- Prices of WTI trade on the defensive in sub-$58.00 levels.

- Attention remains on upcoming API, EIA reports.

- US-Iran effervescence, OPEC+ deal in centre stage.

Prices of the barrel of West Texas Intermediate are giving away part of Friday’s gains and are navigating the sub-$58.00 area for the time being.

WTI focused on trade, geopolitics, data

The barrel of the American benchmark for the sweet light crude oil appears to have met quite strong contention in the $56.00 neighbourhood in past sessions, while today’s price action appear supported by the 100-day SMA so far.

In the meantime, US-China trade tensions and the lack of fresh developments on that front should keep the upside in prices somewhat capped, while the recent agreement by the OPEC+ to extend the agreement to curb production and bouts of volatility on the US-Iran front should keep occasional dips shallow.

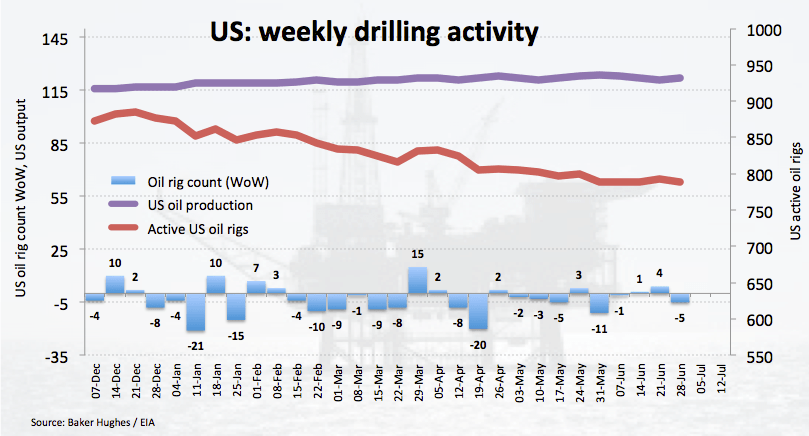

On another front, driller Baker Hughes reported on Friday oil rig count went down by 5 during the previous week, taking US active oil rigs to 788.

Later in the week, the API report on US crude oil supplies is due tomorrow ahead of the DoE’s official report on Wednesday.

What to look for around WTI

Recent price action around WTI showed decent contention emerged around the $56.00 mark, which is at the same time reinforced by the 21-day SMA. However, traders failed to push the barrel of WTI further north of the key $60.00 mark (Monday 1st July), as concerns coming from the demand side – with the US-China trade dispute in centre stage – looks to keep the sentiment under pressure. Supporting prices, however, are fresh geopolitical concerns after the UK seized an Iranian oil tanker in Gibraltar (the oil was supposed to reach Syria, violating EU sanctions), the recent extension of the OPEC+ deal to curb output until the end of Q1 2020, tight US oil markets, US-Iran effervescence and the so-called ‘Saudi put’.

WTI significant levels

At the moment the barrel of WTI is down 0.12% at $57.53 and a surpass of $58.09 (200-day SMA) would expose $60.12 (monthly high Jul.1) and then $60.73 (23.6% Fibo of the December-April rally). On the downside, immediate contention emerges at $55.91 (low Jul.3) seconded by $55.86 (21-day SMA) and finally $50.54 (monthly low Jun.5).