NEO Price Prediction

NEO is changing the game in the crypto world and is forecasted to surpass Ethereum – the second largest cryptocurrency in the world thanks to its new upgrade and ultra-fast transaction times.

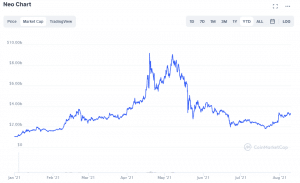

In the first few months of the year, NEO – the cryptocurrency also dubbed ‘Chinese Ethereum’ – surged higher more than 800% before falling 80% to around $25.

In this article, we go through the NEO price prediction for the short-term, medium-term, and long-term as well as the safest place to invest in NEO with the lowest fees.

NEO Price Prediction 2021 to 2022

If you’re looking for a quick NEO coin price prediction then look no further! Our technical analysis and fundamental analysis research are showing the following outcomes:

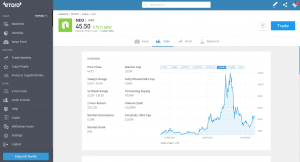

- In one month’s time, NEO against the US dollar (NEO/USD) is likely to be trading at least 40% higher from its current level of around $45.

- Our three-month NEO forecast shows the coin to be trading at $97 from its current price level. This represents a near 116% move higher.

- By the start of 2022, our model shows NEO/USD to be trading at the current high of 2021 which is around $140, representing a more than 210% run higher from currency levels.

If you want to know more about the research behind these forecasts and why NEO could be the best cryptocurrency to buy this year and beyond, then read further below for more detailed insights.

NEO Price History – the Story of 2021 So Far

There have been some major events in the cryptocurrency and blockchain technology space this year, including individual events affecting NEO’s price history.

At the beginning of the year, NEO – formerly known as Antshares – was trading around $15 after several years of sideways price movement. However, the demand for the coin was extremely strong in the first week of the year and the price did not look back for the next few months.

In fact, from the beginning of the year, the price went from $15 to a high of $140 by May – a more than 800% move higher. This was much more bullish than any long forecasts at the time. However, it wasn’t all plain sailing. In February, the price of the coin plunged 44% lower in a bearish trend led by Bitcoin before rallying higher afterward.

There were some major events that helped NEO’s price to rally higher. On February 1st, there was a TestNet Upgrade which helped to launch NEO v.3.0 in March. Towards the end of March, it was announced that NEO will be one of the first cryptocurrencies to support the upcoming DigiFinex debit card. This allows users to pay for goods and services with NEO via UnionPay.

On March 29th and June 14th, the founders of NEO, which was created in China, held an AMA (Ask Me Anything) session on Reddit and Zoom. They also helped provide instructions on how to build smart contracts using NEO. This transparency led to a boost in the coin on each occasion.

However, NEO did not escape the broad sell-off in the cryptocurrency space in May. After Elon Musk announced Tesla wouldn’t be accepting Bitcoin (BTC) until mining operations became more environmentally friendly, the whole crypto space collapsed.

NEO dropped around 80% before basing around $25 in July. The coin is up nearly 100% since this low which also formed at a key technical support level.

NEO Price Forecast

The NEO price prediction for the rest of the year may come as a surprise to some investors. Our technical analysis, fundamental analysis, and sentiment analysis are showing that the coin will most likely be trading around a maximum price of $140 which sits it just below the high of the year so far.

The move still represents a more than 200% move higher from current levels. There are a few reasons behind the potential for this NEO price prediction to reach these levels at the end of the year which are important to know if you are thinking of making a good investment.

First of all, the cryptocurrency sector as a whole is turning more bullish. Investment banking giants are now offering cryptos to their private clients with JP Morgan offering six crypto funds to invest in (which are still mainly in Bitcoin). More institutional capital is moving into the market looking for bargains and the next best coin. There has also been a rise in crypto market algorithms which are bringing more liquidity to the sector.

The currency market cap of NEO shown above highlights there is much more room to grow. The upgrades to the coin are also helping lift sentiment. NEO can handle more than 10,000 transactions per second which is much faster than some of the other coins in circulation. This makes NEO stock ideal for blockchain platforms.

The new upgrade to NEO v.3.0 has a new file storage solution and the ability to create non-fungible tokens – a hot growing new sector in digital assets. You also get paid to own NEO by receiving GAS tokens. These can then be used to pay for transactions and effectively works like a dividend stock. This is just one reason the NEO stock forecast for this year is bullish.

It is also important to look at the technical analysis levels when analysing a NEO stock forecast. After all, most of the cryptocurrency market embrace chart analysis as well as fundamentals when it comes to forecasting the direction of digital currency.

The chart below shows the bottoming pattern for the coin that took place between 2019 and 2021. This created a technical horizontal resistance line at an average price of $25.44. When the price broke through this earlier this year the coin surged higher, close to its record high but fell shy of this.

Interestingly, the most recent sell-off stopped at the same horizontal resistance line in July. Since then the price has rallied nearly 100% higher from the $25.44 price level. This is evidence that the coin is being watched actively by traders all around the world – another bullish sign of larger plays building long-term positions.

Many analysts are also bullish on the NEO stock forecast. For example, Wallet Investor believes that the crypto will be trading north of $130 by the end of the year. Analysts at InvestingCube see the coin north of $150 by the end of the year.

Some are even forecasting $478 by the end of the year which we believe is a stretch. Having said that, when the coin first launched in 2016, it was trading at a minimum price of $0.56. At the end of 2017, it was just below $200. This represents a 60,000% move higher.

NEO Price Prediction Long Term Outlook

If you’re looking for a long-term NEO price prediction for 2025 and the future price beyond then it’s important to focus on the individual components of the coin as well as the broader picture. For example, the NEO v.3.0 upgrade has made the coin much more competitive and well place to compete in the smart economy.

Transaction speeds have become much faster and the ‘gas fees’ have been cut significantly. This helps the coin to stay in line and competitive with the world’s second-largest cryptocurrency, Ethereum (ETH).

Of course, there are times where the whole crypto sector fluctuations move the same way, so checking in with the macro picture is important. It’s likely the crypto sector will be booming in 2025 and 2030.

Not only are institutional investors entering the space, but the whole sector is also likely to become more regulated. While this has caused some short-term weakness, it is a good sign in the long run and will attract more investment capital to the sector.

From a technical analysis perspective, analysing the grand supercycle formation over the past few years provides some very interesting price predictions on the NEO cryptocurrency. The ABCD Fibonacci pattern from the 2020 to 2021 supercycle, is showing an interesting completion zone around $299.41 which is just under the all-important round number of $300.

Based on the fundamental research and technical analysis levels, the NEO price prediction 2025 and beyond is likely to be well beyond the $300 price level so it is certainly one to keep an eye on.

NEO Price Chart

NEO price predictions have varied in the past few years thanks to the volatility of the coin. However, during 2018 and 2021 the coin remained in a tight trading range in between $21.34 and $3.48. Only at the beginning of the year did price manage to break through the upper end of the range.

Since breaking $21.34 at the beginning of the year, the coin ended the next three months with some significant gains. In January it ended up +55.89%, February +58.30%, March +43.79% and April +91.25%. You can see why many individuals are currently focused on the next NEO price prediction.

In May the whole crypto sector struggled to continue the trend higher. The broad market sell-off affected every single coin including NEO. For example, in May the coin fell -42.31%, and in June -34.44%.

However, July saw an uptick of +24.50% and investors are now looking for this to continue. If the price can repeat the bullish months in the early part of this year, a new time high for the year could be coming soon.

Conclusion

With NEO surging more than 800% higher in the first few months of this year, it’s clear to see why NEO price predictions are high on investors’ watchlists. The recent 75% drop in price is attracting more investors to the coin dubbed the ‘Chinese Ethereum.’

Most analysts are bullish on the prospects of the coin to be ending the year towards the highs of 2021. The forecasts for the coin in the longer term are even more bullish making it a very interesting time.