Best Cryptocurrency Brokers 2021

With the rise in the popularity of cryptocurrency over the past decade, many cryptocurrency brokers have begun springing up in an attempt to attract would-be traders. However, with such a vast selection to choose from, it can seem tricky to narrow it down to the best choice for you.

To make the process easier, this guide discusses the Best Cryptocurrency Brokers 2021, exploring their features and fee structures in detail and showing you how to get set up and ready to trade in under ten minutes.

Best Cryptocurrency Brokers 2021 List

The list below presents our top eight cryptocurrency brokers for 2021. In the following section, we’ll explore each of these brokers in detail, reviewing their features and highlighting any relevant fees.

- eToro – Overall Best Cryptocurrency Broker 2021 (FCA Regulated)

- Capital.com – Best Cryptocurrency Broker 2021 for 0% Commissions

- Avatrade – Best Cryptocurrency Broker 2021 for High Leverage

- Robinhood – Best Cryptocurrency Broker 2021 for Beginner Traders

- Libertex – Best Cryptocurrency Broker 2021 for Tight Spreads

- Interactive Brokers – Best Cryptocurrency Broker 2021 for Advanced Traders

- IG – Best Cryptocurrency Broker 2021 for Regulatory Backing

- Webull – Best Cryptocurrency Broker 2021 for User Friendliness

Top Cryptocurrency Brokers Reviewed

To begin trading in the cryptocurrency market, you must open an account with a reliable and licensed broker to facilitate your trades. As mentioned previously, there are many different broker options out there these days, each one with a slightly different fee structure and platform. Choosing the appropriate broker for your needs involves conducting extensive research into your available options to ensure your trading is as seamless as possible.

To help you with your research, this section reviews the best cryptocurrency brokers in detail, giving you all the information you need to make the best decision.

1. eToro – Overall Best Broker for Cryptocurrency 2021 (FCA Regulated)

Our pick for the best crypto trading platform is eToro. eToro boasts over 20 million users worldwide and is regulated by tier-one organisations such as the FCA. What this means for traders is that they receive a safe and licensed trading environment that protects both their capital and personal details.

One of the most appealing things about eToro is its fee structure. eToro does not charge any commissions when you place a cryptocurrency trade – this is in stark contrast to many other brokers and exchanges who can charge up to 3% of your commission size. Instead of commissions, all of eToro’s fees are incorporated into the spread, which is the difference between the buy and sell prices on crypto. Usually, this spread is very tight – for example, Bitcoin’s spread is stated as 0.75%.

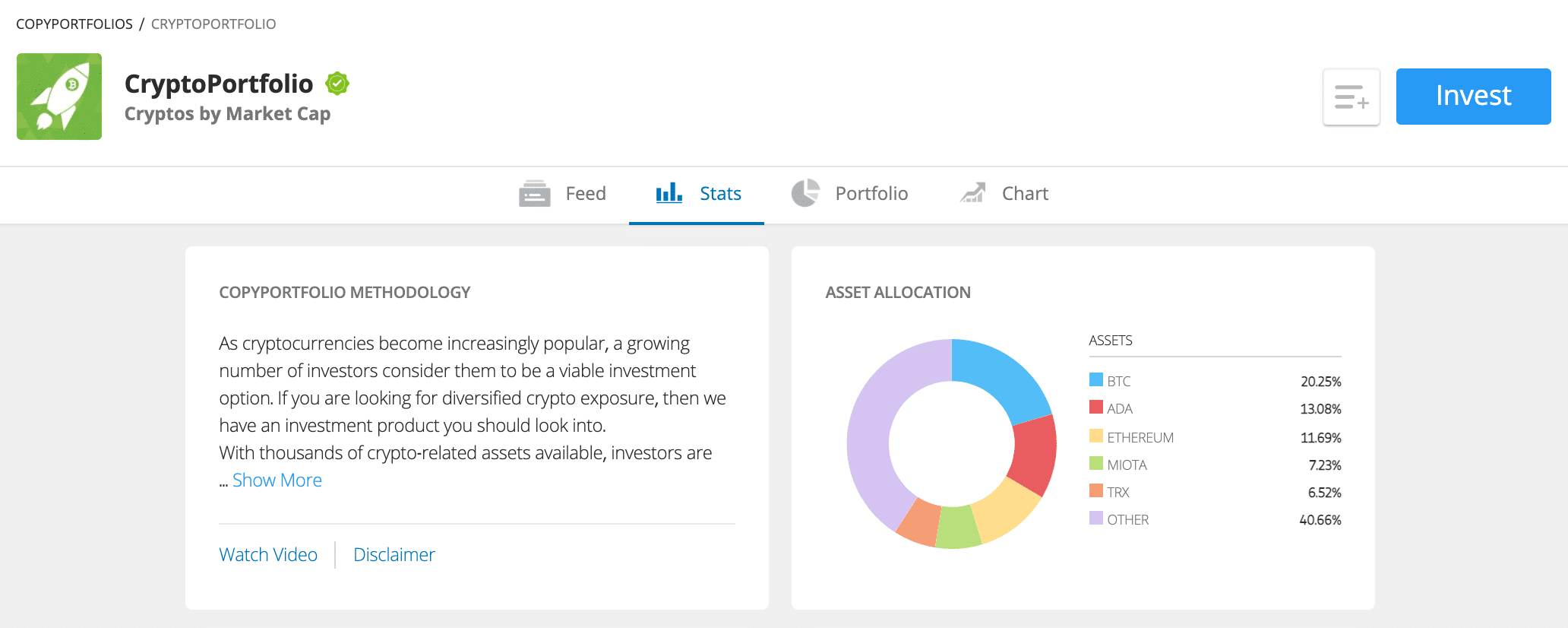

Aside from fee structure, eToro also offers many valuable features for users. These include a handy crypto wallet that allows you to quickly and safely store your crypto purchases (and even exchange them into other digital currencies if you wish). eToro also allows users to invest in their revolutionary ‘CryptoPortfolio’, which provides broad exposure to several different cryptos. Finally, depositing with eToro couldn’t be simpler – users can fund their account via credit/debit card, bank transfer, or various popular e-wallets such as PayPal.

- Heavily regulated trading platform used by over 20 million people

- 0% commission on stocks and ETFs

- Spread-only pricing structure on crypto, indices, forex, and commodities

- Very easy to use – ideal for beginners

- Minimum stake starts at $25 per trade

- Supports debit/credit cards, bank transfers, and e-wallets

- Useful CopyPortfolio feature

Cons

- Charting analysis tools are lacking

67% of retail investors lose money trading CFDs at this site

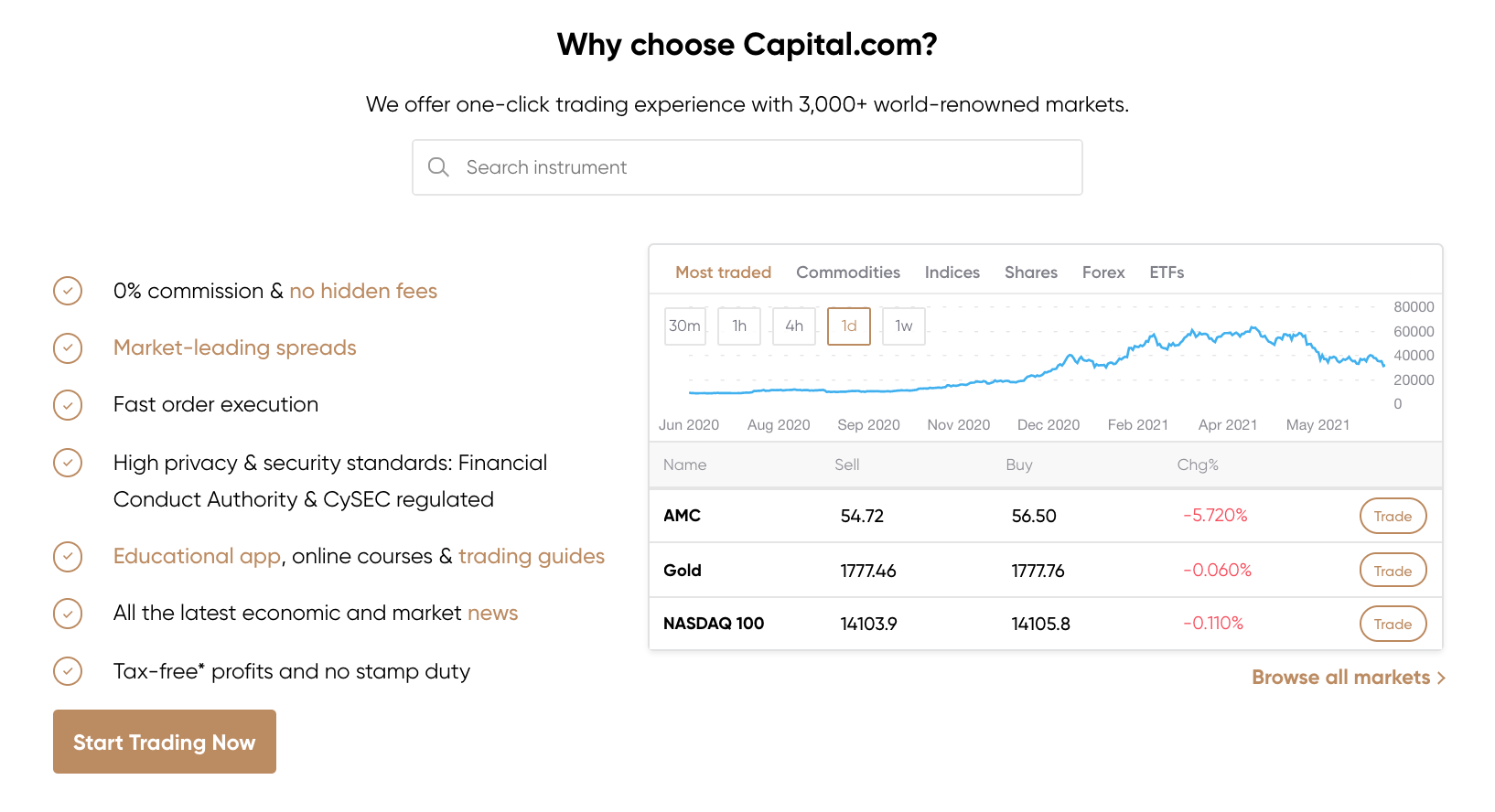

2. Capital.com – Best Cryptocurrency Broker 2021 for 0% Commissions

Another of the best crypto brokers for traders is Capital.com. Capital.com make our list as one of the best brokers that trade cryptocurrency thanks to their heavy regulation and low-cost trading environment. Much like eToro, Capital.com does not charge any commissions when trading crypto. Instead, fees are incorporated into the spread – this spread is very minimal and ranges around 0.5% for Bitcoin.

Capital.com offer a great selection of cryptos to trade, such as Bitcoin, XRP, Ethereum, Dogecoin, Cardano, and more. What’s more, users can even employ 1:2 leverage when crypto trading – essentially doubling your position size and potential profits. In terms of account opening, Capital.com ensures they are accessible to most traders by offering a low minimum deposit threshold of only $20. Deposits are entirely free to make and can be completed via credit/debit card, bank transfer, or various e-wallets.

- 0% commission and tight spreads

- Thousands of markets on offer

- CFD asset classes include crypto, stocks, forex, and commodities

- Minimum deposit of just $20

- Supports debit/credit cards and e-wallets

- Great for beginners

- MT4 supported

- Leverage available – limits depend on your location

Cons

- Only CFDs

67.7% of retail investor accounts lose money when trading CFDs with this provider

3. Avatrade – Best Cryptocurrency Broker 2021 for High Leverage

If you are wondering how to buy cryptocurrency with leverage, Avatrade might be a good option. Avatrade offer crypto CFD trading facilities, which means that you’ll be trading a contract based on the price of the digital currency rather than the currency itself. This allows Avatrade to offer leverage facilities to users – some users can even receive up to 1:25 leverage when trading BTC. The leverage rate offered will vary depending on where you live and which crypto you are trading, so make sure to research beforehand.

In terms of fees, Avatrade offers 0% commission when trading cryptocurrencies, with all costs being incorporated into the spread. Avatrade also provides a good selection of cryptos to trade, including popular options such as Bitcoin, Litecoin, EOS, and more. The great thing is, Avatrade’s platform allows you to buy and sell these cryptos without the need for a wallet – which is ideal for beginner traders who are just looking to test the markets first. Finally, Avatrade also offers a handy demo account in which you can trade cryptos risk-free before trading for real.

- 0% commissions when trading crypto

- Tight spreads

- No need for a crypto wallet

- Handy demo account feature

- Up to 1:25 leverage, depending on location

Cons

- Only offer CFD trading

71% of retail investor accounts lose money when trading CFDs with this provider

4. Robinhood – Best Cryptocurrency Broker 2021 for Beginner Traders

If you are interested in the best crypto broker for beginners, Robinhood might be your best bet. This broker offers a seamless and user-friendly crypto trading experience for US-based traders, with commission-free investing allowed on a range of digital currencies. In addition, Robinhood’s trading app is sleek and easy to use, allowing you to buy and sell cryptos in just a few clicks.

Robinhood also supports fractional investments – meaning that you can purchase fractions of a coin rather than having to buy the whole coin itself. This allows for significant levels of versatility in trading and ensures accessibility to traders of all account sizes. In terms of deposits, Robinhood does not allow account funding from credit or debit cards; however, ACH transfers and wire transfers are both accepted.

- Trusted US-based brokerage firm

- 0% commission on stocks, options, and crypto

- Supports fractional investments

- Great for beginners

- Top-rated mobile app

Cons

- ACH and bank wire deposits only

- US-based traders only

- Limited selection of crypto assets

Cryptoassets are highly volatile unregulated investment products.

5. Libertex – Best Cryptocurrency Broker 2021 for Tight Spreads

Libertex is an excellent option for crypto traders looking to trade in a safe and low-cost environment. Firstly, Libertex is regulated by CySEC – ensuring traders’ capital and personal details are protected. Second, in terms of fees, Libertex differs from other brokers because they do not charge any spreads on their cryptocurrencies – the quote you see is the same for both the buy and the sell-side. Instead, Libertex charges a flat fee as a commission, and these fees can range from 0.47% up to 2.5%, depending on the currency.

Apart from these commissions, Libertex is a relatively low fee cryptocurrency exchange as they do not charge any monthly account fees, deposit fees, or withdrawal fees. They offer over 50 cryptos to trade and even include some niche ones for avid crypto traders. Users can trade on both an online web platform and the mobile app, ensuring accessibility at all times of the day. Finally, Libertex offers a wide variety of deposit methods, including credit/debit card, bank transfer, and various e-wallets such as Skrill, Neteller, and Trustly.

- Tight spreads on all markets

- Low trading commissions

- Minimum deposit of just $100

- Supports CFD instruments on stocks, crypto, ETFs, forex, commodities, and more

- Debit/credit cards and e-wallets accepted

- Heavily regulated and more than 20+ years in the trading space

- MT4 and MT5 supported

Cons

- CFD instruments only – no traditional ownership

83% of retail investor accounts lose money when trading CFDs with this provider

6. Interactive Brokers – Best Cryptocurrency Broker 2021 for Advanced Traders

Interactive Brokers has a fantastic reputation and is a favourite of professional and institutional investors. There are two options within the Interactive Brokers account types offer – a ‘Pro’ account and a ‘Lite’ account, ensuring there’s an option for everybody. Each account comes with its own fee structure; however, the Lite account is lower cost and targeted towards retail traders, whilst the Pro account is more expensive and targeted towards advanced traders.

At the time of writing, Interactive Brokers only offer Bitcoin futures to trade – although that is expected to change soon. The company recently announced that they plan to begin offering a selection of cryptos to trade by the end of Summer in 2021. This plan to provide crypto trading is expected to be hugely popular with traders as Interactive Brokers have traditionally been one of the best platforms in the US for trading the markets. Furthermore, with no minimum deposit threshold and 0% commissions on their Lite account, Interactive Brokers are sure to offer excellent customer value when their crypto trading services launch.

- Fantastic reputation worldwide

- Multiple accounts on offer

- No minimum deposit

- Interactive Brokers Futures Commissions start from 0%

- Account offered for institutional traders too

Cons

- Only offers Bitcoin futures at present

Cryptoassets are highly volatile unregulated investment products.

7. IG – Best Cryptocurrency Broker 2021 for Regulatory Backing

The penultimate addition to our list of the best cryptocurrency brokers is IG. IG primarily focuses on CFD trading and is heavily regulated by top entities like the FCA and BaFin. In addition to this regulation, IG is also listed on the London Stock Exchange, adding to its credibility. At the time of writing, IG offers a selection of 7 cryptos to trade – although not the most extensive selection, it still includes popular options such as Bitcoin, Ether, and Litecoin.

IG follows a similar tactic to other brokers by incorporating their costs into the spread in terms of fees. The spread is quoted in basis points, with Bitcoin’s spread being stated as 36bp – putting IG’s fees in the middle of the pack when it comes to crypto brokers. However, IG also charges a commission based on how active you are in the market; this commission decreases if you trade more often. Notably, IG does not charge any deposit or withdrawal fees, although they charge an inactivity fee after two years of no activity.

- Regulated by the FCA and BaFin

- Fees incorporated int the spread

- No deposit or withdrawal fees

Cons

- Commissions which are based on trading activity

- Inactivity fee charged after two years

Cryptoassets are highly volatile unregulated investment products.

8. Webull – Best Cryptocurrency Broker 2021 for User Friendliness

The final entry on our list of the best cryptocurrency brokers is Webull. This broker is primarily known for stock trading, so that the question may arise: does Webull have crypto? Yes, they have begun upping their game in recent years when it comes to cryptocurrencies. At present, Webull crypto trading offer has eight cryptos to trade, including Bitcoin, Bitcoin Cash, Ethereum, and Litecoin. The great thing is that these cryptos can be bought and sold without paying any commissions whatsoever.

Instead, the fee is incorporated into the spread – much like IG, Webull’s spread is quoted in basis points. Webull charges a 100bp spread on both the buy and the sell side, which essentially equates to a 1% commission. Another significant aspect of Webull’s platform is that you can purchase parts of a coin rather than buy the entire thing. However, at present, Webull does not allow you to transfer your crypto holdings outside of their platform – meaning you’ll have to sell them if you wish to use the money elsewhere.

- Great reputation in the US

- Spreads fixed at 100bp

- Fractional ownership of cryptos

- 0% commissions when crypto trading

Cons

- Only 8 cryptos to choose from

- No way to transfer cryptos off the platform

Cryptoassets are highly volatile unregulated investment products.

Best Cryptocurrency Brokers Comparison

To help you make an appropriate decision when choosing the best cryptocurrency broker for crypto trading, the table below breaks down each of the previously mentioned broker’s fees, along with the maximum leverage they offer. This allows for easy comparison between broker options, ensuring you have a complete understanding of your options. For the purposes of this table, we present the stated commissions and spreads for trading Bitcoin – although these could vary depending on the specific digital currency.

| Bitcoin Trading (Commission) | Bitcoin Trading (Spread) | Deposit Fee | Withdrawal Fee | Max Leverage* | |

| eToro | 0% | 0.75% | None | $5 | 1:2 |

| Capital.com | 0% | From 0.5% | None | None | 1:2 |

| Avatrade | 0% | From 0.25% | None | None | 1:25 |

| Robinhood | 0% | Variable | None | None | N/A |

| Libertex | From 0.1% | 0% | None | None | 1:2 |

| Interactive Brokers | N/A | N/A | None | None | N/A |

| IG | 0% | From 0.1% | None | None | 1:2 |

| Webull | 0% | 100 basis points (buy and sell-side) | None | None | Up to 1:4 |

*To note: the maximum leverage amount stated here may vary, depending on which asset you trade and where you live. Make sure to research this before opening an account.

How to Choose the Best Cryptocurrency Broker for You

There are various factors to consider when choosing between the best cryptocurrency brokers. As you will be trusting them with your capital, it’s crucial that you do your due diligence and research the ‘need to know’ information for each broker. To help streamline this process, the sections below highlight some of the most important things to look for when choosing a cryptocurrency broker.

Safety

One of the most important things to look for when choosing a crypto broker is the level of safety they offer users. It’s crucial that you partner with a broker that is regulated and licensed by one or more top organisations, as this provides credible backing to their security policies.

Most brokers will also conduct KYC checks on new users, ensuring the trading environment is as safe as possible. Again, these KYC checks are essential to look out for – brokers who do not ask for any details from users tend to be unlicensed or unregulated. Partnering with these sorts of brokers is a massive risk as your capital and personal information will be unprotected.

Fees

Understandably, fees are another thing to examine when researching the best cryptocurrency brokers. There’s no point partnering with a broker just to find out that the process of buying and selling cryptos is going to cost you a substantial sum of money. Earlier in this guide, we covered the fees associated with the top crypto brokers on our list. However, the fee categories below are typically the most common ones charged by crypto brokers:

- Commissions: This fee occurs when you place a crypto trade and is usually expressed as a percentage of your position size. Many brokers, such as eToro, will offer 0% commissions – meaning you avoid this fee altogether.

- Spreads: This fee refers to the difference between the buy and sell prices on crypto and can be thought of as the broker’s ‘fee’ for facilitating your trade. Some brokers will offer fixed spreads, whilst others will provide variable spreads.

- Non-trading Fees: These fees include deposit fees, withdrawal fees, inactivity fees, and monthly account fees. These typically vary from broker to broker – and some brokers do not charge them at all.

Range of Assets

The number of tradeable assets is also essential to consider, as this ensures you have access to a steady flow of market opportunities. Most crypto brokers will offer popular digital currencies such as Ethereum and Bitcoin – and some will offer less popular altcoins such as EOS and Cardano.

Many top crypto brokers will constantly add more tradeable digital currencies to their asset selection throughout the year. Usually, the cryptos with the highest levels of liquidity are offered by crypto brokers, whilst crypto exchanges tend to provide a more comprehensive selection of digital currencies and DeFi coins.

Trading Tools

Crypto brokers that offer charting tools and educational materials are also a huge benefit to traders, as these resources can help optimise cryptocurrency trading. Traders interested in technical analysis will want to keep an eye out for brokers that offer extensive charting capabilities and a selection of indicators to use. Economic calendars and newsfeeds are also handy features to look for, as they help traders stay up-to-date with current market events.

Many brokers will also offer their own unique features to entice traders to sign up. One of the most appealing features is the CopyPortfolio feature provided by eToro, which allows users to invest in a professionally managed portfolio without paying any hefty management fees. eToro offers a ‘CryptoPortfolio’ option for traders looking to get exposure to the cryptocurrency market, providing an easy and optimised way of trading digital currencies.

Platforms

The actual trading platform is also essential to consider, as having a clunky and outdated user interface can make trading difficult and cumbersome. As a result, web-based platforms tend to be the most popular formats used by crypto brokers, as these are accessible to the greatest number of users and are straightforward to use. Furthermore, it’s also a good idea to choose a broker who offers a mobile app so that you can act on market opportunities whilst you are out and about.

Account Types

Some brokers will offer multiple account types to traders, with each account being targeted towards a specific niche. Usually, brokers who do this will provide an account for casual traders and an account for professional/advanced traders – so make sure to double-check which one is right for you.

Casual trading accounts often provide a low-cost trading structure and all the essential resources needed to operate in the market. On the other hand, professional accounts tend to cost a little bit more and may even require a minimum trade size; however, in return, they may offer advanced features such as depth-of-market data and tighter spreads.

Payments

Finally, the best cryptocurrency brokers will ensure that they offer various deposit methods for users. These days it’s common for brokers to accept deposits via bank transfer, credit/debit card, and various e-wallets. Some e-wallets that seem to be the most popular with brokers are PayPal, Skrill, Neteller, and Trustly.

As a side note to this, make sure to check the costs for making a deposit, as some brokers will charge a fee for this. This fee could be for currency conversion purposes or just a flat fee for facilitating the transaction – so definitely research this beforehand.

How to Get Started with a Cryptocurrency Broker

Now that you have a good overview of your options when it comes to cryptocurrency brokers, let’s take a look at the process of opening an account with one. This section will show you how to get set up and ready to trade with our recommended best crypto broker, eToro – all in under ten minutes.

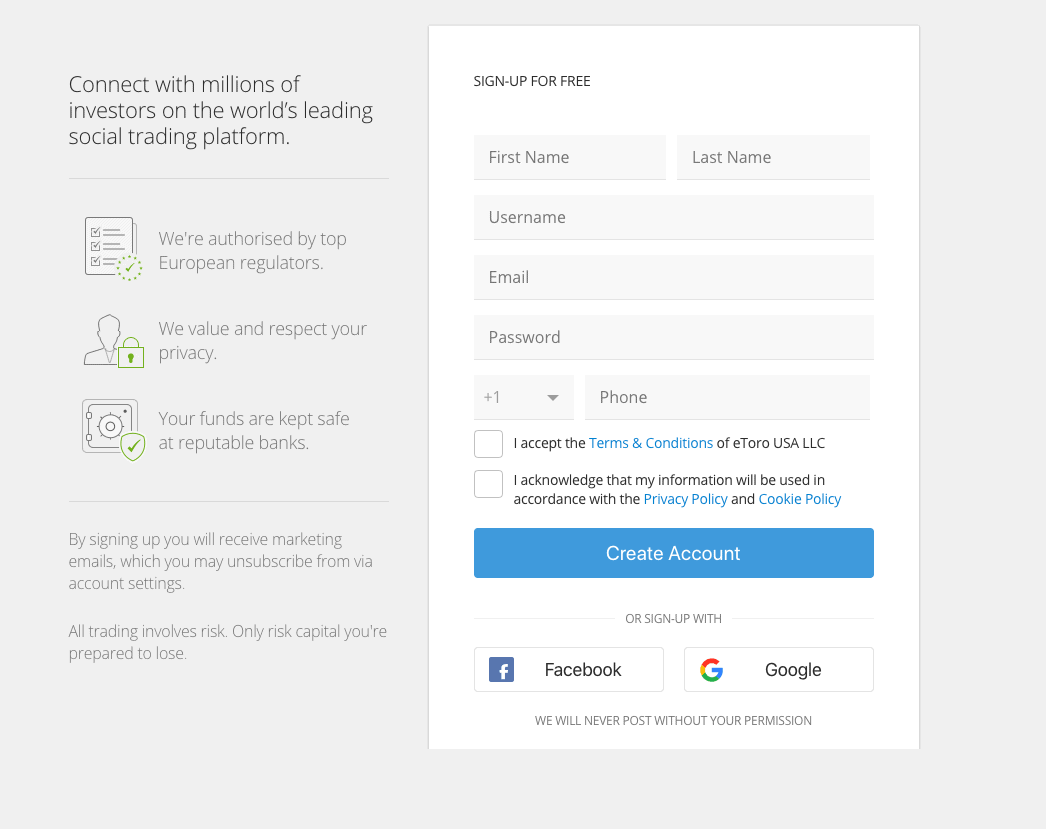

Step 1: Open an eToro Account

Head over to eToro’s website and click ‘Join Now’. You’ll then be asked to enter a valid email address and a password to create your account.

Step 2: Verify your Account

Once you have set up your account and entered the required personal information, you’ll also have to verify your identity and address. This can be completed online and is very straightforward to do. Simply upload proof of ID (a copy of your passport or driver’s license) and proof of address (a copy of a bank statement or utility bill). eToro will then verify these documents, which usually only takes a few minutes.

Step 3: Fund your Account

eToro allows fee-free deposits for all users, with the minimum deposit threshold being $200 for new users. Notably, US users can deposit as little as $50 to open their account. In terms of funding methods, you have the following options available:

- Bank transfer

- Credit card

- Debit card

- PayPal

- Skrill

- Neteller

- Trustly

- Klarna

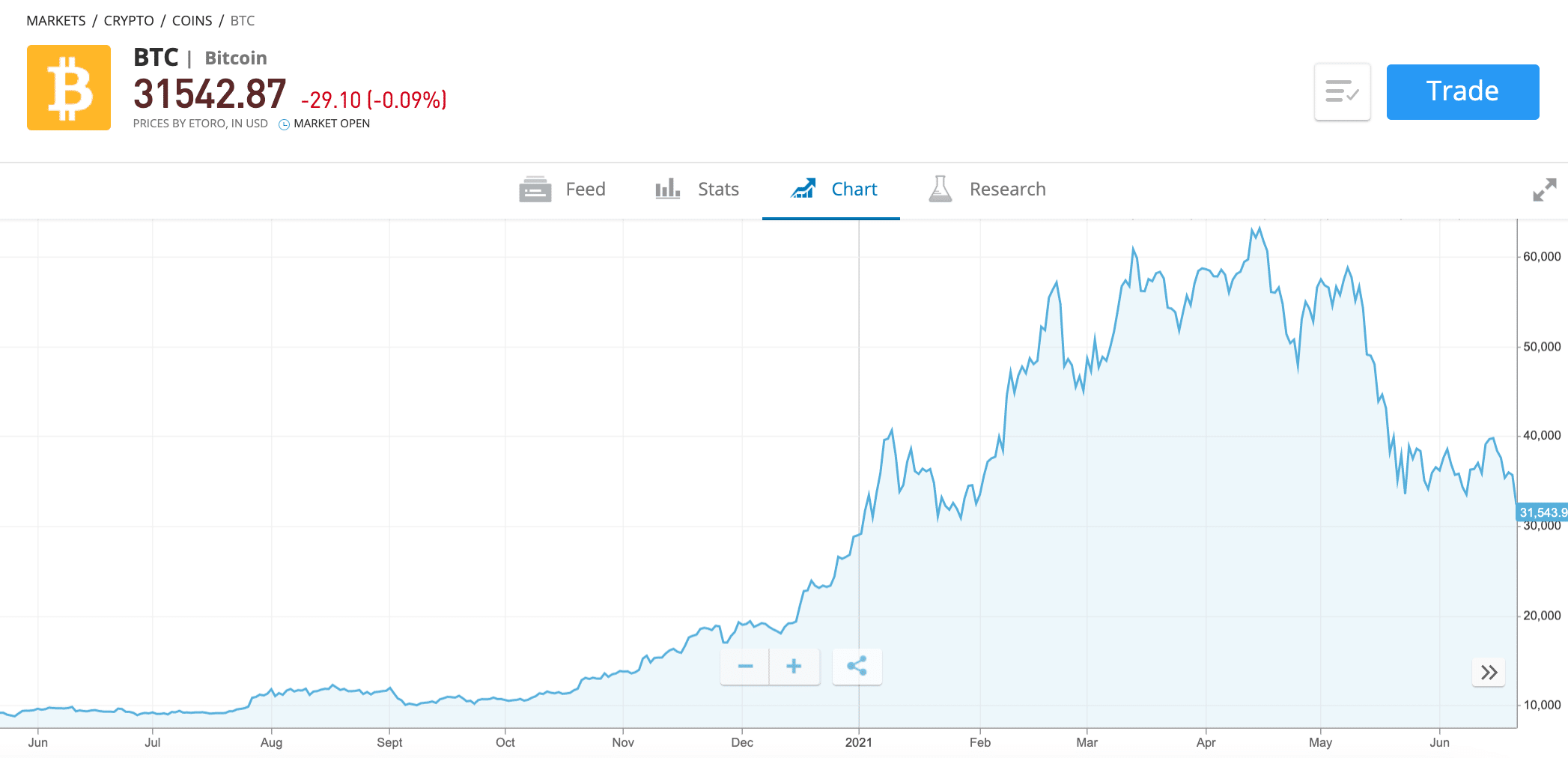

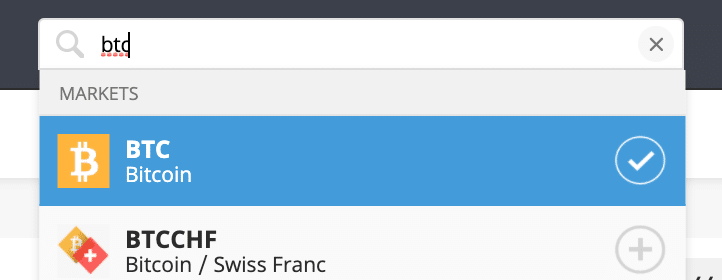

Step 4: Search for your Chosen Crypto

Click into the search bar at the top of the screen and type in the name or ticker symbol of the digital currency you’d like to trade. For the purposes of this guide, we’ll be looking to trade BTC/USD. Once you see the correct option, click on it in the drop-down menu and click ‘Trade’ on the next screen.

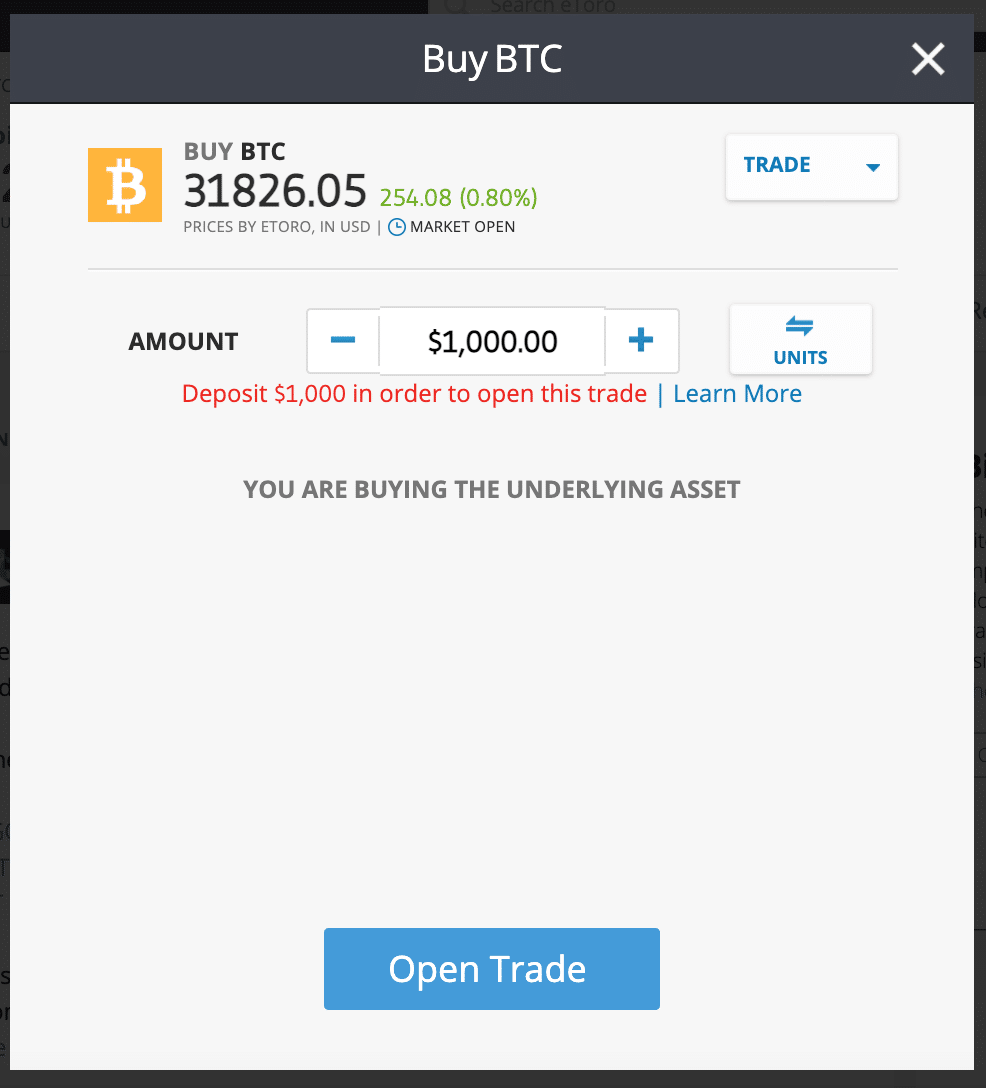

Step 5: Buy Cryptocurrency

An order box will now, much like in the image below. In this box, simply enter the amount you’d like to invest, double-check everything is correct, and click ‘Open Trade’.

And that’s it! You’ve just placed a crypto trade with one of the best cryptocurrency brokers available – all without paying any commissions!

Best Cryptocurrency Broker 2021 – Conclusion

This guide has explored the best available brokers that trade cryptocurrency on 2021, highlighting the pros and cons of each and providing the crucial information you need to make the right choice. Choosing a suitable cryptocurrency broker is a critical component of your trading success – and by using this guide, you’ll have all the tools you need to begin trading optimally.

If you’re ready to begin trading the cryptocurrency market right away, we’d highly recommend opening an account with eToro. The great thing about eToro is that they are regulated by the FCA, which ensures you are as safe as possible when trading crypto. What’s more, eToro does not charge any commissions when you trade cryptocurrencies and allow you to be set up and ready to trade in under ten minutes!

67% of retail investors lose money trading CFDs at this site

FAQs

What is a Cryptocurrency broker?

How do Cryptocurrency brokers make money?

What is the best Cryptocurrency broker?

Which Cryptocurrency brokers accept US clients?

What is spread in a Cryptocurrency broker?