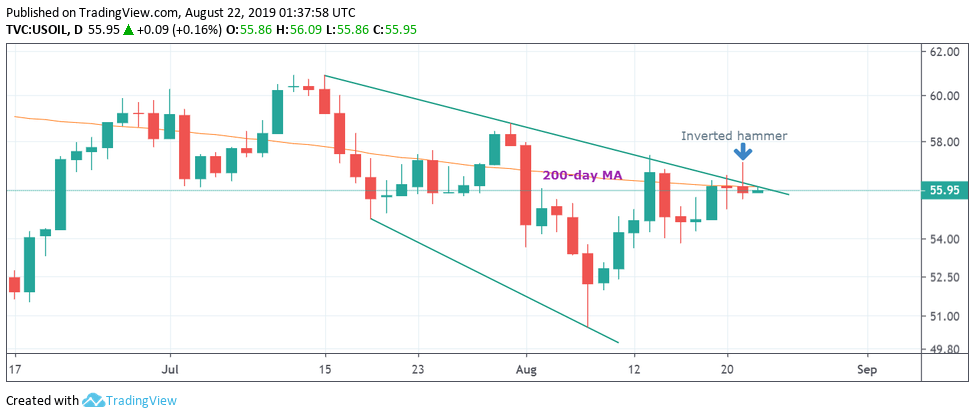

- The confluence of a falling channel hurdle and a long-term moving average is capping upside in WTI.

- Wednesday’s bearish inverted hammer makes today’s close pivotal.

WTI oil is currently trading at $55.96 per barrel, having faced rejection at the confluence of the 200-day moving average (MA) and a bearish channel resistance at $56.10 earlier today.

In the previous two trading days, the black gold printed intraday highs above the upper edge of the falling channel represented by trendlines connecting July 15 and July 31 highs and July 18 and Aug. 7 lows. but failed to close above the key hurdle.

Notably, WTI ended up charting an inverted bearish hammer at the falling channel resistance on Wednesday. An inverted bearish hammer is widely considered an early warning of an impending bearish reversal.

The trend change, however, is confirmed only if prices close below the hammer candle’s low on the following day.

So, the focus today is on $55.57 (Wednesday’s low). Acceptance below that level would confirm a bearish hammer reversal and open the doors for $53.79 (Aug. 15 low).

On the other hand, a daily close above the upper edge of the falling channel, currently at $56.10, would signal a continuation of the rally from the Aug. 7 low of $50.55.

Daily chart

Trend: Neutral-to-bearish

Pivot points