- XRP price trades in a neutral price action, a breakout could happen soon.

- Moving averages, RSI and MACD accentuate Ripple’s horizontal price action.

- Ripple v. SEC Case update: the SEC files a letter re-affirming it’ stance on the DPP dispute.

XRP price has been stuck in indecision since the Tuesday September 07 cryptocurrency market flash crash. Ripple has been hovering between $1.01 and $1.15 with a decreasing price volatility. This points to market indecision with no clear direction of where the cross-border remittances token is likely to move in the near future.

XRP Price Trades Just Above $1.0

The XRP price prediction is neutral for the near term as it exchanges hands around $1.09. Note that after the sharp drop from its recent high at $.144 on September 06, Ripple (XRP) has formed a pennant on the daily chart. This chart pattern will be confirmed after the price breaks above or below the formation.

The 200-day Simple Moving Average (SMA) ($0.928) and the 100-day SMA ($0.872) have flattened out and the Relative Strength Index (RSI) index is positioned close to the midpoint at 48.89, suggesting a balance between selling and buying pressure. Moreover, the movement of the Moving Average Convergence Divergence (MACD) indicator close to the zero line suggests that the Ripple price market momentum is currently neutral.

XRP/USD Daily Chart

A bullish breakout will be realised if Ripple closes the day above the resistance line of the pennant suggesting a correction upwards. The first target objective on the upside is a move to $1.40 and a break above this level, the XRP/USD price may rally to $1.60.

On the flipside, if the Ripple price breaks below the support line of the pennant, the bullish view will be invalidated signalling the resumption of the downtrend. The international remittances token could then drop to the 200-day SMA ($0.928) and the 100-day SMA ($0.872) respectively.

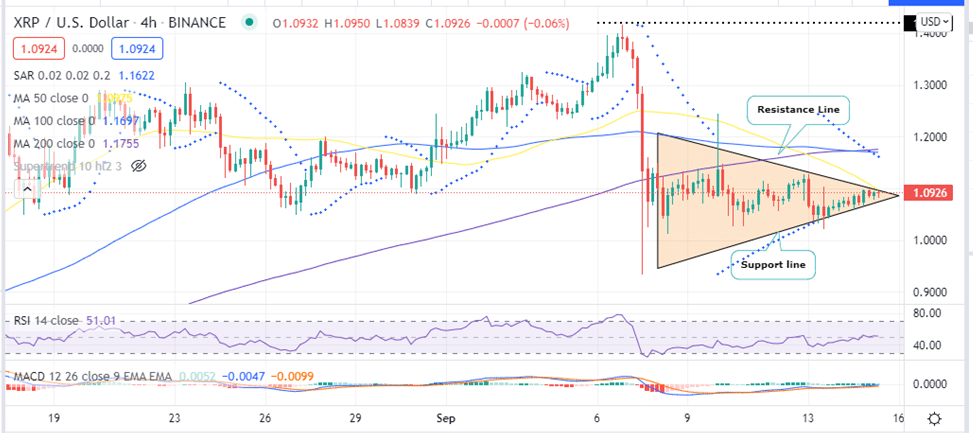

XRP/USD Four-Hour Chart

A look at the four-hour chart shows the XRP price is being squeezed from both sides inside the triangle. All the 50, 100 and 200 moving averages are flat and the RSI is just above the midpoint at 51.73, which does not give a clear advantage either to the bulls or the bears.

A break above the resistance line is facing stiff resistance from the 50-perdiod SMA at$1.096. If the price turns down from the current level, the bearish pressure may resume the downtrend sinking Ripple below the support line. If the sellers are successful, XRP may drop to $1.0 over the next few sessions.

On the upside, if bulls drive the price above the 50-period SMA, the asset could challenge the resistance line. A breakout and close above this resistance could signal the start of an uptrend.

Ripple v. SEC Lawsuit Update

The Ripple vs. SEC case as the SEC files a letter re-affirming it’ stance on the DPP issue. James Filan, an attorney following the XRP case closely disclosed earlier today updating the Ripple community on the progress of the case.

In the Letter Brief, the regulator gives information supporting allegedly privileged data it is keeping from Ripple Labs. The SEC asserts that Judge Netburn will review all the documents in-camera and that these documents are “pre-decisional and deliberative”, and henceforth protected by the Deliberative Process Privilege (DPP). Moreover, the SEC says that these documents are also protected by the attorney-client privilege and the work product doctrine.

The regulatory agency also argues that Ripple’s requirement that it produces internal and inter-agency documents, that were previously protected by DPP will compromise the genuine consultation efforts from the SEC employees. The SEC writes in the brief:

“The compelled release of the SEC’s pre-decisional deliberations relating to digital assets would discourage meaningful deliberation among SEC officials and staff relating to investigations, potential cases, and other regulatory activities taken or under Consideration in a field where regulation carries significant consequences for the financial markets.”

Ripple had earlier filed a motion compelling discovery in the DPP dispute in which the court ordered the SEC to produce in-camera, the documents listed under seal. The regulator objected to this motion arguing that these documents are in fact SEC internal documents and communications with other law enforcement agencies.

The SEC has also reinforced its ‘irrelevance’ stance, arguing that most documents that it was compelled to produce are non-responsive, and are not required to be produced in the case. The SEC also claimed that it logged these documents in good faith to avoid further litigation on certain categories of documents, including SEC officials’ notes of external.

“But the majority of the intra-agency documents logged by the SEC constitute internal SEC communications, notes, and drafts that are not responsive to this Court’s orders: they are the very “intra-Agency communications” that “need not be searched or logged” because they are not “intra-agency memoranda or formal position papers.”

However, the regulator maintained that it stands with its stance that these documents are not responsive to the Court’s orders.

- If you wish to trade XRP, you read our guide on how to buy cryptocurrency.

Looking to buy or trade Ripple now? Invest at eToro!

Capital at risk