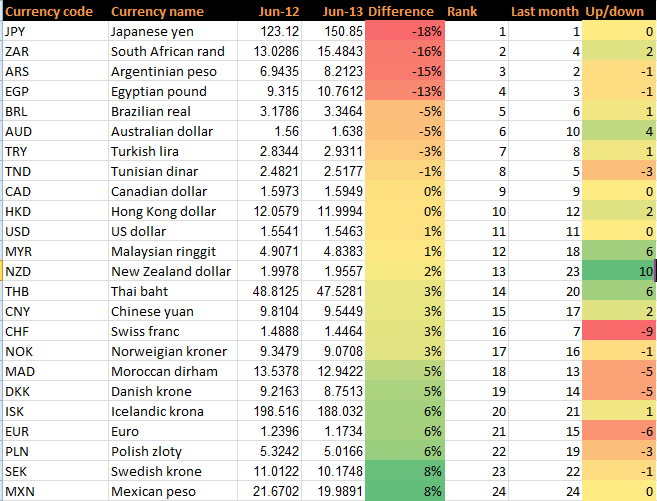

The Japanese yen (JPY) has remained the biggest loser shedding 18 per cent against the pound following a fundamental shift in monetary policy from the Bank of Japan to a more aggressive approach – favouring a weaker JPY.

The commodity currencies have recently unwound sharply from strong levels following expectations that the US Federal Reserve will start to taper their asset purchase programme in September. In addition, we have recently had fresh concerns that growth in China is looking a little softer which also weighs on the commodity related currencies such as the AUD, NZD and ZAR.

Guest post by Phil McHugh, senior analyst, Currencies Direct

Suggestions of the Fed tapering has dramatically adjusted a variety of currencies. Emerging market currencies which until recently have been concerned with their domestic currency being too strong are now, in some cases, trying to defend a currency that is weakening too quickly. We can see examples of this in the movements in Thai baht and the Malaysian ringgit. This is a dramatic example of market volatility and how the dynamics can shift from a trigger event, in this case the potential unwinding of Fed liquidity. This has hit emerging market and commodity related currencies in particular and we can see that the pound has gained.

GBP/USD has seen a slight weakness compared to last year but with the Fed looking to taper we could see this pair start to move lower. Watch the pound over the coming weeks as we learn more from Mark Carney the new Bank of England governor on his attitude to future policy. The 6 per cent loss in GBP/EUR reflects a sharp fall in the pound as we started 2013 with weak economic data, a cut in the credit rating and the chance of a triple dip recession. The Bank of England also helped to talk the pound lower and it has to date remained lower against the euro which has not hit any significant crisis points (so far) in 2013. Going forward Mr Carney may heap further pressure on the pound with a more aggressive BoE policy approach.