Despite June being the worst month in more than eight years, XAU/USD can recover most of its losses. The precious metal finished the first half of the year disappointingly. However, prices are still below the $1800/oz round number.

Fed’s hawkish tone

The Fed played a vital role in reversing the bullish positions accumulated for a couple of months (April and May).

The Fed gave the markets a surprise by admitting that inflation is higher than expected and announcing its forecasts for a two-fold rate hike in 2023.

As gold plunged to $1,770 an ounce just after the release of June FOMC economic forecasts, the market became a sobering reminder for investors and analysts that the road to new highs cannot be smooth.

But precious metal investors shouldn’t give up on gold. Since the Fed is focused on achieving its full-time target before it hikes rates, gold will still have time to compensate for its losses.

But while the goal of full employment is far from reaching, the Fed is forced to adhere to a flexible policy.

As for the supply, most likely, the demand will exceed the supply, and there will be an increase in prices for all precious metals in general.

XAU/USD’s Safe-haven appeal

The main springboard for quotes in recent days is the tense pandemic situation in the world. The hike in coronavirus cases in several countries and the active spread of the new Delta strain cause concern for investors.

Tightening quarantine measures may again lead to a decline in economic activity, which in turn will have a positive effect on the price of gold as a safe-haven asset.

XAU/USD after NFP

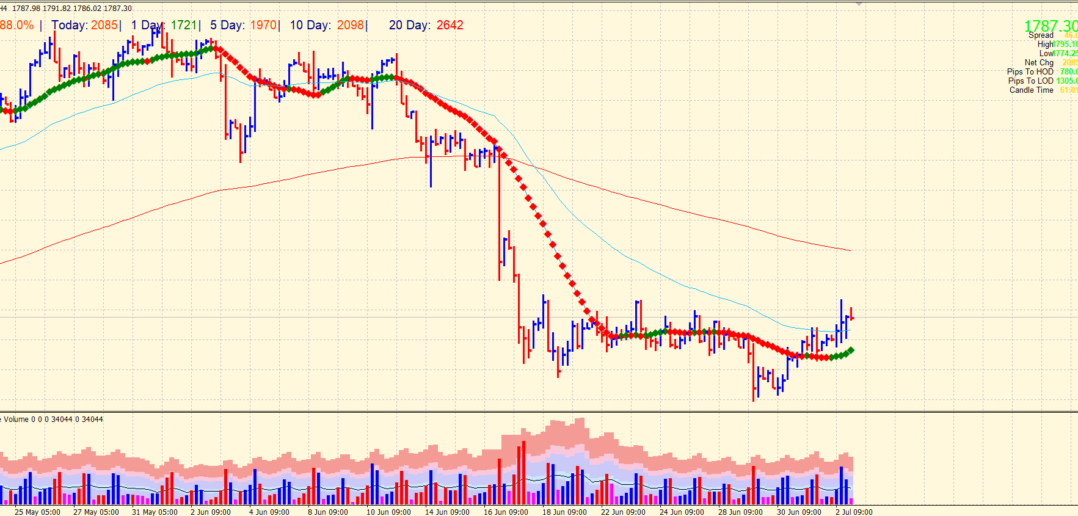

Meanwhile, on Friday, the value of the precious metal continued to rise. Gold closed the week at $1787 with a net change of +0.61%. Thanks to the NFP missing expectations on the unemployment rate at 5.9%, gold rapidly jumped from $1780 to $1795. However, it pared some gains but closed the week on the slightly positive node.

XAU/USD technical forecast: Key zones to the lookout.

The 4-hour chart has an interesting scenario. The price is above 20 and 50-period SMAs which is a positive signal. But the volume is neutral to bullish at the moment.

The upside targets are $1800 (psychological mark), followed by $1816 (20-period SMA). On the flip side, $1773 (20-SMA) can serve as interim support, followed by a swing low at $1750.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.