- Prices of the WTI climb to the vicinity of the $57.00 mark.

- Saudi Arabia expected to cut crude output further in April.

- API, EIA reports next on the docket later in the week.

Prices of the barrel of the WTI are posting strong gains at the beginning of the week, trading in the vicinity of the key $57.00 mark and reverting at the same time Friday’s pullback.

WTI up on Saudi Arabia output, looks to data

The barrel of the American benchmark for the sweet light crude oil are recovering ground lost last Friday, when poor trade data in the Chinese docket hurt the sentiment around crude oil and sparked fresh concerns over a slowdown in the Asian economy.

Fresh comments earlier today that Saudi Arabia would increase its production cuts in April have lifted prices and mood around crude oil today, although a breakout of the $57.00 handle still remains elusive.

Moving forward, the usual weekly reports on US crude oil stockpiles by the API and the EIA are coming up on Tuesday and Wednesday, respectively.

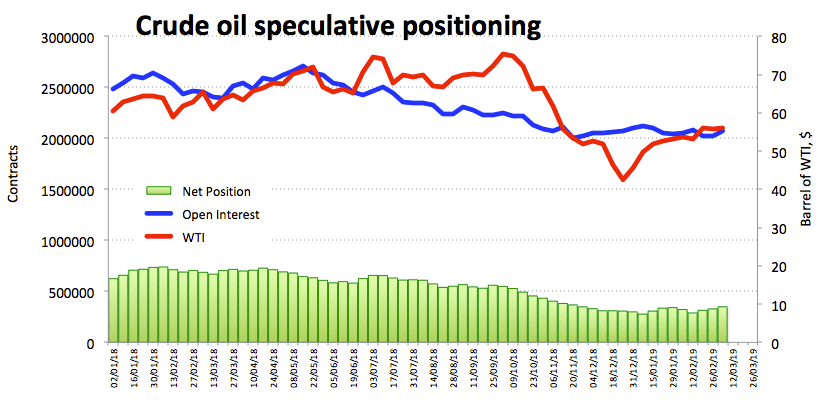

Also accompanying the recovery in crude prices this year, oil speculative net longs climbed to the highest level since late November 2018 during the week ended on March 5, according to the latest CFTC report.

What to look for around WTI

Crude oil prices are extending the sideline theme prevailing since mid-February amidst speculations over a US-China trade deal and recent concerns over the likelihood of a slowdown in the Chinese economy. However, the underlying bullish stance on crude oil remains well supported by tight conditions in the US markets (amidst US net imports in historic low levels and the rising activity in refiners ahead of the summer session), the so-called ‘Saudi Put’ plus the current OPEC+ agreement to curb production and ongoing US sanctions against Iran and Venezuela.

WTI significant levels

At the moment the barrel of WTI is up 1.04% at $56.50 and a breakout of $56.84 (high Mar.11) would open the door for $57.60 (2019 high Mar.1) and then $58.00 (high Nov.16 2018). On the downside, the next support emerges at $55.66 (21-day SMA) seconded by $54.50 (low Mar.8) and finally $52.64 (55-day SMA).