- Crude oil prices rebound to the $71.00 area post-EIA report.

- WTI keeps the sideline theme unchanged near 4-year peaks.

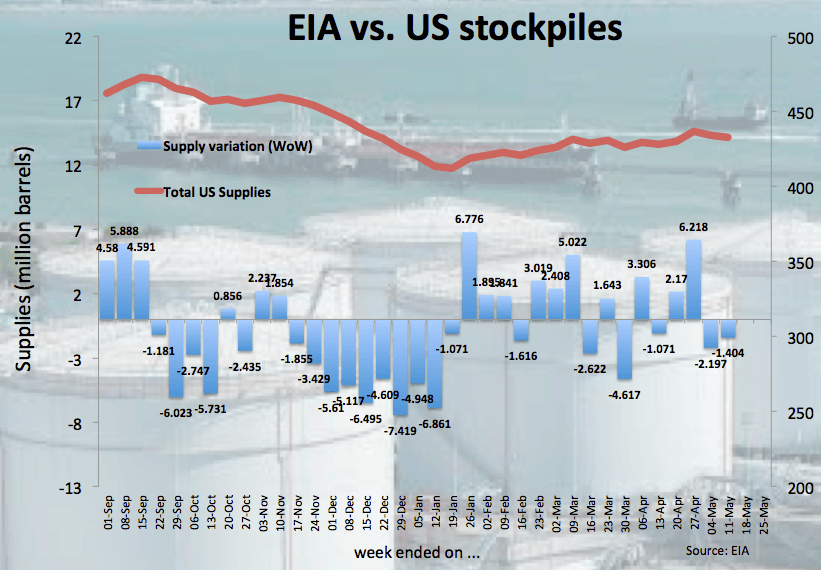

- US crude oil inventories decreased by around 1.4 mbpd last week.

Prices of the barrel of the American reference for the sweet light crude oil are bouncing off earlier troughs and are retaking the $71.00 mark following the latest report by the EIA.

WTI higher on upbeat EIA

Prices of the West Texas Intermediate are rebounding from the mid-$70.00s after the EIA reported US crude oil supplies decreased more than initially forecasted by 1.404 mbpd during the week ended on May 11.

Further out, Weekly Distillate Stocks dropped by 0.092 mbpd and Gasoline inventories went down by 3.790 mbpd, bettering prior surveys.

Additionally, stockpiles at Cushing increased by 0.053 mbpd, adding to last week’s 1.388 mbpd build.

Crude oil prices are prolonging the recent sideline theme in the upper end of the range, as traders remain vigilant on the potential sanctions against Iran after the US withdrew from the nuclear deal last week. Other drivers, such as the critical situation in Venezuela and tensions in the Middle East are also keeping occasional dips as shallow.

WTI significant levels

At the moment the barrel of WTI is up 0.35% at $71.30 and a breach of $70.48 (10-day sma) would aim for $69.27 (21-day sma) and finally $66.86 (low May 1). On the other hand, the next up barrier emerges at $71.89 (2018 high May 15) followed by $72.00 (psychological level) and then $77.77 (high Nov.21 2014)