- WTI bears seeking a restest of the daily support structure.

- Oil market’s wild card is making for larger-scale volatility on Tuesday.

WTI prices are down some 1.4% at the time of writing albeit well off the lows for the day which were made on news that there could be a significant announcement on the progress on the Iran file.

The wild card of the oil market has been with Iran.

bulls fear a return to the 2015 deal could allow for the removal of U.S. sanctions on the Persian Gulf country’s crude exports, raising the prospects of more Iranian barrels of supply coming back to the market.

On news that there is a possible Iran deal announcement tomorrow, WTI fell out of the sky and dropped to a low of $64.14 from a high of $66.19.

The wires are reporting that the heads up came from Russia’s envoy, Mikhail Ulyanov, to the Vienna talks at the United Nations’ International Atomic Energy Agency.

On Twitter, the diplomat said “unresolved issues still remain and the negotiators need more time and efforts to finalise an agreement on restoration” of the accord.

Meanwhile, the energy complex had been bid and shrugging off angst surrounding covid-19 flare-ups in Asia.

The demand story for this summer as the global recovery gets underway has been supportive of oil prices.

”Global congestion rates are highlighting sharp rises in mobility across Europe and China, supporting this view,” analysts at TD Securities explained.

”The market also anticipates a sharp rise in demand for travel, with flights tracked during China’s latest Labour day holidays pointing to massive pent-up demand for travel, although the composition of travel has recently highlighted a preference for the automobile.”

However, ”ultimately” the analysts argued, ”the massive scale of OPEC’s spare capacity suggests that a break north of $70/bbl is not sustainable.”

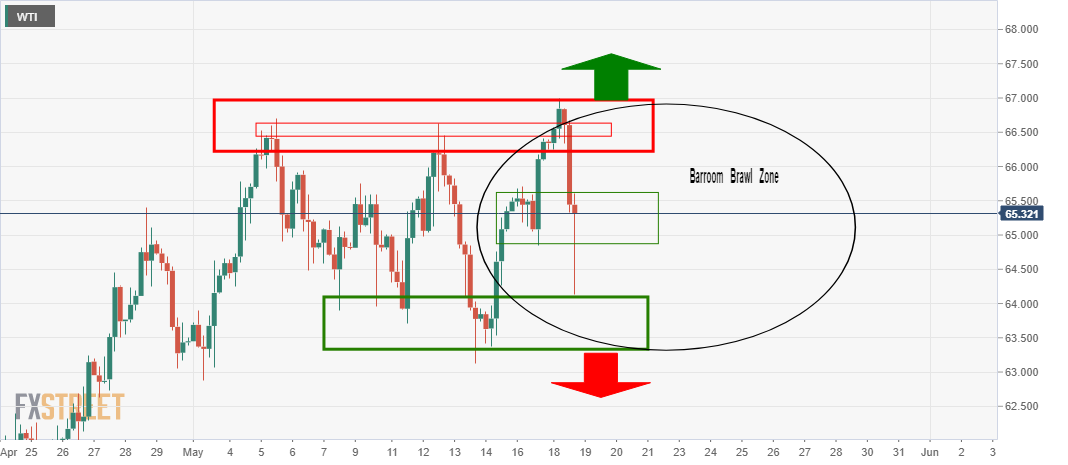

WTI technical analysis

The price is in a major sea of chop between a wide sideways range, or otherwise known as the ”Barroom Brawl Zone”:

The price action is random and volatile and breakout traders are looking for the breach of either side of the channel.

However, there could be a meanwhile opportunity within the channel on the basis that the price action has left a sizeable wick on the downside in a 50% mean reversion.

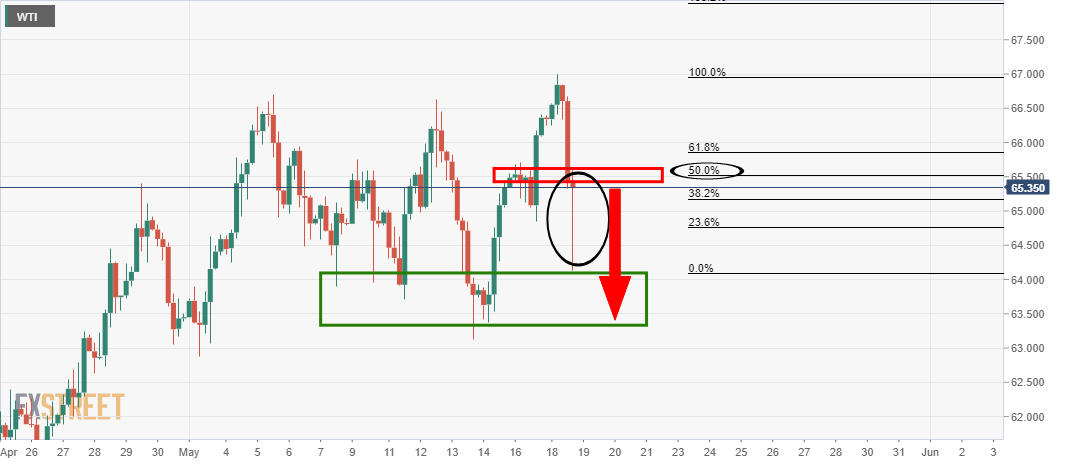

15-min chart

The opportunity is move evident from a 15-min vantage point perspective.

The price is being resisted near a 61.8% Fibo of the 15-min price drop’s range.

On breaking the current support, on a restest of the structure, the price would be at a discount and the probabilities will be in the bull’s favour for a downside retest of the daily channel’s support structure.