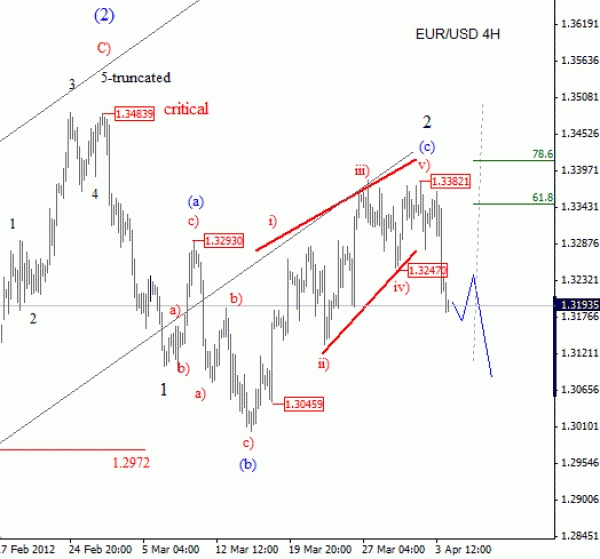

The Euro moved sharply lower in this week from 1.3380 area, and closed below previous 1.3250 swing.

And also because of the sharp bearish price action, we came out with an idea that a recovery from 1.3000, labeled as wave (c) of 2 is finished and that market will move even deeper in days ahead; ideally below 1.3000 within impulsive decline.

A rally back above 1.3380 will invalidate our wave count!

Guest post by Gregor Horvat

Do you want more detailed Elliott Wave Analysis? Check the video below which includes also Gbp/usd, Usd/Chf and S&P500: