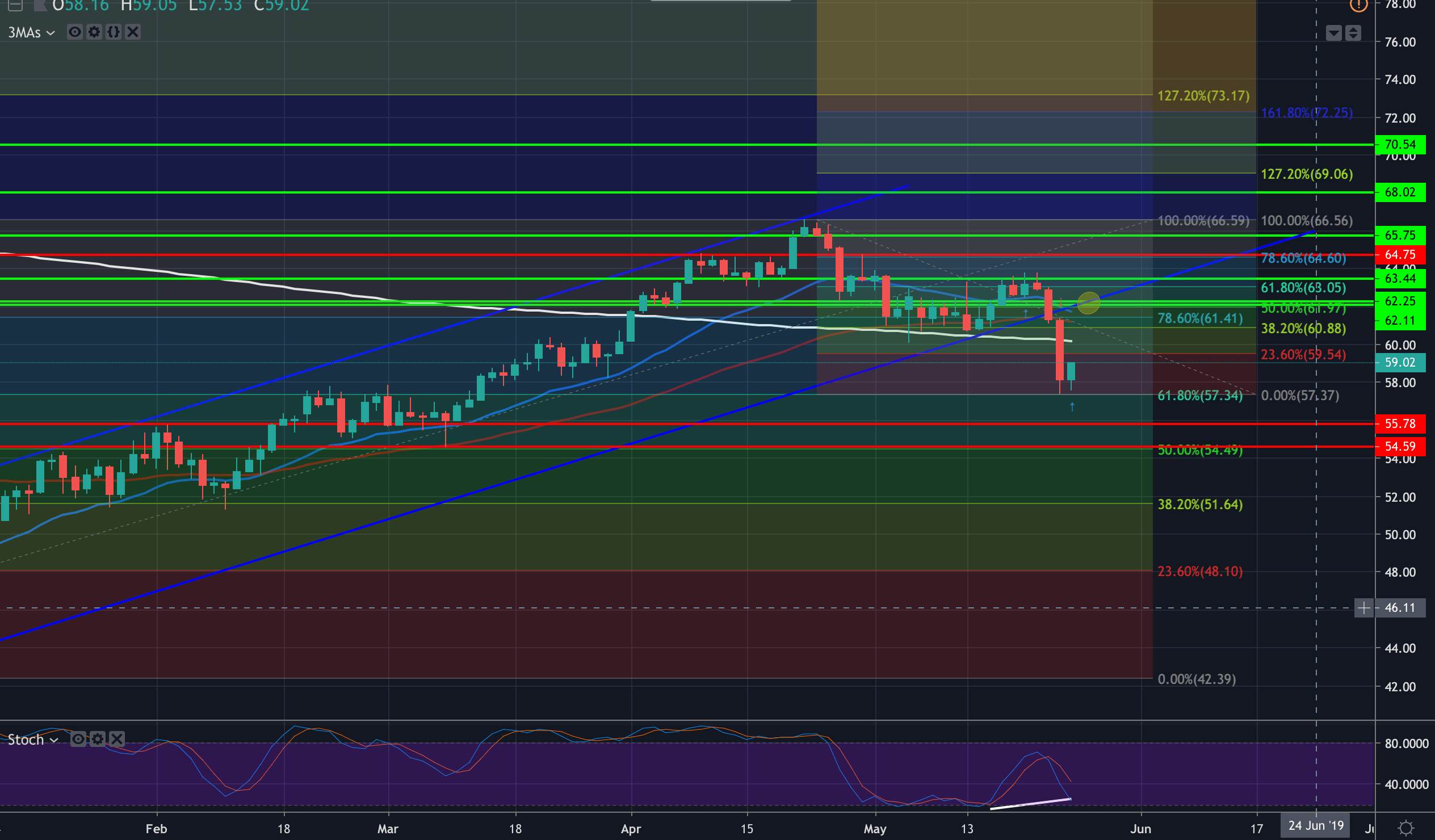

- WTI dropped below the golden cross (50/200 DMA cross-over 60.80/90 level), subsequently taking out the 60 handle meeting a low at 57.36 to the 61.8% Fibo.

- Price on Friday corrected to the 59 handle but remains below the 200-DMA.

- Slight bullish stochastics/price divergence opens the case for a run to test 60 the figure where it meets the 200-DMA.

- A 50% reversion of the April – to recent lows will open a test of the rising channel’s prior support and 62 the figure.

- A break out to the downside again opens risk to 54.50 and the 50% retracement of 2019 range ahead of the 200-W MA down at 52.40 and then the 38.2% Fibo and Feb lows at 52.50/51.40 respectively.