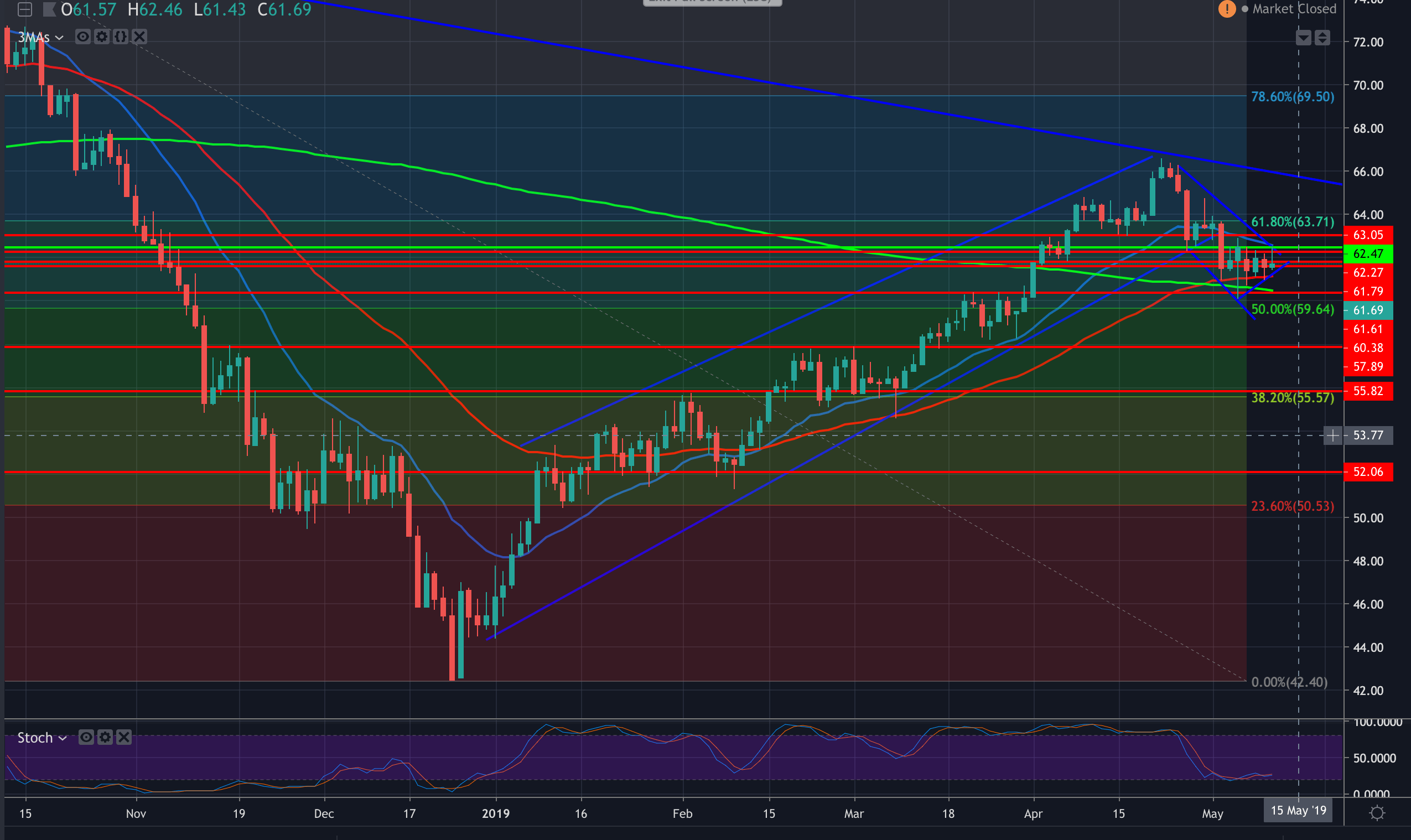

- Oil has been stuck trading in a lateral position on the charts with compressed volatility in the last few days.

- The price has been holding above the golden cross but it needs to get over the 20-D SMA just above recent highs, guarding the 63 handle targets, and given the heightened risks surrounding Iran, a break there opens 9th April highs at 64.77.

- Should bears take back full control, the 200 DMA and 50% Fibo level accumulating in confluence at 60.60/59.60 respectively will come into play.

- A break of the 50% level opens prospects for the 25th March lows at 58.20 ahead of the late Feb/early March highs guarding a break to the early Feb highs at 55.80.

Daily chart