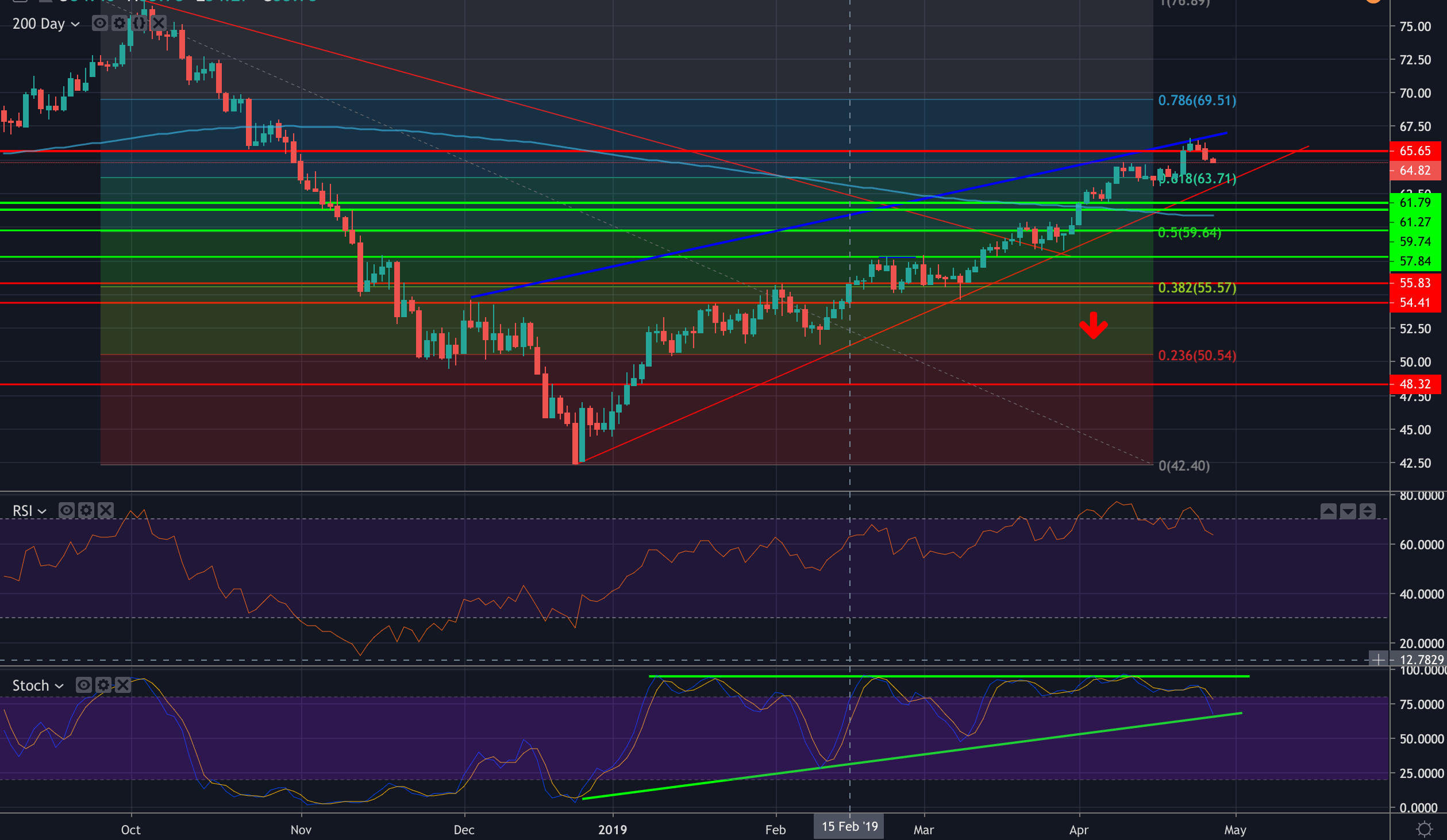

- WTI is down to a prior resistance which could act as a support from which bulls will seek to get long if it holds and price corrects.

- However, the charts are in overbought territory and if price action respects the law of gravity, bulls could be squeezed out down to the rising wedge’s support.

- Bears will then look for the price to buckle below the 61.8 Fibo, at 63.70.

- On a break there, the 200-D SMA at 60.80 will then be exposed – Given how coiled the stochastics are across multiple time frames, there is an overwhelming case for the downside.

- However, should bulls commit here of even within the rising wedge at any point in this correction, then the case for a test of 69.50 and the 70 psychological level remains on the cards.