In July last year GBP/EUR was hitting levels of 1.28 with talk of a break of 1.30 on the cards. Since that low for the euro we have seen a huge upturn in fortunes with the euro gaining confidence and momentum.

The euro has been lifted by the European Central Bank vowing to do everything possible to support the euro and in addition by the US Federal Reserve stepping up their monetary easing and a more dovish Bank Of England weakening the USD and the pound.

Guest post by Phil McHugh, senior analyst, Currencies Direct

Importantly the euro has also, to a large degree, managed to avoid huge crisis points, like Greece, and the moments of tension that have arisen have been handled better and with less damage to the single currency. As present, the euro does look a little overvalued and with the expectation of a rate cut from the ECB then we could see the euro start to give up some of its gains.

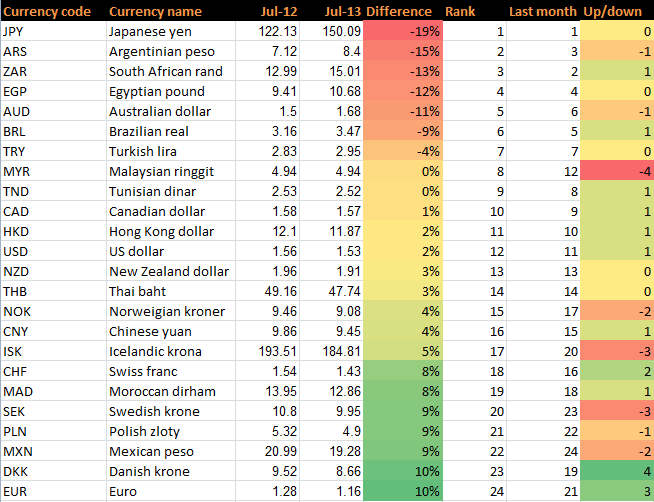

The Danish krone has been another winner gaining from a strong demand for Danish bonds and a reluctance from the central bank to cut as aggressively as the ECB leading to inflows for a safe haven with an edge on yield. The SEK although a strong performer has not managed to keep up with the pace of the DKK as growth has been slightly disappointing. Sweden cut interest rates in December last year and there has been expectations of a further rate curbing demand for the SEK.

The Japanese yen still holds the biggest loser spot after unprecedented monetary easing which was geared to weaken the JPY and hence to boost growth. Recently the JPY has consolidated a little but overall the central bank is still expected to maintain a loose and aggressive policy which leans towards a negative bias.

In addition, the expectations that the US Federal Reserve will start to taper their monetary easing in September could lead to further gains on USD/JPY. Looking at the USD it is evident that on a year-on-year basis it has been relatively steady against the pound. This could be set to change in the event of Fed tapering which is expected to lead to USD gains across the board so look out for a USD move later in the year from September should the US Fed taper.