Best Crypto Trading Platform 2021 – Cheapest Platform Revealed

With the total market capitalization of digital currencies surpassing the $1 trillion dollar level in 2021 – it goes without saying that there are now hundreds of crypto trading platforms to choose from. Before selecting a provider – you’ll need to look at core factors surrounding fees and commissions, regulation, supported markets, payments, and customer service. In this guide, we review the Best Cryptocurrency Trading Platform for 2021 and walk you through the required steps to get started with an account today.

Best Cryptocurrency Trading Platforms 2021

The best cryptocurrency trading platforms for 2021 can be found below. We review each provider in great detail further down.

- eToro – Overall Best Cryptocurrency Trading Platform 2021

- Capital.com – Best Cryptocurrency Trading Platform for Leveraged CFDs

- Binance – Best Crypto Exchange for Day Trading Digital Currencies

- Robinhood – Best Crypto Platform for Beginners Based in the US

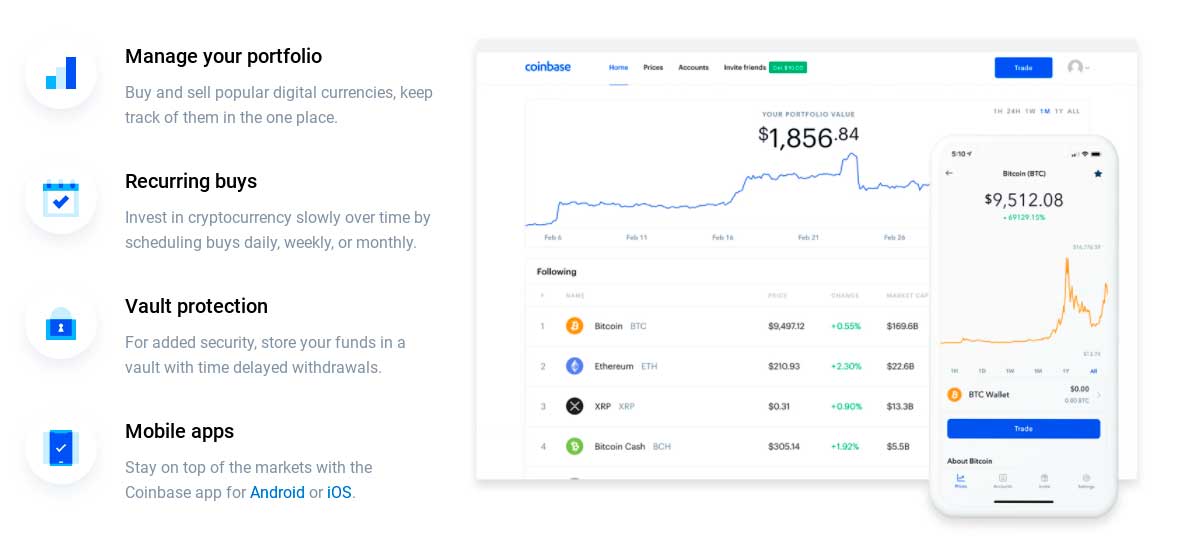

- Coinbase – Best Cryptocurrency Trading Platform for First-Time Buyers

- Libertex – Best Cryptocurrency Trading Platform for Tight Spreads

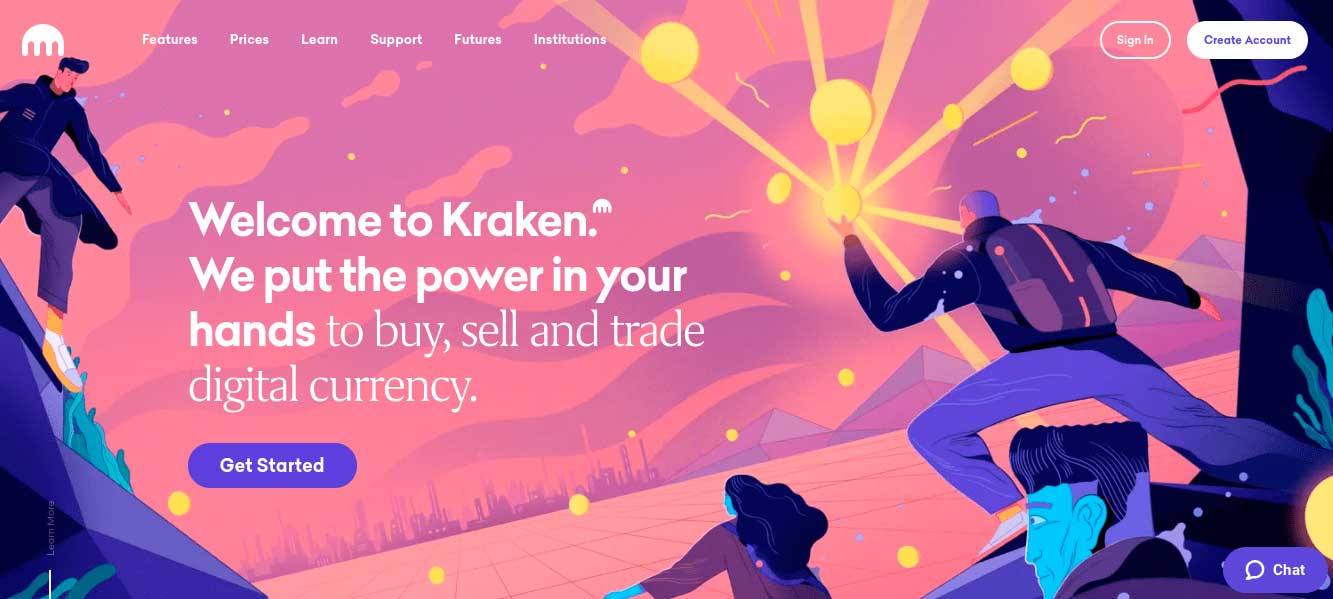

- Kraken – Best Cryptocurrency Trading Platform for Europeans

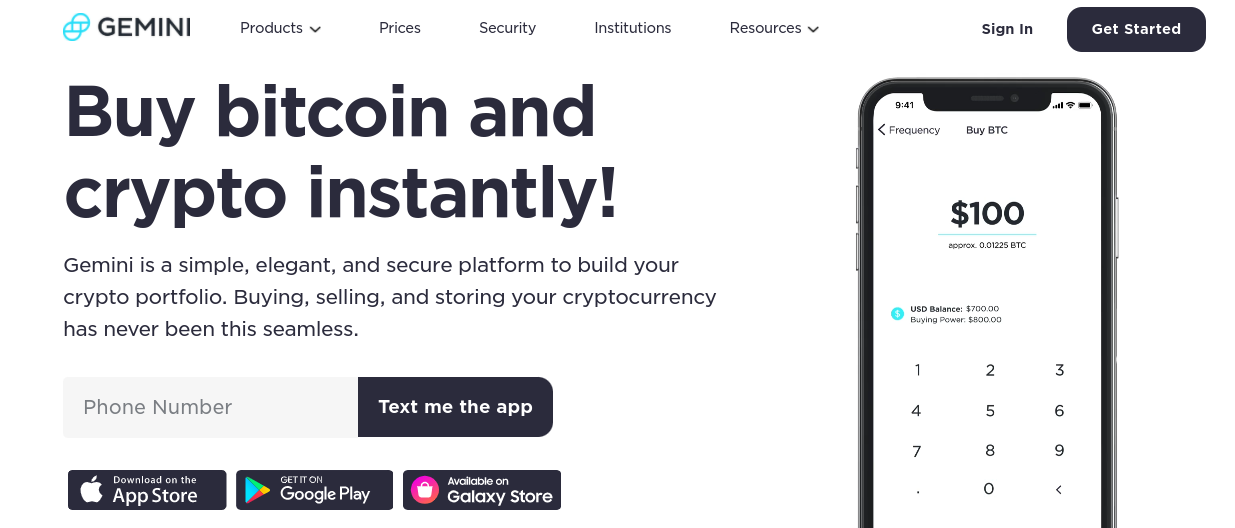

- Gemini – Best Crypto Trading Exchange for Large Investments

- Luno – Best Crypto Broker for Mobile Trading

- Coinmama – Best Cryptocurrency Trading Platform for Long-Term HODLers

Best Crypto Trading Platforms Reviewed

When searching for the best cryptocurrency trading platform for your investment goals – there are several key metrics to focus on. For example, the platform should offer a wide selection of digital currency markets at competitive commissions. There should be support for your preferred payment method and of course – the platform should have a great reputation.

To help you choose the right provider, below you find in-depth reviews of the best cryptocurrency trading platforms available in the market right now.

1. eToro – Overall Best Cryptocurrency Trading Platform 2021

This includes major crypto assets like Bitcoin, Ethereum, Ripple, and Litecoin – as well as a selection of Defi coins. The latter covers Uniswap, Yearn.Finance, Chainlink, Decentraland, and more. This means you can easily buy the best established cryptos as well as the new cryptocurrencies poised to explode. When it comes to minimums, you can buy and sell cryptocurrencies at eToro from just $25 per trade.

In terms of fees, this is where eToro really stands out. The platform operates a spread-only commission model – meaning that you simply need to cover the difference between the bid and ask price. To give you an example, Bitcoin can be bought and sold at a minimum spread of just 0.75%. You can easily deposit funds into eToro too – as the platform supports plenty of popular payment methods.

This includes debit and credit cards issued by Visa, MasterCard, and Maestro. E-wallets are also supported – including Paypal and Neteller. Bank transfers are also an option but this can delay the deposit by a couple of days. The minimum deposit for US traders is just $50. Most other countries are required to meet a minimum of $200. We should also note that eToro offers a number of popular trading tools that allow you to invest in cryptocurrencies passively.

For example, the CryptoPortfolio – which is professionally managed by the eToro trading team, allows you to invest in 16 different crypto assets through a single trade. In a similar nature to a conventional ETF, eToro will regularly rebalance the portfolio to make sure it alligns with the wider cryptocurrency market. You then have the eToro Copy Trading tool, which allows you to mirror the buy and sell positions of an experienced crypto trader.

For example, if they risk 10% of their capital on EOS, you will copy the exact same trade – but at a proportionate amount. Both the CopyPortfolio and Copy Trading tools come with no additional fees, but there is a minimum investment amount of $1,000 and $500 respectively. In addition to cryptocurrencies, this brokerage site offers thousands of alternative financial instruments. This includes stocks from 17 international exchanges, ETFs, indices, forex, precious metals, energies, and more.

Most importantly – eToro is authorized and regulated by a number of reputable bodies. This includes ASIC, CySEC, and the FCA. The crypto platform is also approved by FINRA and the SEC. If you are trading cryptocurrencies for the very first time, eToro offers a virtual portfolio platform. This mirrors live crypto market conditions, so you can buy and sell digital assets without needing to deposit or risk any money.

- Heavily regulated trading platform used by over 20 million people

- 0% commission on stocks and ETFs

- Spread-only pricing structure on crypto, indices, forex, and commodities

- Very easy to use – ideal for beginners

- Minimum stake starts at $25 per trade

- Supports debit/credit cards, bank transfers, and e-wallets

- Copy Trading features promote passive investing

Cons

- Charting analysis tools are a bit basic

67% of retail investors lose money trading CFDs at this site

2. Capital.com – Best Cryptocurrency Trading Platform for Leveraged CFDs

Capital.com is a CFD trading platform that also offers spread betting facilities. The provider is home to thousands

This includes a huge selection of crypto-to-fiat pairs – such as BTC/USD and ETH/EUR. You then have crypto-to-crypto pairs like BTC/BYN and ETH/BTC. If you’re keen to trade Defi coins too, Capital.com offers more than 30 markets. As noted above, Capital.com offers CFD instruments – meaning that you can actively trade crypto assets without owning the underlying coins. Instead, CFDs simply track the real-world price of the cryptocurrency.

This does, however, present plenty of benefits. Firstly, as the underlying digital token doesn’t exist – you don’t need to worry about storage or wallet security. Next, CFDs are leveraged financial products – so you can trade with more than you have in your account. For example, if you trade Bitcoin at a stake of $50 and apply leverage of 1:2 – your position is boosted to $100. By trading crypto CFDs at Capital.com, you will also be able to choose from a long or short position.

This means that you can look to profit in the event the value of a cryptocurrency goes down. Best of all, Capital.com is a 100% commission-free broker that in most cases – offers super-tight spreads. We also like the free demo account offered by the provider – which mirrors live market conditions. The minimum deposit is just $20 and you can choose from several convenient payment types. This includes debit/credit cards, bank transfers, and a number of e-wallets.

- 0% commission and tight spreads

- Thousands of markets on offer

- CFD asset classes include crypto, stocks, forex, and commodities

- Minimum deposit of just $20

- Supports debit/credit cards and e-wallets

- Great for beginners

- MT4 supported

- Leverage available – limits depend on your location

Cons

- You can’y invest in the underlying asset – CFD instruments only

67.7% of retail investor accounts lose money when trading CFDs with this provider

3. Binance – Best Crypto Exchange for Day Trading Digital Currencies

The platform offers hundreds of cryptocurrency pairs. This includes both fiat-to-crypto and crypto-cross markets. In particular, Binance is great for trading smaller-cap coins and ERC-20 tokens. The most dominant marketplace is, however, BTC/USDT. Binance is also involved in crypto derivatives. This includes leveraged Bitcoin futures and options contracts.

When it comes to trading commissions, the entry-level rate is set at 0.10% – which is low. You can get this down even further when you meet certain volume thresholds throughout the month, or you have BNB Coins in your Binance wallet. The exchange is also great if you want to perform advanced pricing analysis and chart evaluation. The platform even comes inclusive of chart drawing tools and technical indicators.

In terms of making a deposit, the best way to do this is via a cryptocurrency – as this is free. Plus, when you fund your account with a digital currency, there is no requirement to provide personal information or upload KYC documents. If you want to deposit funds with a debit or credit card, Binance will charge up to 4% – depending on your location. Bank transfers are often free but again – this depends on where you live.

- Maximum commission of 0.10% per slide

- Supports hundreds of crypto markets

- Fiat currency facilities available

- Accounts take minutes to set up

- Crypto derivatives markets include Bitcoin futures and options

- Sinigfcant levels of liquidity and trading volume

Cons

- High fees on debit/credit deposits

Cryptoassets are highly volatile unregulated investment products.

4. Robinhood – Best Crypto Platform for Beginners Based in the US

If you’re based in the US and are looking for a simple and burden-free way of investing in crypto – Robinhood will likely suffice. The platform is best known for its stock trading facility and is one of the best trading apps around – which is now used by millions of US-based investors. With that said, Robinhood also offers a small selection of digital currencies that you can buy with ease.

This includes Bitcoin, Dogecoin, Bitcoin Cash, Ethereum, and several others. By using Robinhood to trade crypto, you can get started with just a few dollars. This is because the platform supports fractional ownership – meaning you can purchase a small fraction of a single coin. Most importantly, Robinhood is a commission-free platform – so you can invest in a super low-cost manner.

There are no ongoing platform fees at Robinhood, albeit, there is a Gold Account that costs $5 per month. This comes with a number of perks – such as being able to trade on margin at a competitive interest rate of 2.5% annually. The Gold Account also offers increased instant deposits and access to comprehensive research reports. Robinhood accepts deposits in the form of ACH and bank wire – so there’s no support for debit/credit cards.

- Trusted US-based brokerage firm

- 0% commission on stocks, options, and crypto

- Supports fractional investments

- Great for beginners

- Top-rated mobile app

Cons

- ACH and bank wire deposits only

- US-based traders only

- Limited selection of crypto assets

Cryptoassets are highly volatile unregulated investment products.

5. Coinbase – Best Cryptocurrency Trading Platform for First-Time Buyers

Then, it’s just a case of choosing a cryptocurrency to buy, entering your stake, and confirming the order. Coinbase is home to dozens of digital currencies of all shapes and sizes. The main issue is that the provider is expensive. For example, debit/credit card deposits cost 3.99% and trading commission is set at 1.49% for all orders over $200.

On the flip side, you will be using one of the most trusted crypto exchanges in this industry. On top of being regulated in the US, Coinbase is home to institutional security controls. This includes cold storage of client funds (98%), two-factor authentication. and IP address whitelisting. Coinbase also offers a digital wallet that not only allows you to store your digital assets – but you can buy them too.

- Regulated in the US and used by over 35 million clients

- Dozens of supported digital currencies

- Easily deposit funds with a debit/credit card

- Perfect for inexperienced traders

- Coinbase Pro offers more advanced features

Cons

- Charges high fees on debit/credit card deposits

- Commission of 1.49% charged on trades of $200+

- Perhaps too basic for seasoned pros

- Customer support is poorly rated

Cryptoassets are highly volatile unregulated investment products.

6. Libertex – Best Cryptocurrency Trading Platform for Tight Spreads

Libertex really stands out in the pricing department, as crypto trading commissions are typically sub-0.1%. Even more importantly, Libertex is a tight spread CFD trading platform. For those unaware, this means that there is no gap between the bid and ask price – so you are essentially trading at wholesale rates.

There is no requirement to meet a huge minimum account balance to benefit from this tight spread policy – as you only need to deposit $100 to get started. After that, the minimum deposit drops down to $10 per transaction. Supported payment methods at Libertex include debit/credit cards and e-wallets. On top of digital currencies, the broker also supports stocks, indices, commodities, forex, ETFs, and more. Libertex is regulated by the FSCA and CySEC.

- Tight spreads on all markets

- Low trading commissions

- Mininmum deposit of just $100

- Supports CFD instruments on stocks, crypto, ETFs, forex, commodities, and more

- Debit/credit cards and e-wallets accepted

- Heavily regulated and more than 20+ years in the trading space

- MT4 and MT5 supported

Cons

- CFD instruments only – no traditional ownership

Cryptoassets are highly volatile unregulated investment products.

7. Kraken – Best Cryptocurrency Trading Platform for Europeans

When it comes to fees, Kraken is relatively competitive, albeit, it depends on what you are looking to trade. For example, if you seek to use the Instant Buy feature by using your debit or credit card, this will cost you 3.75% + €0.25. If transferring funds from your bank account, this feature will cost 0.5%. If you already have capital in your account, Kraken charges a market taker fee of 0.20% per slide.

You’ll need to trade more than $50,000 in a 30-day period to get this commission reduced. In terms of stand-out tools, we do like the crypto derivative department at Kraken. Not only does this allow you to trade digital currency futures, but you can do so with leverage of up to 50x. This means that a $200 stake can be turned into trading capital of $10,000. There is also a demo platform that allows you to trade crypto futures in a risk-free manner.

- One of the best crypto exchanges for Europeans

- Supports SEPA and debit/credit cards

- Spot trading commission of 0.20% per slide

- Leverage of up to 50x

- Offers Bitcoin futures markets

Cons

- Instant Buy feature is expensive

- No support for e-wallets

Cryptoassets are highly volatile unregulated investment products.

8. Gemini – Best Crypto Trading Exchange for Large Investments

While most of the best crypto exchanges discussed so far are aimed at casual retail traders – Gemini is ideal if you are looking to invest significant volumes. This is because the provider is behind one of the most solid regulatory frameworks in the cryptocurrency industry. Firstly, the platform is authorized and regulated by the New York State Department of Financial Services (NYSDFS) as a trust company.

This in itself comes with a plethora of safeguards with respect to client fund protection and auditing requirements. Gemini is also home to substantial security controls that ensure your crypto assets are kept safe at all times. This includes the likes of cold storage and multi-sig technology – as well as two-factor authentication, address whitelisting, and support for hardware devices.

In terms of supported markets, Gemini supports more than 40 cryptocurrency pairs. You will be charged handsomely to trade on the exchange, with commissions starting at 1.49% plus a mark-up of 0.50%. However, if you are investing large amounts, this could be a price worth paying because of the institutional-grade security controls offered. Gemini also offers interest-bearing crypto savings accounts that allow you to earn income on your digital currency holdings.

- Safety-first mindset

- Regulated by the NYSDFS as a trust company

- Institutional-grade security features

- More than 40+ crypto assets supported

- Offers interest-bearing crypto savings accounts

Cons

- Trading fees are expensive

- Onboarding times are slow

Cryptoassets are highly volatile unregulated investment products.

9. Luno – Best Crypto Broker for Mobile Trading

Since its inception, Luno has facilitated more than $21 billion worth of cryptocurrency buy and sell orders across 8 million+ customers. In order to get started, you will first need to download the Luno app and then open an account. Before you can deposit money with your debit/credit card or bank account – you will need to upload some ID. This is fast and efficient as Luno utilizes a third party that can verify documents in minutes.

Not only is Luno great for simplicity, but the app allows you to trade cryptocurrency in a low-cost manner. Although fees will ultimately depend on your country of residence, bank transfer deposits are typically fee-free. You will also benefit from a market taker commission of just 0.10% per slide – and even less if you find yourself trading larger volumes. We also like the Learning Portal that Luno offers, as well as its support for crypto savings accounts.

- Top-rated crypto trading app (iOS and Android)

- Low commission of 0.10% per slide

- Bank transfer deposits are usually free

- Great reputation – used by over 8 million people since 2013

- Supports local currencies in a plethora of countries

- Very easy to use

Cons

- Debit/credit card fees can be expensive

- No margin trading facilities

Cryptoassets are highly volatile unregulated investment products.

10. Coinmama – Best Cryptocurrency Trading Platform for Long-Term HODLers

Once you have quickly uploaded a copy of your passport or driver’s license, you can proceed to buy your chosen crypto asset. Crucially, you will be required to enter your wallet address at the time of the purchase. This is because Coinmama will automatically transfer your digital coins to your wallet as soon as the debit/credit card payment is processed.

This means that you don’t need to worry about wallet security at Coinmama, as you are in full control of where you store your digital tokens. The overarching drawback with Coinmama is that it is one of the most expensive cryptocurrency exchanges around. For example, debit/credit card fees amount to 5% and a commission of 3.90% will be payable when you buy a cryptocurrency. You also need to factor in the mark-up that Coinmama charges – which stands at 2% above the market rate.

- Easily buy crypto with a debit or credit card

- Launched back in 2013 and used by over 2.8 million people

- Coins are automatically transferred to your wallet upon making a purchase

- KYC process is fast-tracked

- Available in most countries

Cons

- Super-expensive fees

- No support for e-wallets

- Limited selection of crypto markets

Cryptoassets are highly volatile unregulated investment products.

Crypto Trading Platforms Fees & Payments Comparison

In the sections above we have reviewed the very best crypto exchanges for 2021. To recap, the table below outlines the main fees and commissions to take into account when comparing crypto brokers and exchanges.

| Platform | Trading Commission | Deposit Fee | Withdrawal Fee | Payment Methods |

| eToro | Spread-Only (From 0.75%) | 0% for US Traders, 0.5% Elsewhere | $5 | Debit/Credit Cards, e-wallets, Bank Transfer |

| Capital.com | 0% | FREE | FREE | Debit/Credit Cards, e-wallets, Bank Transfer |

| Binance | 0.10% | Up to 4% on Debit/Credit Cards | Depends on Payment Method | Debit/Credit Cards, Crypto, Bank Transfer |

| Robinhood | 0% | FREE | FREE | Bank Wire and ACH |

| Coinbase | 1.49% | 3.99% on Debit/Credit Cards | 2% on Debit/Credit Cards | Debit/Credit Cards, Crypto, Bank Transfer |

| Libertex | Sub 0.1% and ZERO Spreads | FREE | FREE | Debit/Credit Cards, e-wallets, Bank Transfer |

| Kraken | From 0.20% | FREE Bank Transfers | 0.09 EUR on SEPA | Debit/Credit Cards, Crypto, Bank Transfer |

| Gemini | 1.49% + 0.5% | 3.49% on Debit/Credit Cards | Depends on Payment Method | Debit/Credit Cards, Crypto, Bank Transfer |

| Luno | From 0.10% | Depends on Country | 0.30 EUR on SEPA | Debit/Credit Cards, Crypto, Bank Transfer |

| Coinmama | 3.90% + 2% Mark-Up | 5% on Credit Cards | Automatic Wallet Transfer | Debit/Credit Cards, Bank Transfer |

How to Choose the Best Crypto Trading Platform for You

Still not sure which crypto platform is right for? If so, we are now going to discuss the most important factors to look out for in your search for the best crypto trading platform.

Regulation

Let’s start with regulation. As you might well know, much of the cryptocurrency exchange industry operates without a regulatory license. Ultimately, this means that your capital is at risk.

This is why we suggested sticking with regulated platforms that put the customer at the heart of everything. For example, the likes of eToro, Capital.com, and Libertex are authorized and regulated by several reputable financial bodies.

Robinhood and Coinbase, in particular, are regulated in the US specifically. By choosing a regulated broker or exchange, the platform will need to keep client funds in segregated bank accounts and perform KYC checks to keep financial crime away.

Assets

You do, of course, also need to check whether or not your preferred crypto asset(s) is supported by the platform. If you’re looking to keep things simple by purchasing a major digital currency like Bitcoin (BTC) or Ethereum (ETH) – then you can do this with all of the best cryptocurrency trading platforms that we have reviewed today.

With that said, if you’re looking to buy an up-and-coming or trending crypto asset like Dogecoin or the Shiba Inu Coin – you might need to do a bit more digging. Similarly, if you’re interested in Defi coins – which many in the industry argue could be the next big thing – you need to make sure the platform supports it before you sign up.

Fees

We have talked extensively about fees throughout our reviews of the best cryptocurrency exchanges and for good reason. After all, you’ll want to be able to trade in a low-cost manner as opposed to paying unnecessary charges.

The most important fees that you need to consider when trading cryptocurrencies are as follows:-

- Commissions: This fee is payable when you buy and sell cryptocurrencies. In all but a few rare cases, the commission is expressed as a percentage and is multiplied against your stake. For example, Coinbase charges a commission of 1.49%. This means that a $400 crypto trade would cost you a commission of $5.96 You will again need to pay 1.49% when you cash your crypto trade out. Platforms like Capital.com and Robinhood charge no commission at all.

- Spread: Unless you are using a ZERO spread broker like Libertex, this fee always needs to be taken into account. The spread is simply the difference between the buy and sell price being quoted by the platform. At eToro, for example, you will pay a spread of just 0.75% – which is the only trading fee charged.

- Deposits and Withdrawals: This fee is probably the most important charge to look out for, especially if using a debit or credit card. For example, at Coinbase and Gemini, you will pay a deposit fee of 3.99% and 3.49% respectively. Coinmama is even more expensive at 5%. Over at eToro, you will pay just 0.5% and nothing if you are based in the US.

You can refer back to our platform fee comparison table further up in this guide to get an overview of what charges to expect.

Trading Tools & Features

If you’re interested in a certain tool or feature – make sure your chosen platform offers it. To give you an idea of what to look for – we found the following stand-out features when reviewing the best cryptocurrency trading platforms.

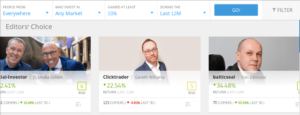

Copy Trading

The best crypto broker in the market – eToro, offers an innovative feature called Copy Trading. As we briefly explained earlier, this allows you to actively trade cryptocurrencies but in a passive way.

Past performance is not an indication of future results

All you need to do is select a successful eToro trader to copy and decide how much you want to invest ($500). After that, you will copy each and every position that the trader places – but at an amount proportionate to what you invested.

For example:

- You invest $4,000 into a proven cryptocurrency trader on eToro

- The trader allocates 15% of their portfolio into EOS and 10% into Ripple

- In turn, you invest $600 into EOS (15%) and $400 into Ripple (10%)

- The trader closes their EOS trade at a profit of 40% – so you do the same automatically

- On your stake of $600 – your 40% EOS profit translates into gains of $240

There are thousands of successful crypto traders to choose from at eToro – so you’re sure to find one that alligns with your long-term investment goals.

Leverage and Short-Selling

When using a CFD trading site like Capital.com or Libertex – you will be able to trade cryptocurrency with leverage. Once again, this means that you can amplify the size of your position. For example, if you place a $300 buy order on BNB/USD at leverage of 1:5 – the value of trade will be increased to $1,500. In other words, your potential profits will be boosted by a factor of 5x.

Additionally, the aforementioned CFD platforms also permit short-selling. There is no requirement to borrow cryptocurrency from the broker, as it’s just a case of placing a sell order. For example, if you place a $500 sell order on BTC/USD and the pair drops in value by 10% – your profit will amount to $50.

Crypto Savings Accounts

If you are a long-term crypto investor then it’s worth checking whether your platform offers savings accounts. This allows you to earn interest on your cryptocurrency holdings without needing to cash out. As such, not only will you earn passive income but you will still benefit if the digital currency appreciates in value. This feature is offered by the likes of Binance and Luno.

Liquidity

Liquidity is a crucial element to consider when trading cryptocurrencies online. For those unaware, this refers to the amount of money available in a particular market at a specific price

For example:

- Let’s say that you wanted to buy an ERC-20 token at a stake of $2,000

- At your chosen exchange, you can buy the token at a rate of $5

- However, you can only buy $500 worth of the token at $5

- After that, the price increases to $7 per token

The above example illustrates the issue of choosing a platform that doesn’t have enough liquidity. Crucially, you won’t be able to buy or sell your chosen crypto at a favorable price – as there isn’t enough capital on the platform to cover your trade. All of the best crypto exchanges discussed today are home to large levels of liquidity – especially eToro and Binance.

User Experience & Mobile App

In searching for the best crypto platform for you – think about your level of experience. That is to say, if you are trading digital currencies for the first time, it’s crucial to pick a provider that offers a burden-free user experience.

For example, opening an account and verifying your identity should never take more than a few minutes. It should also be a breeze to find your preferred market and subsequently place orders. This ease-of-use should also be the case if using the exchange’s mobile app.

Payment Methods

If you don’t have any crypto assets to hand, you will need to deposit funds with a fiat currency method. The easiest way to get money into your crypto trading account is to use a debit/credit card or e-wallet.

eToro, for example, supports everything from Visa and MasterCard to Paypal and Neteller. At the other end of the spectrum, the likes of Robinhood only support bank wire or ACH deposits.

Customer Service

The best cryptocurrency trading platforms offer top-notch customer support. For example, both eToro and Binance allow you to speak with a support agent in real-time via live chat. You then have the likes of Capital.com – which has one of the best telephone support centers in the brokerage arena. Some platforms only offer email as a support channel – so check this before you sign up.

How to Get Started with a Crypto Broker

To conclude our guide on the best cryptocurrency trading platforms for 2021 – we are now going to show you how to get started with eToro.

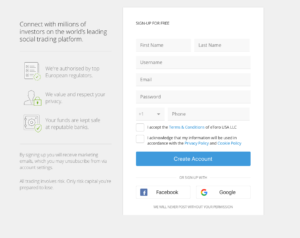

Step 1: Open a Trading Account

Visit the eToro website and open an account.

This should take you no more than a couple of minutes and will require:

- Basic Personal Information

- Contact Details

- Confirmation of Email and Mobile Number

- National Tax Number

Step 2: KYC

The KYC process at eToro can be completed pretty much instantly. All you need to supply is a valid copy of your government-issued ID and a proof of address.

Step 3: Deposit Funds

You can now deposit funds. US traders must deposit at least $50. Apart from a few exceptions, all other traders must meet a minimum of $200.

You can choose from the following deposit methods on eToro:

- Bank Transfer

- Debit Card

- Credit Card

- Paypal

- Neteller

- Skrill

US-based traders will benefit from fee-free deposits. All other traders will pay a small deposit fee of 0.5% across all payment types.

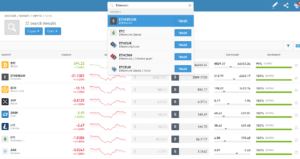

Step 4: Find Crypto Market

You can now use the search box to find the cryptocurrency that you wish to trade. In our example, we are searching for Ethereum.

You can also view what digital currency pairs are available by clicking on the ‘Trade Markets’ button.

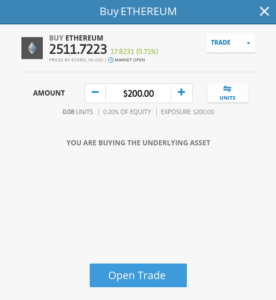

Step 5: Place Crypto Trade

You can set up an order. First, choose from a buy or sell position – depending on whether you think the price of the crypto will rise or fall.

Then, enter your stake ($25 minimum) and click on the ‘Open Trade’ button to confirm your position.

eToro – Overall Best Cryptocurrency Trading Platform 2021

We have reviewed the 10 best cryptocurrency trading platforms currently available in the market. As we have discussed, you need to choose a platform based on your own financial goals and objectives.

If you’re strapped for time and want to start trading right now – we found that the best crypto exchange for 2021 is eToro. Not only is the platform heavily regulated, but it offers industry-leading fees.

Plus, you will have access to heaps of crypto markets on a spread-only basis and you can set your trading account up in minutes!

67% of retail investors lose money trading CFDs at this site