- WTI advances to the $53.00 region and fails.

- Traders’ focus stays on coronavirus, supply concerns.

- The weekly report by the API is coming up later in the session.

Prices of the barrel of the WTI are edging higher on Wednesday amidst the better tone in the risk-associated complex.

WTI failed just ahead of $53.00

The barrel of the American benchmark for the sweet light crude oil has faded Tuesday’s pullback and is now trading in fresh 3-week highs in the vicinity of the $53.00 mark.

In fact, traders appear to have left behind – albeit momentarily – concerns regarding the COVID-19 and its impact on the Chinese economy and are instead shifting their focus to the supply side of the market.

Indeed, the almost omnipresent military conflict in Libya continues to threaten the country’s output and exports while there is still no progress regarding any OPEC+ negotiation to extend the output cut agreement or announce deeper cuts in the production of the cartel, which is due to finally meet on March 6th.

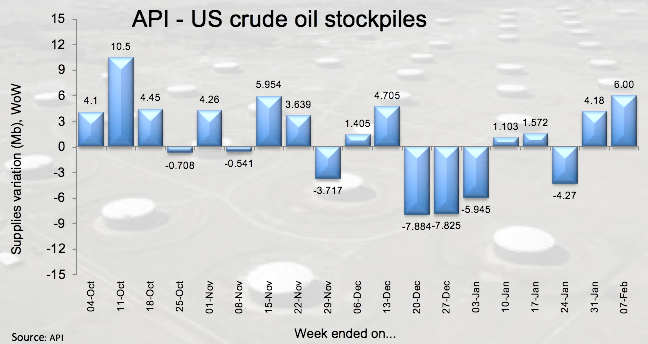

Later in the session, the API will report on the weekly variation of US crude oil supplies ahead of Thursday’s official report by the DoE. Last Friday, driller Baker Hughes said US oil rig count went up by to during last week, taking the active oil rigs to 678.

What to look for around WTI

The rebound in crude oil prices from YTD lows in the $49.30 region seems to have run out of impetus just below the $53.00 mark per barrel so far. Looking at the broader drivers of the price action in the commodity, the OPEC+ has to still make up its mind regarding the output cut deal, the conflict in Libya is seen taking longer than expected to resolve while concerns surrounding the coronavirus in China are far from abated despite some positive headlines as of late.

WTI significant levels

At the moment the barrel of WTI is gaining 1.62% at $52.96 and faces the next barrier at $53.03 (monthly high Feb.19) seconded by $54.35 (weekly high Jan.29) and then $56.43 (200-day SMA). On the flip side, a breach of $50.90 (weekly low Feb.18) would aim for $49.31 (2020 low Feb.5) and finally $42.20 (2018 low Dec.24).