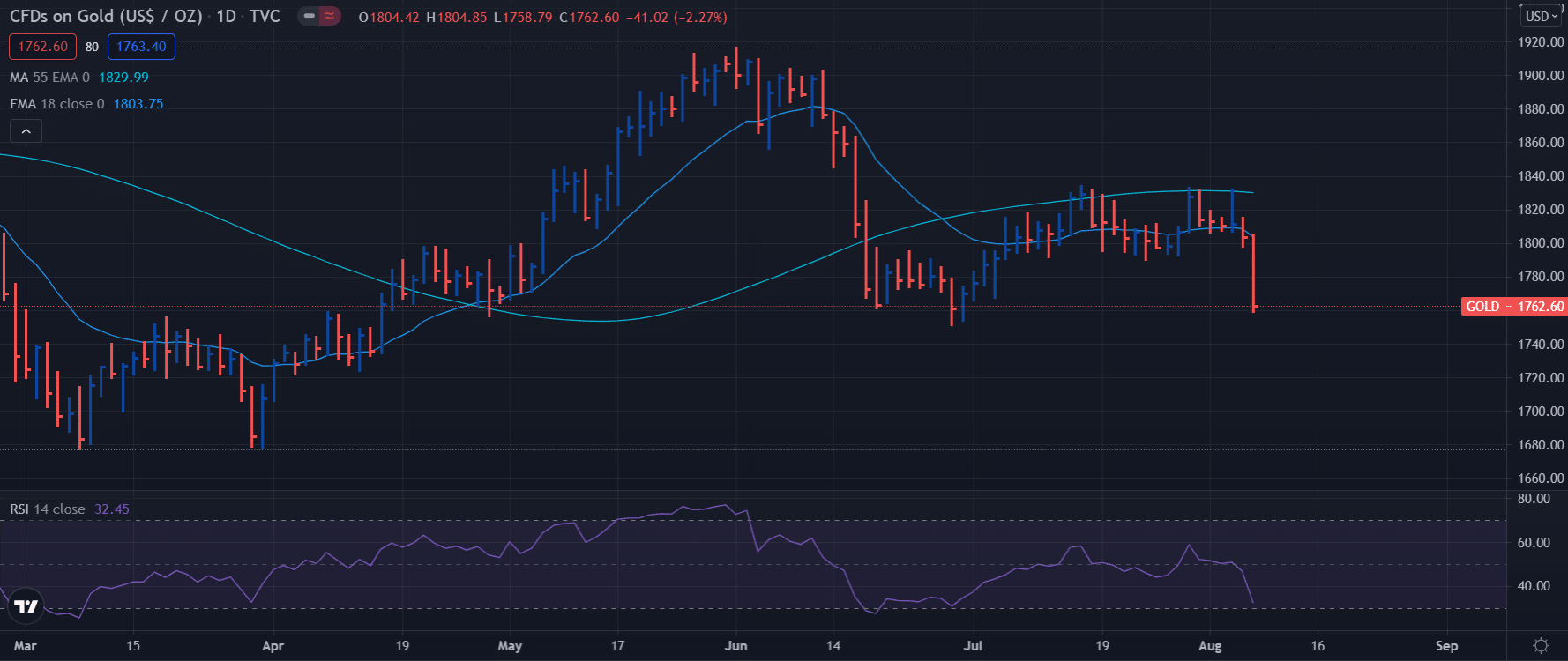

- On Wednesday, gold peaked at $1,830.

- After the publication of labor results, the dollar gained ground against gold.

- The price closed the week around $1,763.

- For the coming week, the price could be closer to $1,780.

The gold price weekly forecast is bearish with a probability of some upside correction. Gold started last week with bearish impulses that reversed on Wednesday when the price hit a high of $1,830. However, the rise was reversed on Friday after the publication of the results of NFP. The value of gold on Friday reached a low of $1,758 to close the day with a value of $1,760.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

The strengthening of the US dollar against gold was driven by the interest rate expectations hike by 2023.

On Wednesday, the rise in the price of gold was triggered after it was revealed that private sector employment in July increased by just 330,000 and not 695,000 as expected by the market.

After this came to the comments of Fed Vice President Richard Clarida, assuring that by the end of 2022, the conditions for an interest rate hike could be met. In turn, the Fed President in Dallas declared that the Fed should gradually reduce the purchase of bonds as soon as possible. Although he also clarified that a faster reduction does not mean an increase in interest rates.

Finally, on Friday, the surprising data of non-farm payrolls were released. According to the US Bureau of Labor Statistics, 943,000 new jobs were created in July, surpassing the expected 870,000. In addition, the unemployment rate fell to 5.4%, and underemployment fell to 9.2%.

Upcoming Events

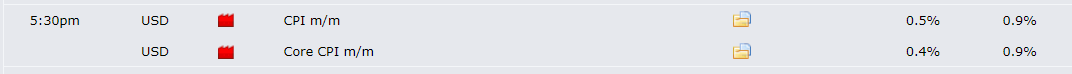

Next week the United States Bureau of Labor Statistics will publish the consumer price index and core consumer price index. The expected rates for these indexes are 0.5 and 0.4%, respectively.

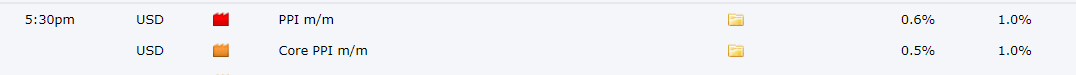

On Thursday, the producer price index figures will be released. It is expected to increase by 0.6%, thus decreasing the 1.0% of the previous period. Also, on Thursday, will be released the number of applications for unemployment benefits. The number of applications is expected to drop to 375,000. If all these forecasts are fulfilled, the US dollar will be stronger compared to its peers.

Gold technical analysis: RSI forecasts more bearishness

The Relative Strength Index fell below 40 for the first time in a month, indicating a downtrend. However, the RSI has not yet reached 30, so it still has room to follow its course to the south.

–Are you interested to learn more about forex signals? Check our detailed guide-

The immediate support level is $1,750, which was the June low. If a breakdown occurs, the next support level will be $1,730.

Gold next week forecast

Despite the downturn at the end of the week, unless the US results are exceptional, it’s expected for gold to recover some ground towards $1,780.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.